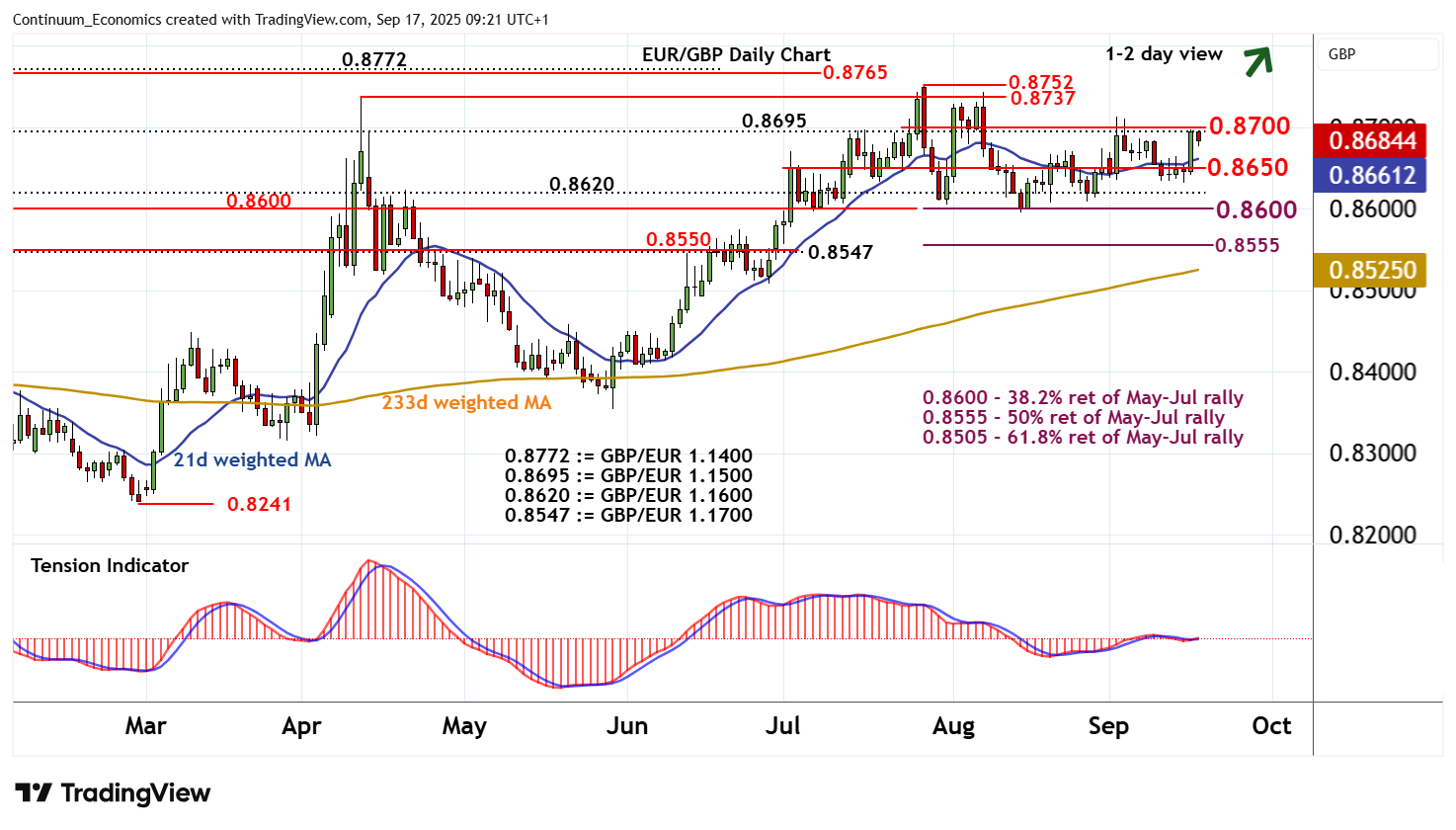

Chart EUR/GBP Update: Consolidating sharp gains - daily studies rising

The break above 0.8650 has met anticipated selling interest at 0.8695, (GBP/EUR 1.1500), and congestion around 0.8700

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.8765 | ** | November 2023 high | S1 | 0.8650 | ** | congestion | |

| R3 | 0.8752 | ** | 28 Jul YTD high | S2 | 0.8620 | * | GBP/EUR 1.1600 | |

| R2 | 0.8737 | ** | 11 Apr (m) high | S3 | 0.8600 | ** | cong, 38.2% ret | |

| R1 | 0.8695/00 | ** | GBP/EUR 1.1500; cong | S4 | 0.8555 | ** | 50% ret of May-Jul rally |

Asterisk denotes strength of level

08:50 BST - The break above 0.8650 has met anticipated selling interest at 0.8695, (GBP/EUR 1.1500), and congestion around 0.8700. Overbought intraday studies are unwinding, suggesting room for a pullback. But rising daily readings are expected to limit scope in renewed buying interest above 0.8650. Following cautious trade, fresh gains are looked for. A break above 0.8695/00 will improve price action and open up critical resistance within the 0.8737 monthly high of 11 April and the 0.8765 current year high of 28 July. However, negative weekly readings should limit any tests of this range in profit-taking. Meanwhile, a close below 0.8650 would turn price action neutral once again and give way to consolidation above 0.8600/20.