Published: 2025-12-12T12:30:50.000Z

Chart USD/ZAR Update: Another fresh year low

1

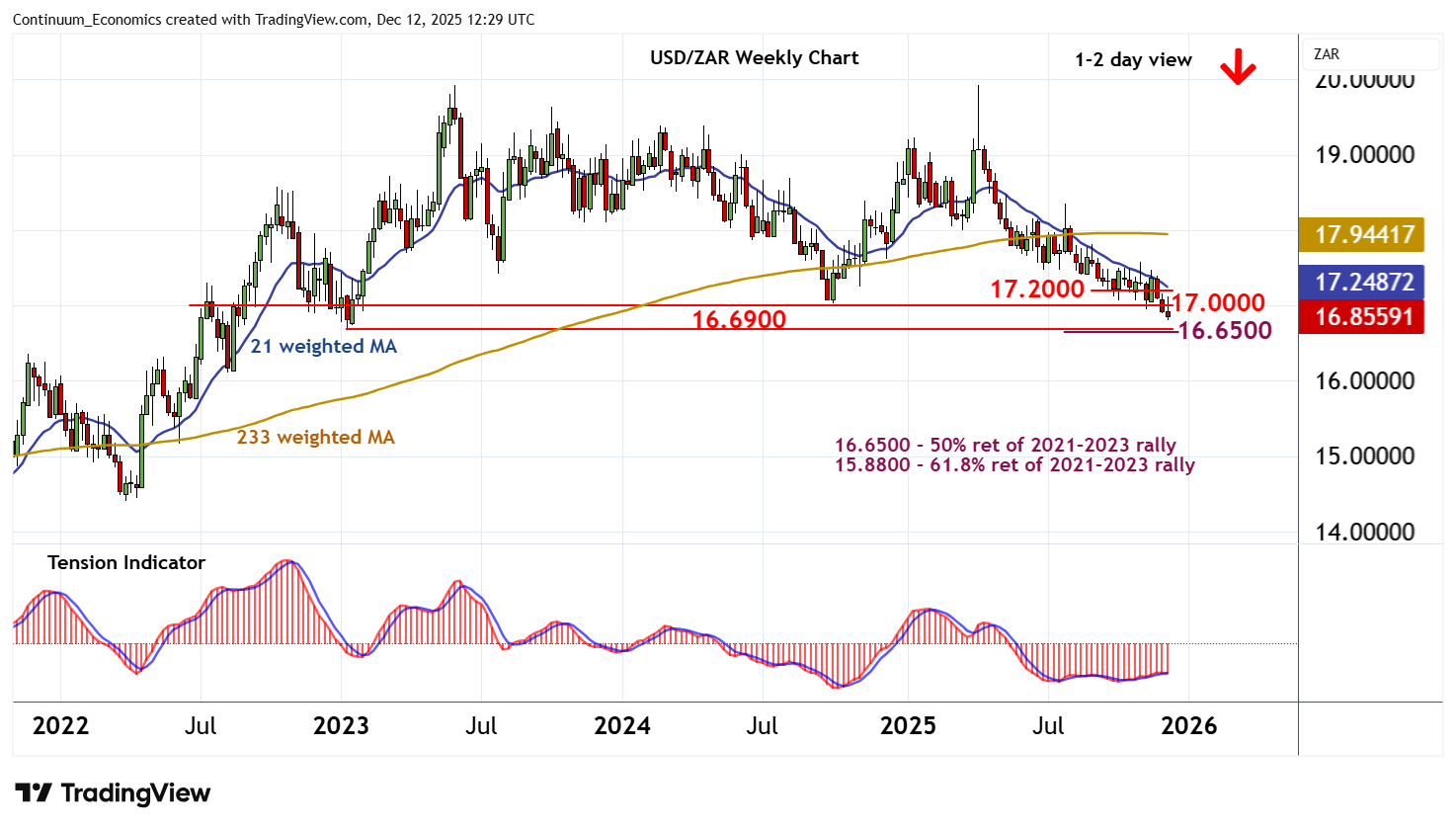

Anticipated selling interest has reached a fresh 2025 year low around 16.8065

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 17.5000 | ** | congestion | S1 | 16.8065 | fresh 2025 (y) low | ||

| R3 | 17.4000 | * | congestion | S2 | 16.6900 | ** | January 2023 (y) low | |

| R2 | 17.2000 | * | congestion | S3 | 16.6500 | ** | 50% ret of 2021-2023 rally | |

| R1 | 17.0000 | ** | congestion | S4 | 16.1060 | ** | August 2022 low |

Asterisk denotes strength of level

12:00 GMT - Anticipated selling interest has reached a fresh 2025 year low around 16.8065, where oversold intraday studies are prompting short-term consolidation. Daily studies are negative and weekly charts are also under pressure, highlighting room for further losses in the coming sessions. A break beneath here will add weight to sentiment and extend April losses towards the 16.6900 year low of January 2023 and the 16.6500 Fibonacci retracement. Meanwhile, resistance remains at congestion around 17.0000 and extends to further congestion at 17.2000. This range should cap any immediate tests higher.