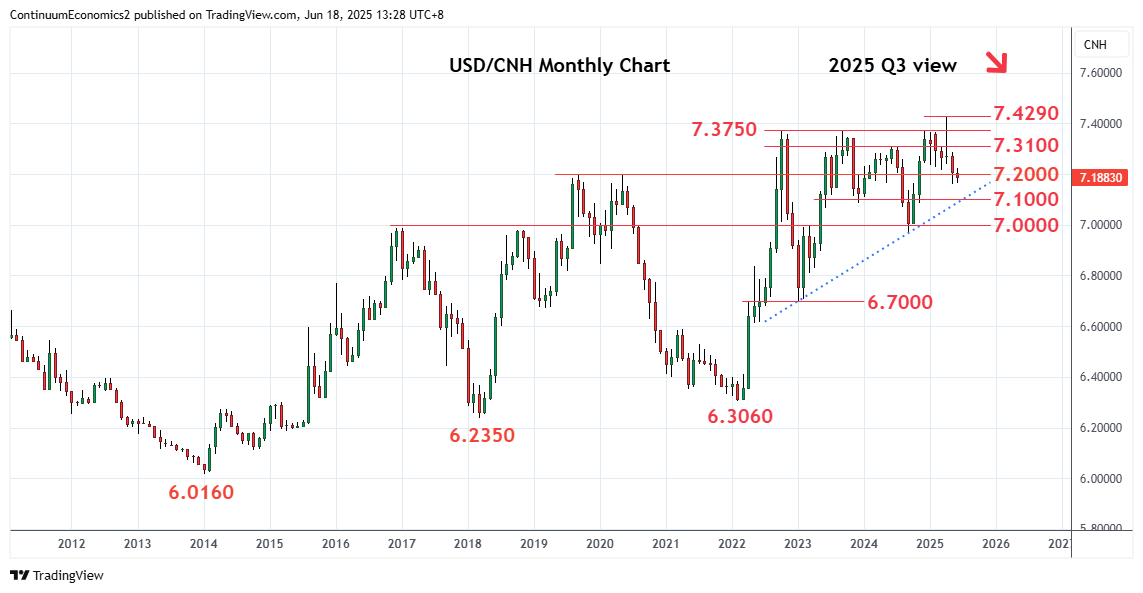

Chartbook: Chart USD/CNH: Room to extend losses from April spike high

Saw rally through the 2023/2024 year highs at 7.3700/7.3750 to reach fresh high at 7.4290 in early April

Saw rally through the 2023/2024 year highs at 7.3700/7.3750 to reach fresh high at 7.4290 in early April. Sharp rejection there to close below 7.3700 gave way to steady losses through the 7.2200 and 7.2000 support to return focus to the downside before stabilizing at 7.1615 low.

Consolidation above the latter see prices tracing out a bear flag, suggesting room for eventual break here to extend losses to the 7.1000 level and trend line from the January 2023 year low. Break of the latter will return focus to the 7.0000 psychological level then the 6.9710, September 2024 year low.

Meanwhile, resistance is lowered to the 7.2200 congestion and March low, now expected to cap and sustain losses from the 7.4290 high. Break here open up room for stronger corrective bounce to the 7.2800/7.3000 congestion area where renewed selling is expected.