Published: 2024-07-01T08:13:23.000Z

Chart USD/CHF Update: Edging higher

2

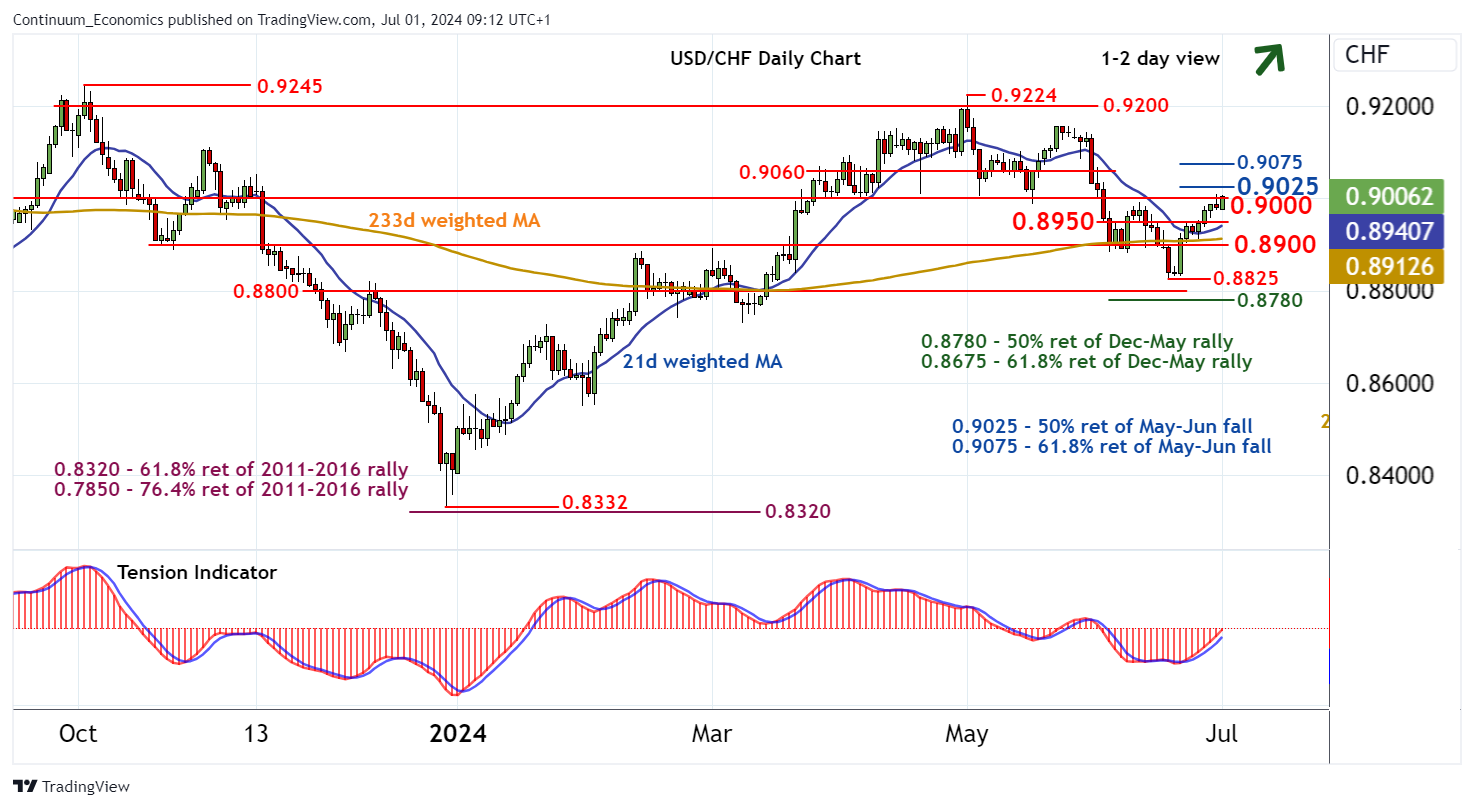

Little change, as prices extend pressure on resistance at 0.9000

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.9075 | ** | 61.8% ret of May-Jun fall | S1 | 0.8950 | * | break level | |

| R3 | 0.9060 | break level | S2 | 0.8900 | * | congestion | ||

| R2 | 0.9025 | ** | 50% ret of May-Jun fall | S3 | 0.8825 | * | 18 Jun (w) low | |

| R1 | 0.9000 | * | break level | S4 | 0.8800 | * | congestion |

09:05 BST - Little change, as prices extend pressure on resistance at 0.9000. Daily readings are positive, highlighting potential for continuation beyond here. However, overbought daily stochastics are flattening and broader weekly charts are mixed, suggesting fresh selling interest towards the 0.9025 Fibonacci retracement. A further close above here, however, would improve sentiment and extend June gains towards 0.9060/75. Following corrective trade, fresh losses are looked for. A later close below support at 0.8950 will open up congestion around 0.8900. Further slippage will add weight to sentiment and put focus on the 0.8825 weekly low of 18 June.