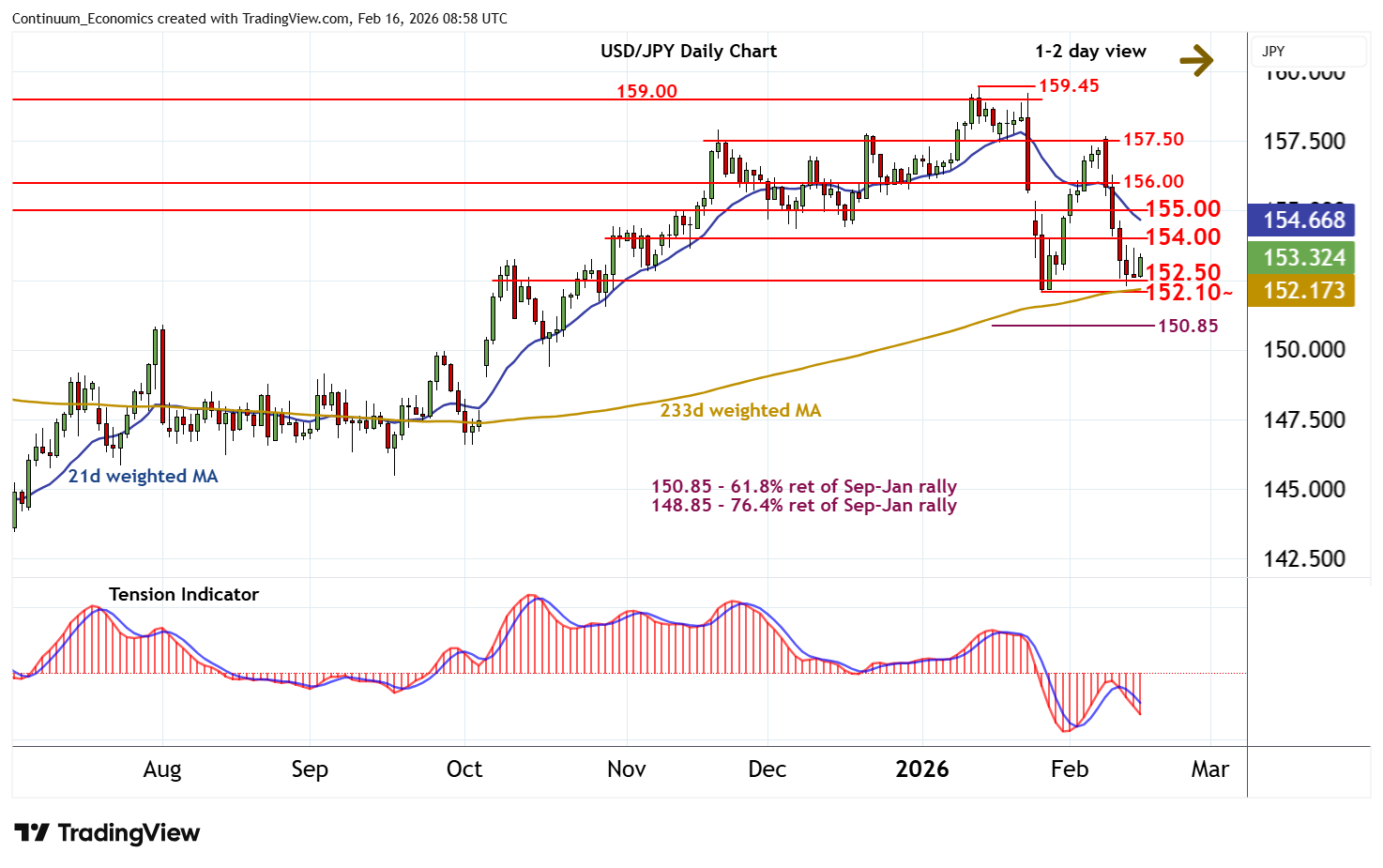

Chart USD/JPY Update: Range trade - studies under pressure

Consolidation has given way to a drift lower towards congestion support at 152.50

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 157.50 | * | congestion | S1 | 152.50 | * | congestion | |

| R3 | 156.00 | * | congestion | S2 | 152.10~ | ** | 27 Jan YTD low | |

| R2 | 155.00 | * | break level | S3 | 150.85 | ** | 61.8% ret of Sep-Jan rally | |

| R1 | 154.00 | * | congestion | S4 | 150.00 | ** | break level |

Asterisk denotes strength of level

08:50 GMT - Consolidation has given way to a drift lower towards congestion support at 152.50, where rising intraday studies are prompting a bounce back to 153.30. Continuation towards congestionr esistance at 154.00 cannot be ruled out. But negative daily readings and bearish weekly charts should limit any initial tests in renewed consolidation. A close above here, if seen, would open up 155.00, where fresh selling interest is expected to appear. Following cautious trade, lower levels are looked for. A break below 152.50 will open up the 152.10~ current year low of 27 January. A close beneath here will confirm a near-term top in place at the 159.45 current year high of 14 January, as focus then turns to the 150.85 Fibonacci retracement.