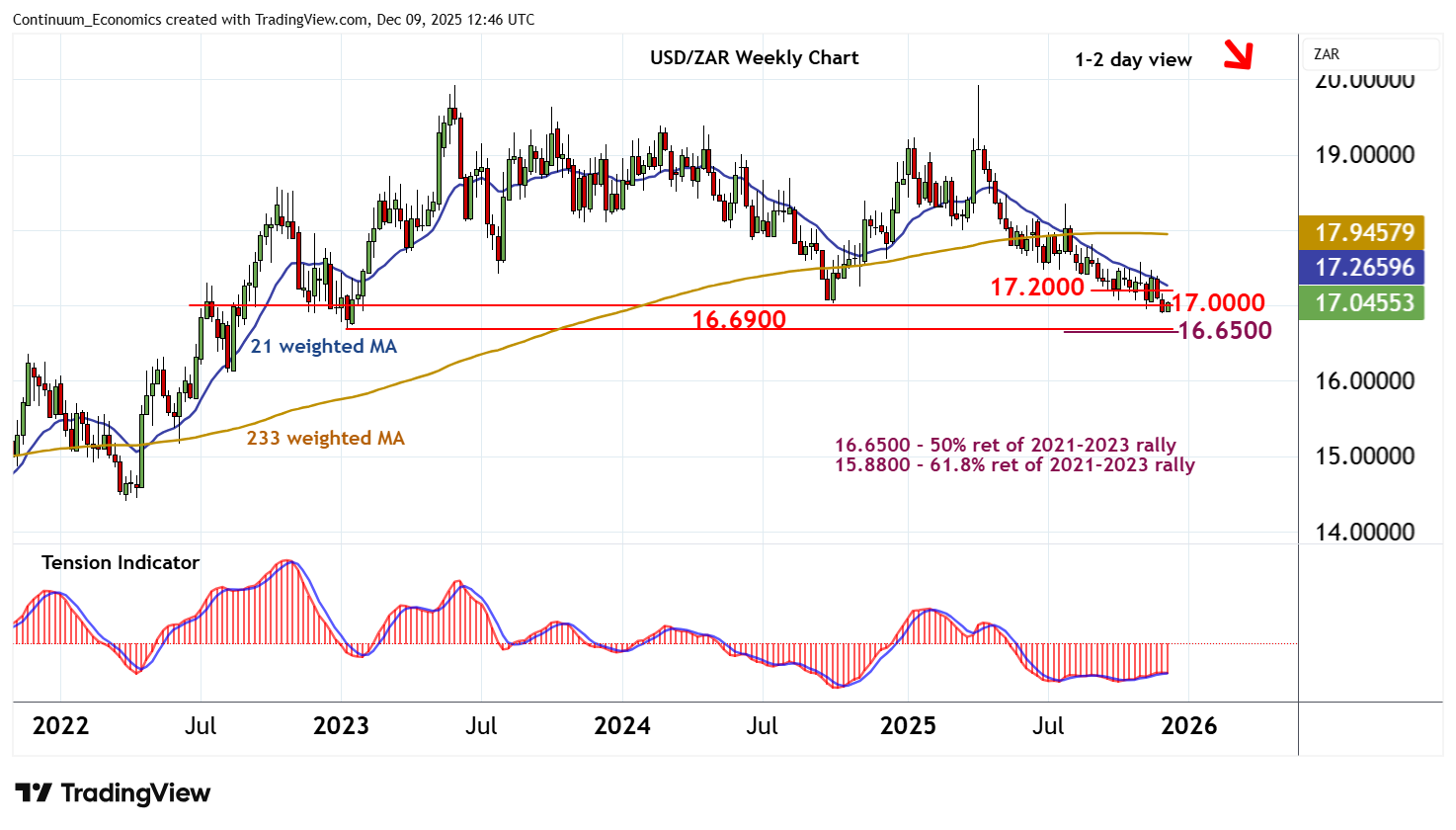

Chart USD/ZAR Update: Balanced above fresh 2025 year low - studies under pressure

Anticipated losses have posted a fresh 2025 year low below 17.000 around 16.9000

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 17.5775 | 5 Nov (w) high | S1 | 17.0000 | ** | congestion | ||

| R3 | 17.5000 | ** | congestion | S2 | 16.9000 | * | 5 Dec YTD low | |

| R2 | 17.4000 | * | congestion | S3 | 16.6900 | ** | January 2023 (y) low | |

| R1 | 17.2000 | * | congestion | S4 | 16.6500 | ** | 50% ret of 2021-2023 rally |

Asterisk denotes strength of level

12:20 GMT - Anticipated losses have posted a fresh 2025 year low below 17.000 around 16.9000, before bouncing back into consolidation above 17.0000. Oversold daily stochastics are unwinding and the bearish daily Tension Indicator is flattening, suggesting room for a bounce. But negative weekly and longer-term charts are expected to limit scope in renewed selling interest towards congestion resistance at 17.2000. Following corrective trade, fresh losses are looked for. A close below 16.9000-17.0000 will add weight to sentiment and extend April losses towards the 16.6900 year low of January 2023 and the 16.6500 Fibonacci retracement.