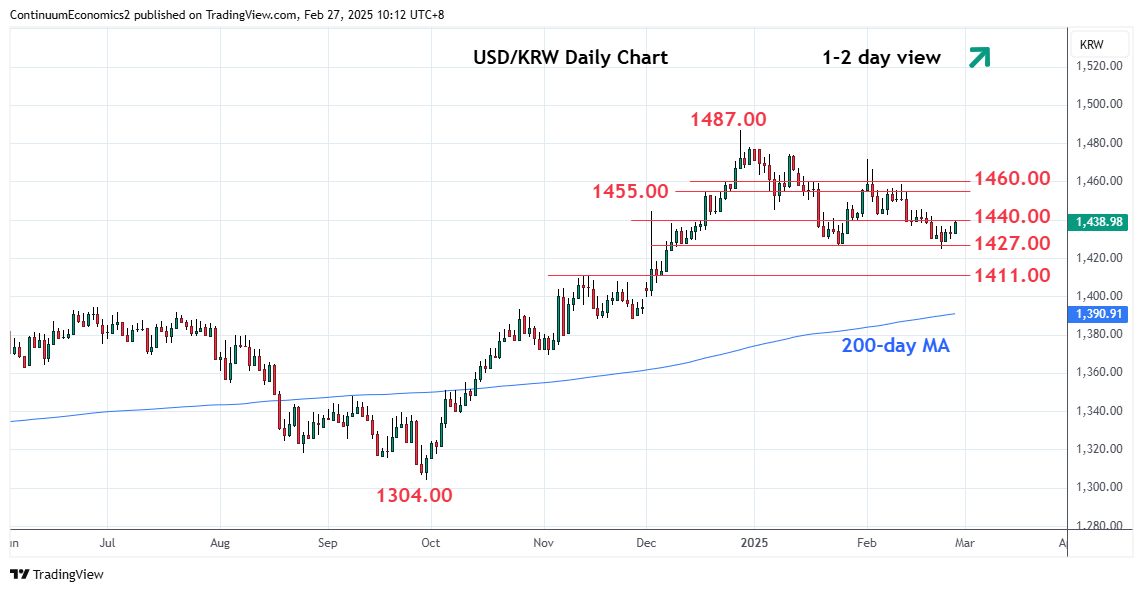

Extending bounce from the 1425.00 low as daily studies unwind oversold readings to correct losses from the 1472.00, 3 February high

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 1460.00 | ** | congestion, 31 Dec high | S1 | 1425.00 | ** | 24 Feb YTD low | |

| R3 | 1455.00 | * | 18 Dec high | S2 | 1417.00 | * | 38.2% Sep/Dec rally | |

| R2 | 1450.00 | * | congestion | S3 | 1411.00 | ** | Nov high | |

| R1 | 1440.00 | * | congestion | S4 | 1400.00 | * | Apr high |

Asterisk denotes strength of level

02:15 GMT - Extending bounce from the 1425.00 low as daily studies unwind oversold readings to correct losses from the 1472.00, 3 February high. Resistance is at the 1440.00/1442.00 congestion area which is expected to cap. Break here will open up room to the 1450.00 congestion then the strong resistance at the 1455.00/1460.00 area. Gains are expected to give way to fresh selling pressure later and break of the 1427.00/1425.00 lows will extend the broader losses from the December high to the 1420.00 level then 1417.00, 38.2% Fibonacci level.