Chartbook: Chart EUR/GBP: Corrective pullback/consolidation before higher

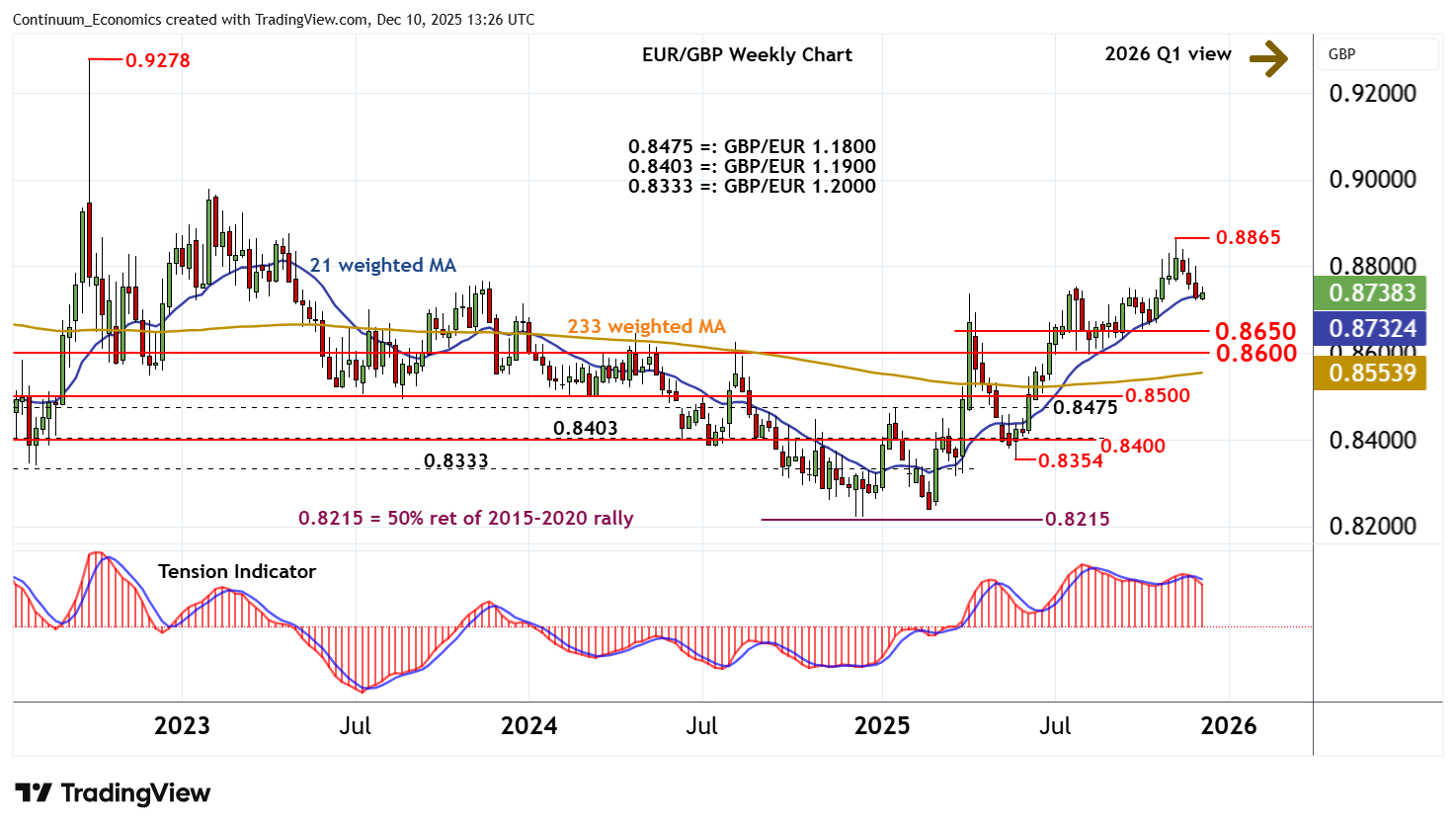

Anticipated gains have posted a fresh 2025 year high at 0.8865,

before turning lower in steady profit-taking to trade below 0.8800.

Weekly stochastics and the weekly Tension Indicator are under pressure, highlighting room for deeper losses into early 2026 Q1, with focus to turn to congestion around 0.8650.

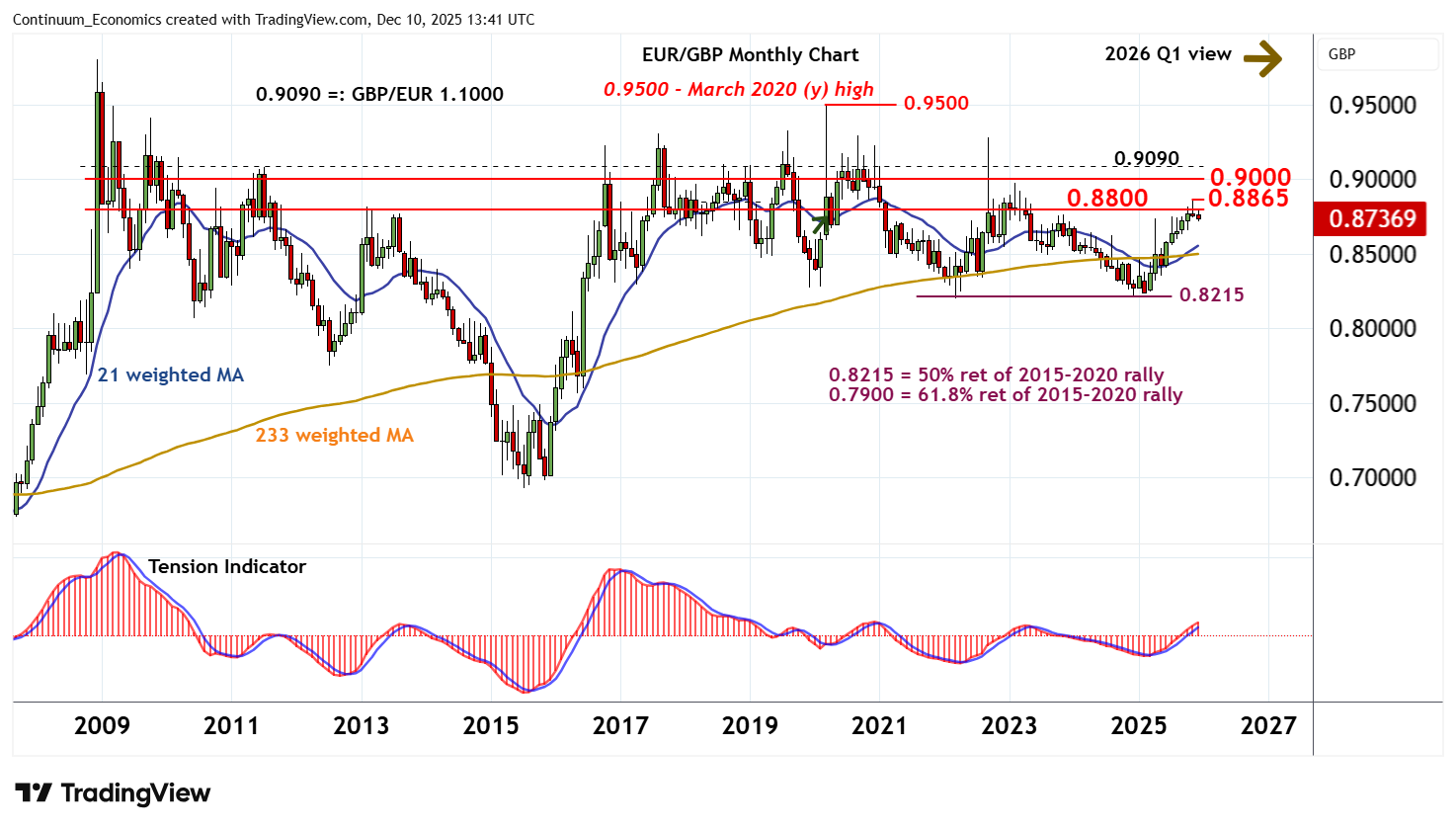

Just lower is 0.8600, but mixed/positive monthly charts and bullish longer-term readings are expected to limit any tests in renewed buying interest/consolidation.

A close beneath here, however, will add weight to sentiment and extend November losses towards 0.8475, (GBP/EUR 1.1800), and congestion around 0.8500.

Meanwhile, resistance is at congestion around 0.8800 and extends to the 0.8865 current year high of 14 November.

Following corrective trade, fresh gains are looked for.

However, a close above 0.8865 is needed to turn sentiment positive and extend December 2024 gains towards psychological resistance at 0.9000 and 0.9090, (GBP/EUR 1.1000).

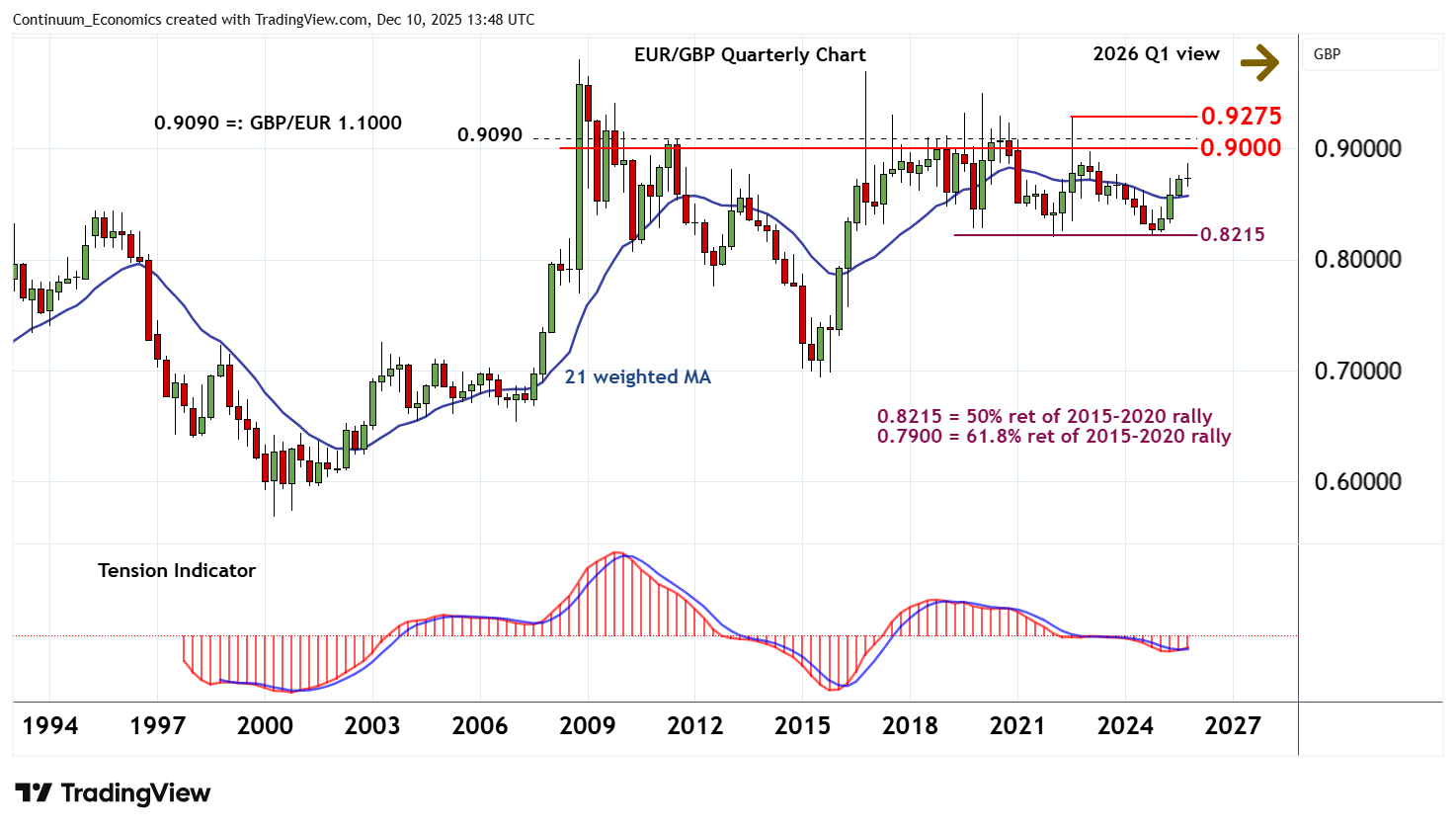

Longer-term charts are positive,

pointing to room for a later break above here in the coming months towards the 0.9275 year high of September 2022.