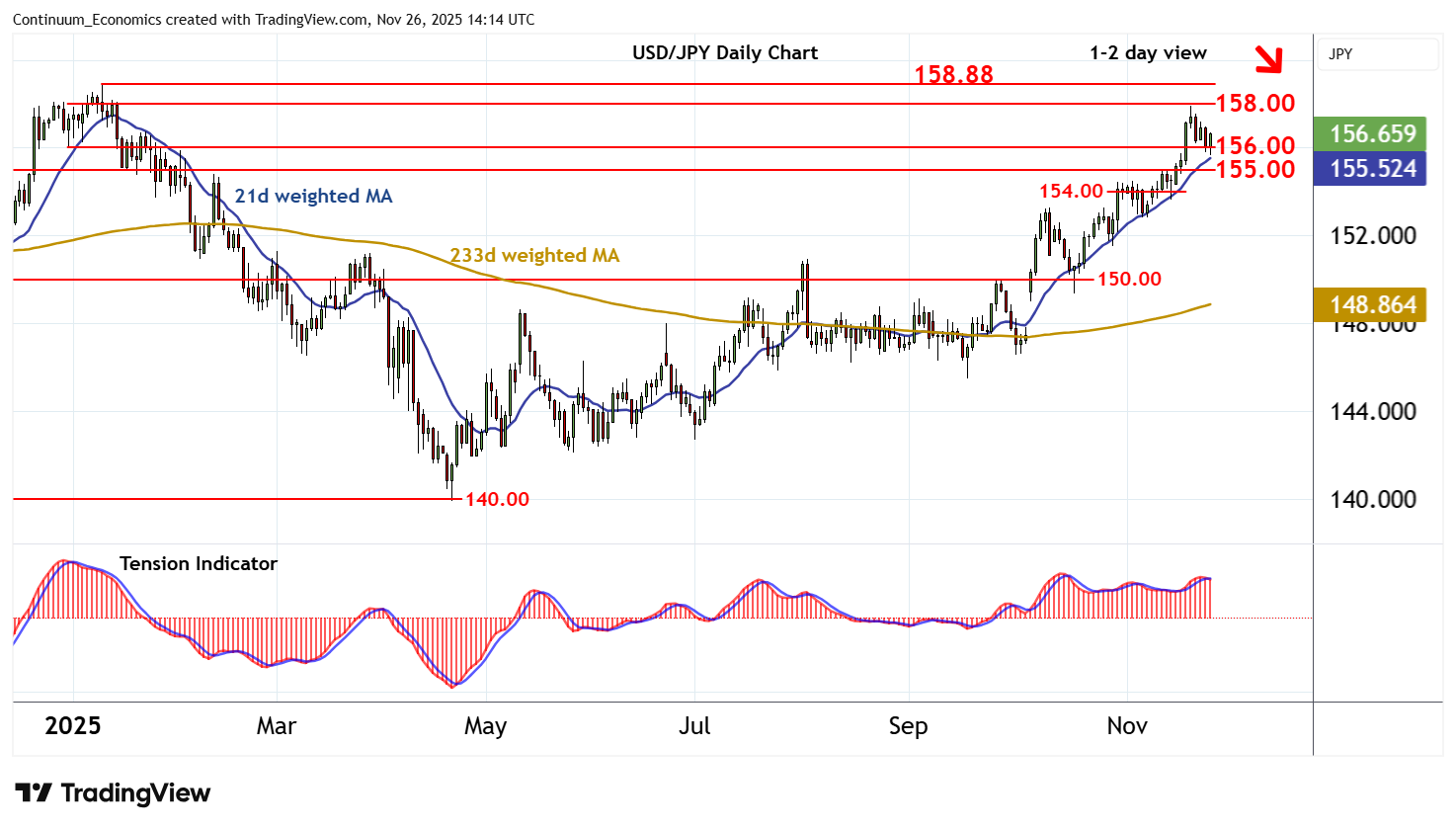

Chart USD/JPY Update: Choppy trade - daily studies under pressure

The anticipated break below 156.00 has bounced from 155.65

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 161.95 | ** | Jul 2024 | S1 | 156.00 | * | congestion | |

| R3 | 160.00 | ** | congestion | S2 | 155.00 | * | break level | |

| R2 | 158.88 | ** | 10 Jan YTD high | S3 | 154.00 | * | break level | |

| R1 | 157.90/00 | * | 20 Nov (w) high; break level | S4 | 153.00 | * | congestion |

Asterisk denotes strength of level

13:50 GMT - The anticipated break below 156.00 has bounced from 155.65, as oversold intraday studies unwind, with prices currently balanced around 156.65. Daily readings continue to track lower, highlighting room for a fresh test below 156.00. But mixed positive weekly charts should limit any break in renewed buying interest above support at the 155.00 break level. Following cautious trade, fresh gains are looked for. Resistance remains at the 157.90 weekly high of 20 November and the 158.00 break level. But a close above the 158.88 current year high of 10 January is needed to turn sentiment positive and extend September 2024 gains towards historic congestion around 160.00.