Published: 2025-06-03T11:56:58.000Z

Chart EUR/PLN Update: Room for higher

Senior Technical Strategist

-

Consolidation has given way to anticipated gains

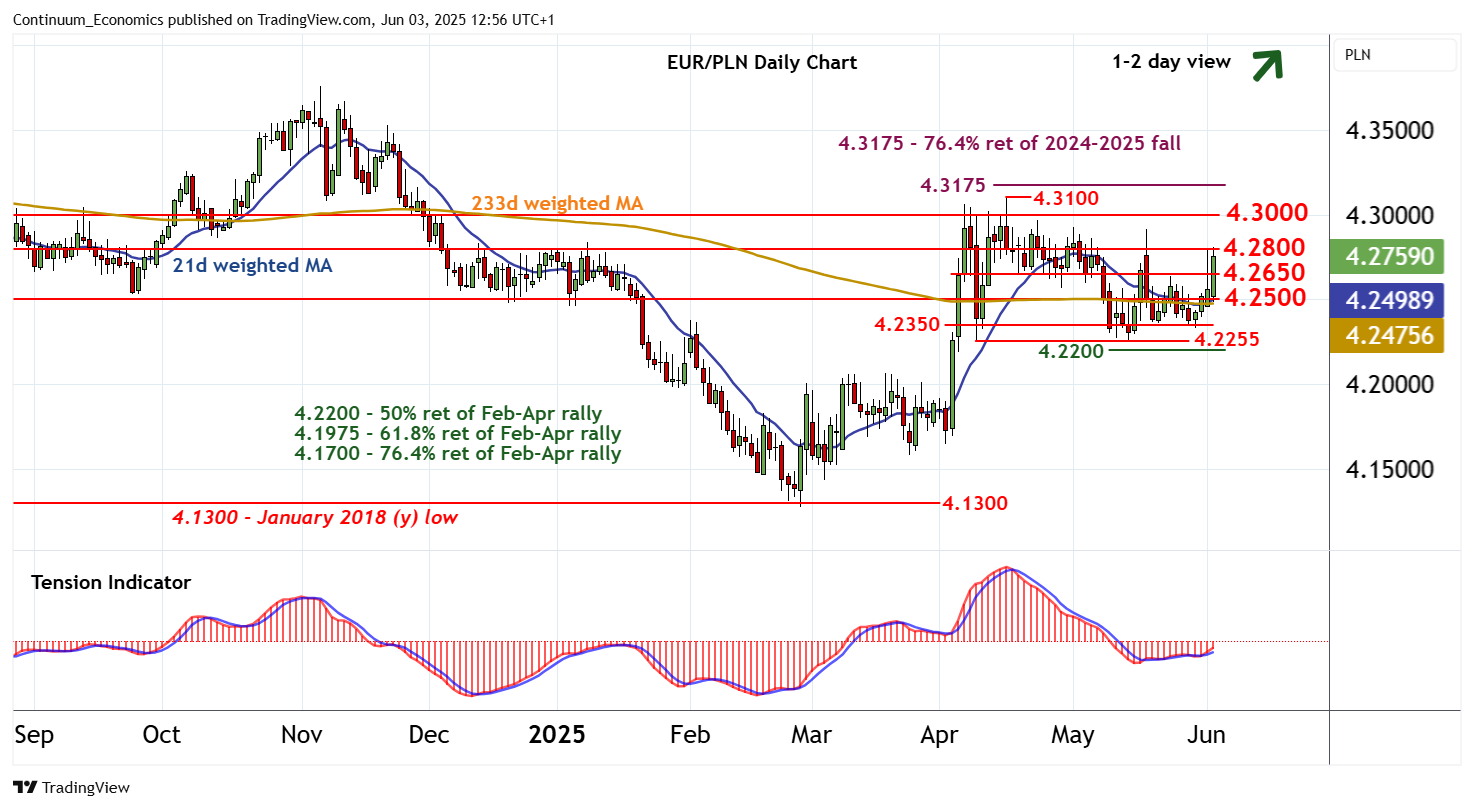

| Levels | Imp | Comment | Levels | Imp | Comment | |||

| R4 | 4.3175 | ** | 76.4% ret of 2024-2025 fall | S1 | 4.2650 | * | break level | |

| R3 | 4.3100 | * | 16 Apr YTD high | S2 | 4.2500 | * | congestion | |

| R2 | 4.3000 | * | break level | S3 | 4.2350 | * | congestion | |

| R1 | 4.2800 | ** | congestion | S4 | 4.2255 | * | 9 Apr (w) low |

Asterisk denotes strength of level

12:40 BST - Consolidation has given way to anticipated gains, with prices currently balanced in fresh consolidation following the test of congestion resistance at 4.2800. Rising daily readings highlighting room for continuation towards 4.3000. But negative weekly charts should limit any initial tests in renewed selling interest towards here. Meanwhile, support is raised to 4.2650 and extends to congestion around 4.2500. This range should underpin any immediate setbacks. A close below the 4.2200 Fibonacci retracement and the 4.2255 weekly low of 9 April is needed to turn sentiment negative and extend April losses initially towards the 4.1975 retracement and 4.2000.