Published: 2025-09-01T06:53:14.000Z

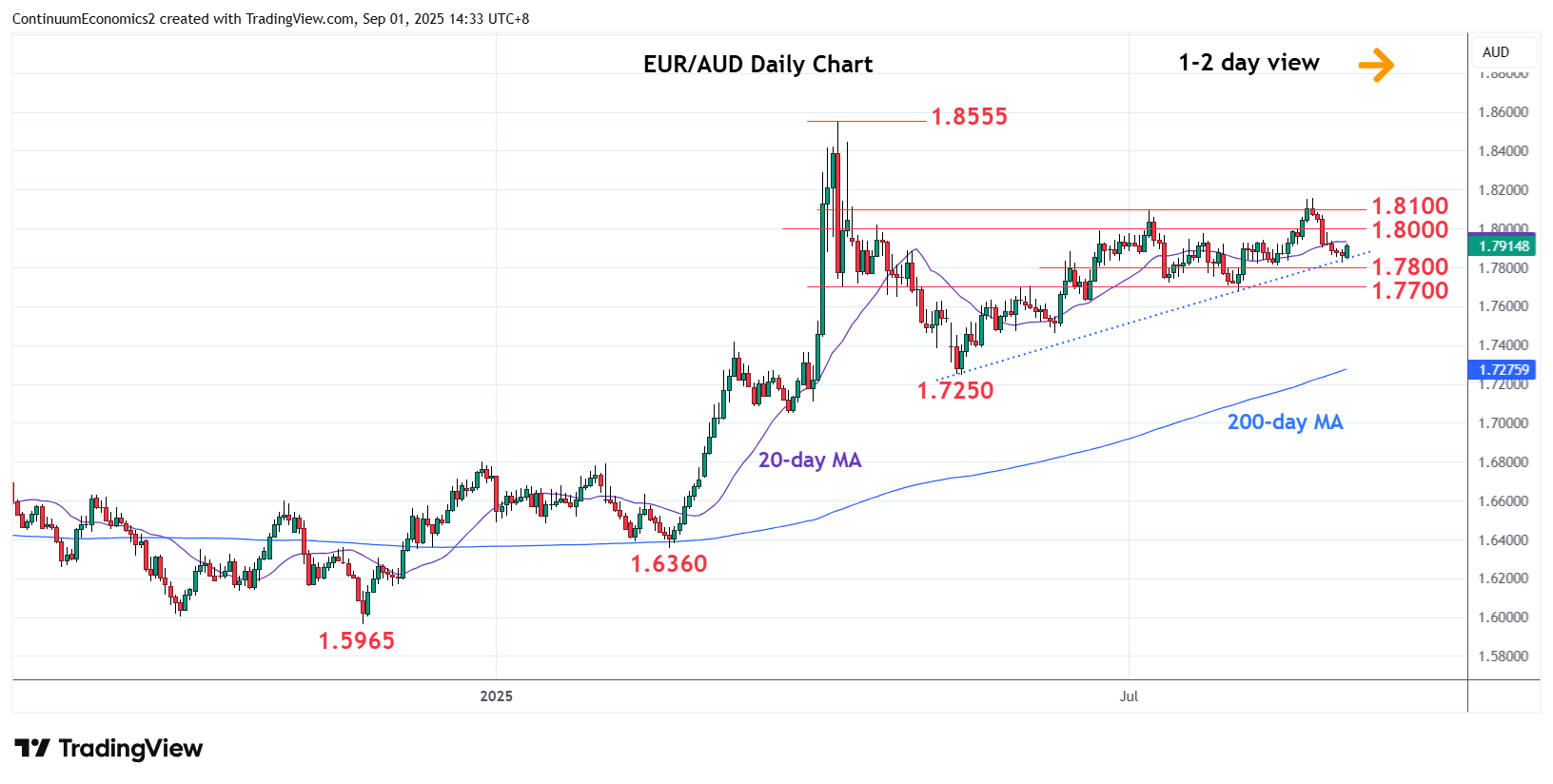

Chart EUR/AUD Update: Consolidating test of May trendline

0

-

Turned up from test of the May trendline from the 1.7250 low as prices consolidate losses from the 1.8155 high

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.8200 | congestion | S1 | 1.7810/00 | * | 12 Aug low, congestion | ||

| R3 | 1.8155 | ** | 21 Aug high | S2 | 1.7700 | ** | congestion, 50% | |

| R2 | 1.8100 | * | Jul high, congestion | S3 | 1.7630 | * | 18 Jun low | |

| R1 | 1.8000 | * | congestion | S4 | 1.7600 | * | congestion, 61.8% |

Asterisk denotes strength of level

06:50 GMT - Turned up from test of the May trendline from the 1.7250 low as prices consolidate losses from the 1.8155 high and unwind oversold intraday and daily studies. Negative weekly studies suggest bounce here giving way to fresh selling pressure later and see room for deeper pullback to retrace the May/August rally. Break of support at the 1.7810/00 area will see room for extension to retest strong support at 1.7700, July low and 50% Fibonacci level. Meanwhile, resistance is at the 1.8000 level which is expected to cap and sustain losses from the 1.8100/1.8155, July and 21 August highs.