Published: 2025-07-30T13:27:44.000Z

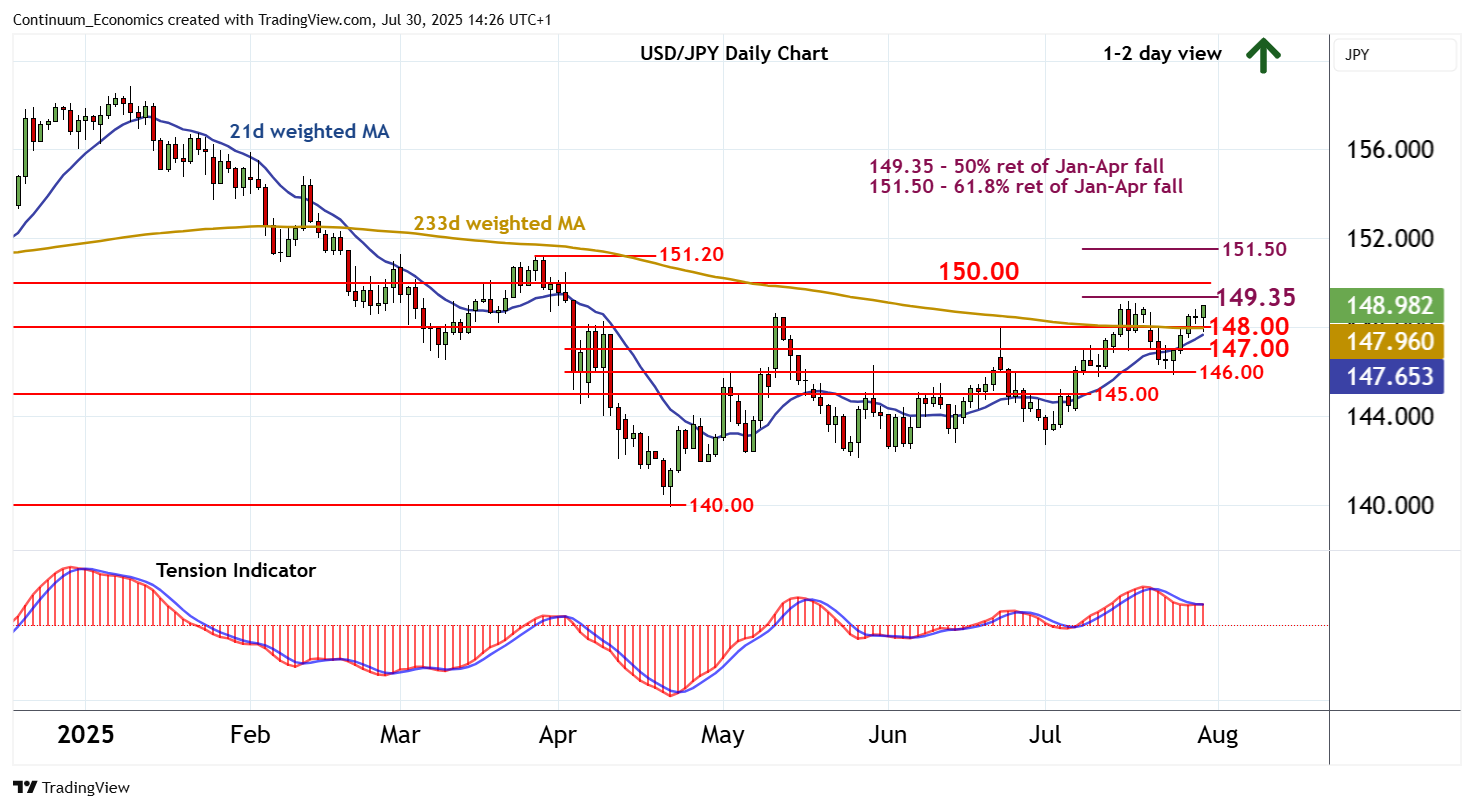

Chart USD/JPY Update: Critical resistance at the 149.35 Fibonacci retracement

Senior Technical Strategist

3

Cautious trade around support at 148.00 is giving way to a USD- and JPY-driven bounce

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 151.50 | ** | 61.8% ret of Jan-Apr fall | S1 | 148.00 | ** | break level | |

| R3 | 151.20 | ** | 28 Mar (w) high | S2 | 147.00 | congestion | ||

| R2 | 150.00 | ** | congestion | S3 | 146.00 | * | break level | |

| R1 | 149.35 | ** | 50% ret of Jan-Apr fall | S4 | 145.00 | * | congestion |

Asterisk denotes strength of level

14:00 BST - Cautious trade around support at 148.00 is giving way to a USD- and JPY-driven bounce, with prices approaching 149.00. Daily studies continue to track higher, highlighting room for a test of critical resistance at the 149.35 Fibonacci retracement. But flat overbought weekly stochastics could limit any initial tests in consolidation, before the rising weekly Tension Indicator prompts a break. A close above here would further improve sentiment and extend broad April gains initially to congestion resistance at 150.00. Meanwhile, a close below 148.00 would turn sentiment neutral and prompt consolidation above congestion around 147.00.