Published: 2025-07-01T10:19:21.000Z

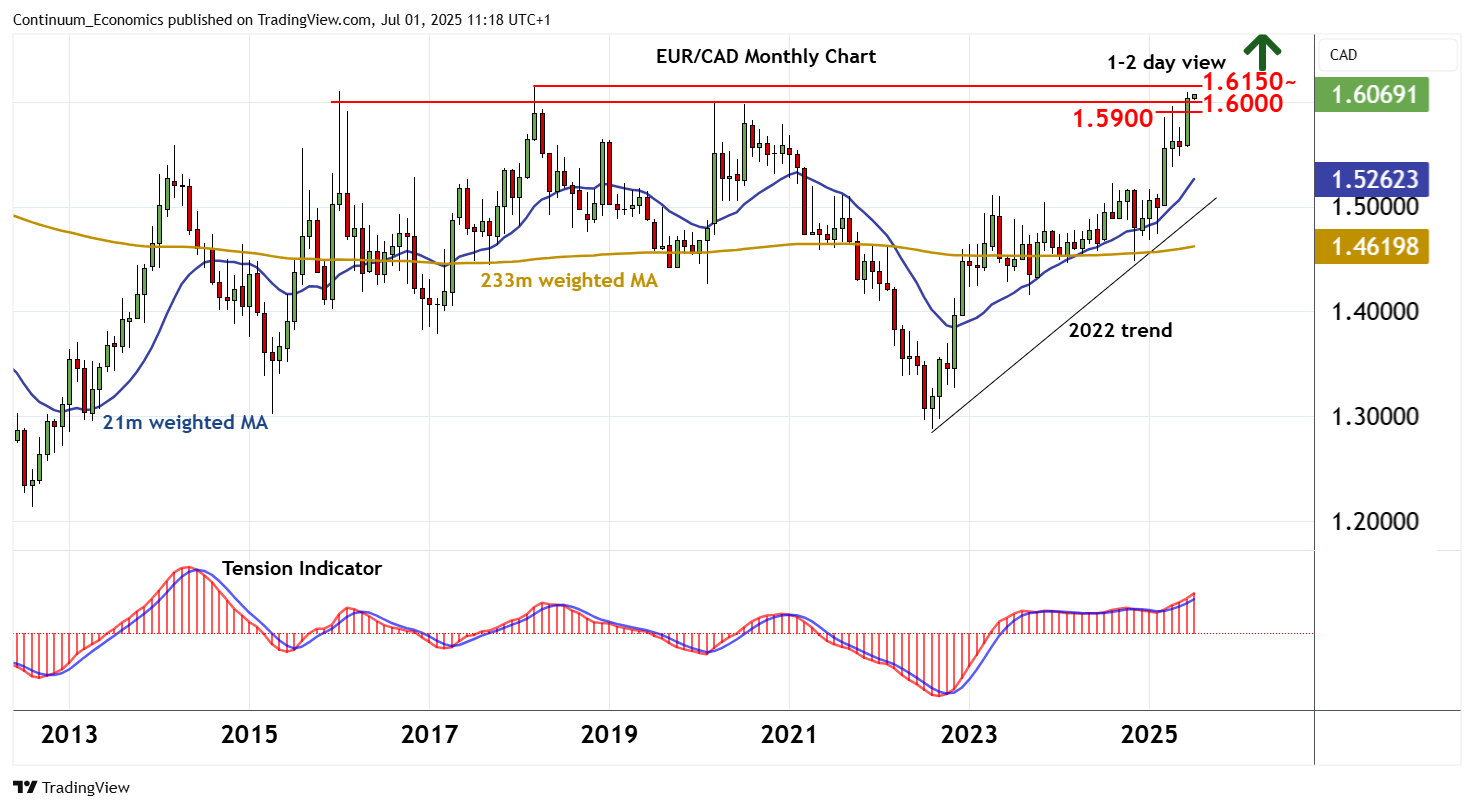

Chart EUR/CAD Update: Balanced at year highs - studies continue to rise

Senior Technical Strategist

-

Little change, as mixed intraday studies keep near-term sentiment cautious and extend consolidation beneath the 1.6090 current year high of 27 June

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.6325~ | ** | Jun-July 2009 high | S1 | 1.6000 | ** | congestion | |

| R3 | 1.6200 | historic congestion | S2 | 1.5900 | * | congestion | ||

| R2 | 1.6150~ | ** | March 2018 (y) high | S3 | 1.5800 | congestion | ||

| R1 | 1.6090 | 27 Jun YTD high | S4 | 1.5700 | break level |

Asterisk denotes strength

10:55 BST - Little change, as mixed intraday studies keep near-term sentiment cautious and extend consolidation beneath the 1.6090 current year high of 27 June. Daily readings have turned higher once again and weekly charts are positive, highlighting room for still further gains in the coming sessions. A break above 1.6090 will improve sentiment and extend August 2022 gains towards critical multi-year resistance at the 1.6150~ year high of March 2018. Continuation beyond here will extend 2012 gains into levels from 3Q2009. Meanwhile, support remains at congestion around 1.6000. A break, if seen, would turn sentiment neutral and prompt consolidation above further congestion around 1.5900.