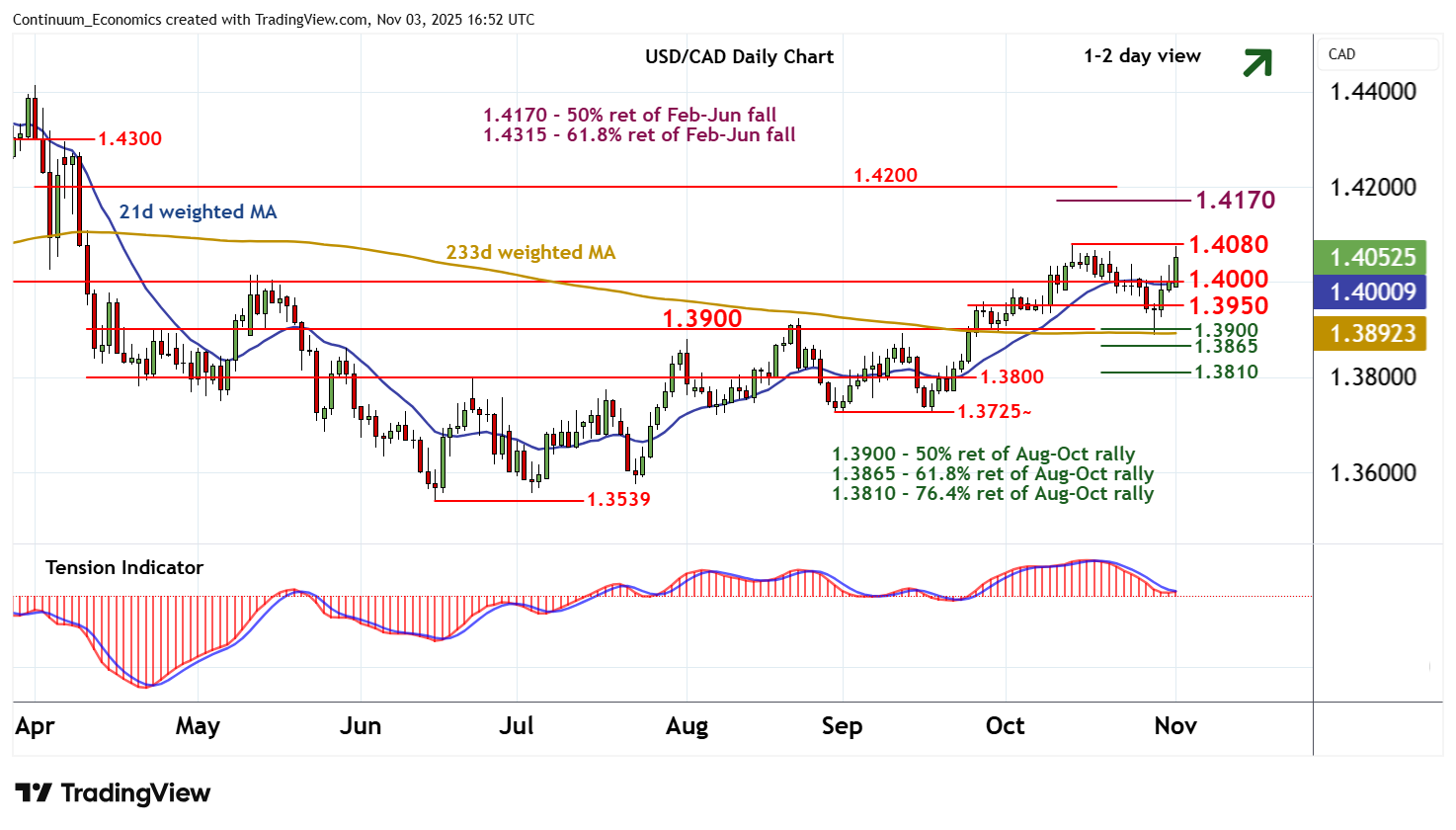

Chart USD/CAD Update: Studies improving

Consolidation around 1.4000 has given way to the anticipated test of strong resistance at the 1.4080 weekly high of 14 October

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.4300 | * | break level | S1 | 1.4000 | * | break level | |

| R3 | 1.4200 | * | congestion | S2 | 1.3950 | * | pivot | |

| R2 | 1.4170 | ** | 50% ret of Feb-Jun fall | S3 | 1.3900 | ** | break level, 50% ret | |

| R1 | 1.4080 | ** | 14 Oct (w) high | S4 | 1.3865 | ** | 61.8% ret of Aug-Oct rally |

Asterisk denotes strength of level

16:35 GMT - Consolidation around 1.4000 has given way to the anticipated test of strong resistance at the 1.4080 weekly high of 14 October. Daily readings continue to rise and broader weekly charts are mixed/positive, highlighting room for further strength in the coming sessions. A close above here will improve price action and extend mid-June gains towards strong resistance at the 1.4170 Fibonacci retracement and congestion around 1.4200. However, already overbought weekly stochastics are expected to limit any initial tests in consolidation. Meanwhile, support remains at the 1.4000 break level, and should underpin any immediate setbacks.