Published: 2025-06-03T07:46:31.000Z

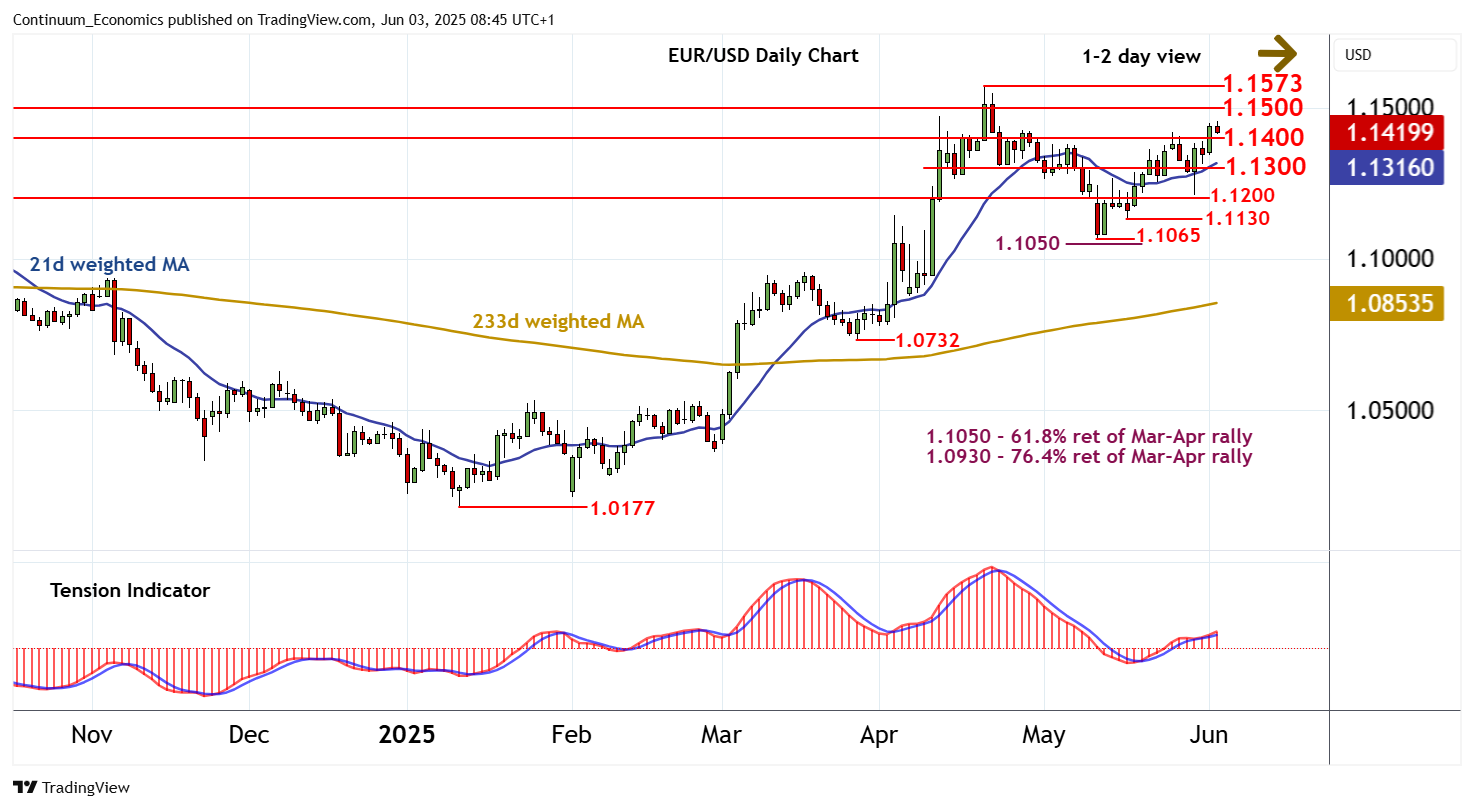

Chart EUR/USD Update: Consolidating gains - limited downside tests

Senior Technical Strategist

1

The break above 1.1400 has met selling interest around 1.1455

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.1615 | November 2021 ( m) high | S1 | 1.1400 | * | congestion | ||

| 14 | 1.1600 | * | congestion | S2 | 1.1300 | * | break level | |

| R2 | 1.1573 | ** | 21 Apr YTD high | S3 | 1.1200 | * | congestion | |

| R1 | 1.1500 | * | congestion | S4 | 1.1130 | * | 16 May low |

*Asterisk denotes strength of level

08:30 BST - The break above 1.1400 has met selling interest around 1.1455, as positive intraday studies turn down, with prices currently balanced in consolidation around 1.1415. Overbought daily stochastics are also flattening, suggesting room for a test back below congestion support at 1.1400. But the positive daily Tension Indicator and mixed/positive weekly charts are expected to limit scope in renewed buying interest towards 1.1300. Following cautious trade, fresh gains are looked for. Resistance is at congestion around 1.1573. But a close above the 1.1573 current year high of 21 April will confirm continuation of September 2022 gains, and initially open up congestion around 1.1600 and the 1.1615 monthly high of November 2021.