Published: 2025-07-31T07:31:11.000Z

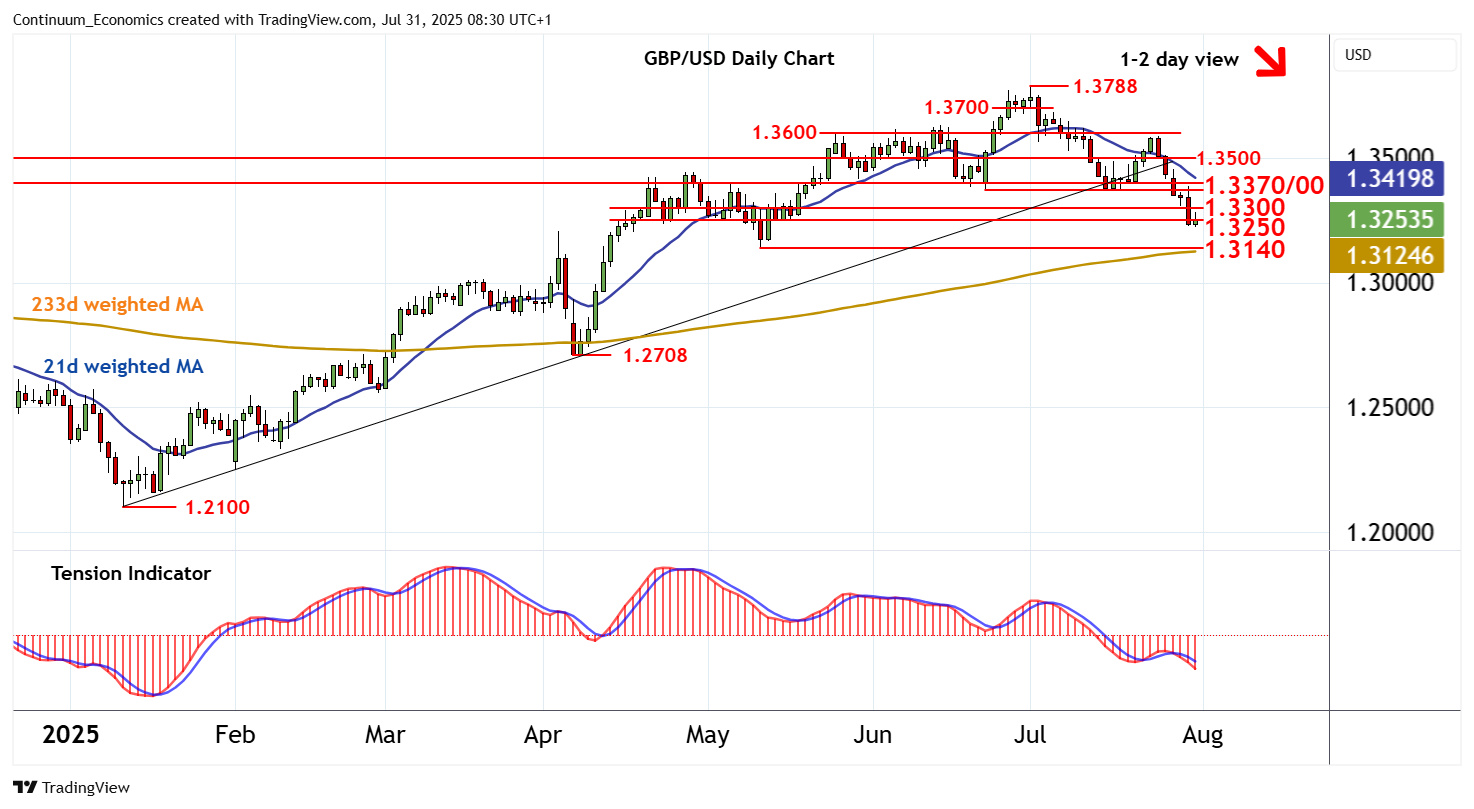

Chart GBP/USD Update: Short-term consolidation - studies remain under pressure

Senior Technical Strategist

2

Anticipated losses have tested below the 1.3250 congestion lows

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.3500 | ** | congestion | S1 | 1.3250 | * | congestion lows | |

| R3 | 1.3400 | * | congestion | S2 | 1.3200 | * | break level | |

| R2 | 1.3370 | * | 23 Jun (m) low | S3 | 1.3140 | ** | 12 May (m) low | |

| R1 | 1.3300 | * | congestion | S4 | 1.3000 | ** | break level |

Asterisk denotes strength of level

08:10 BST - Anticipated losses have tested below the 1.3250 congestion lows, with prices reaching 1.3225~ before bouncing back above here. Intraday studies are rising and oversold daily stochastics are flattening, suggesting potential for a test of congestion resistance at 1.3300. But the negative daily Tension Indicator and bearish weekly charts should limit any break in renewed selling interest beneath the 1.3370 monthly low of 23 June and congestion around 1.3400. Following cautious trade, fresh losses are looked for. A close back below 1.3250 will add weight to sentiment and extend July losses initially to 1.3200. A further close below the 1.3140 monthly low of 12 May will add weight to sentiment and open up 1.3000.