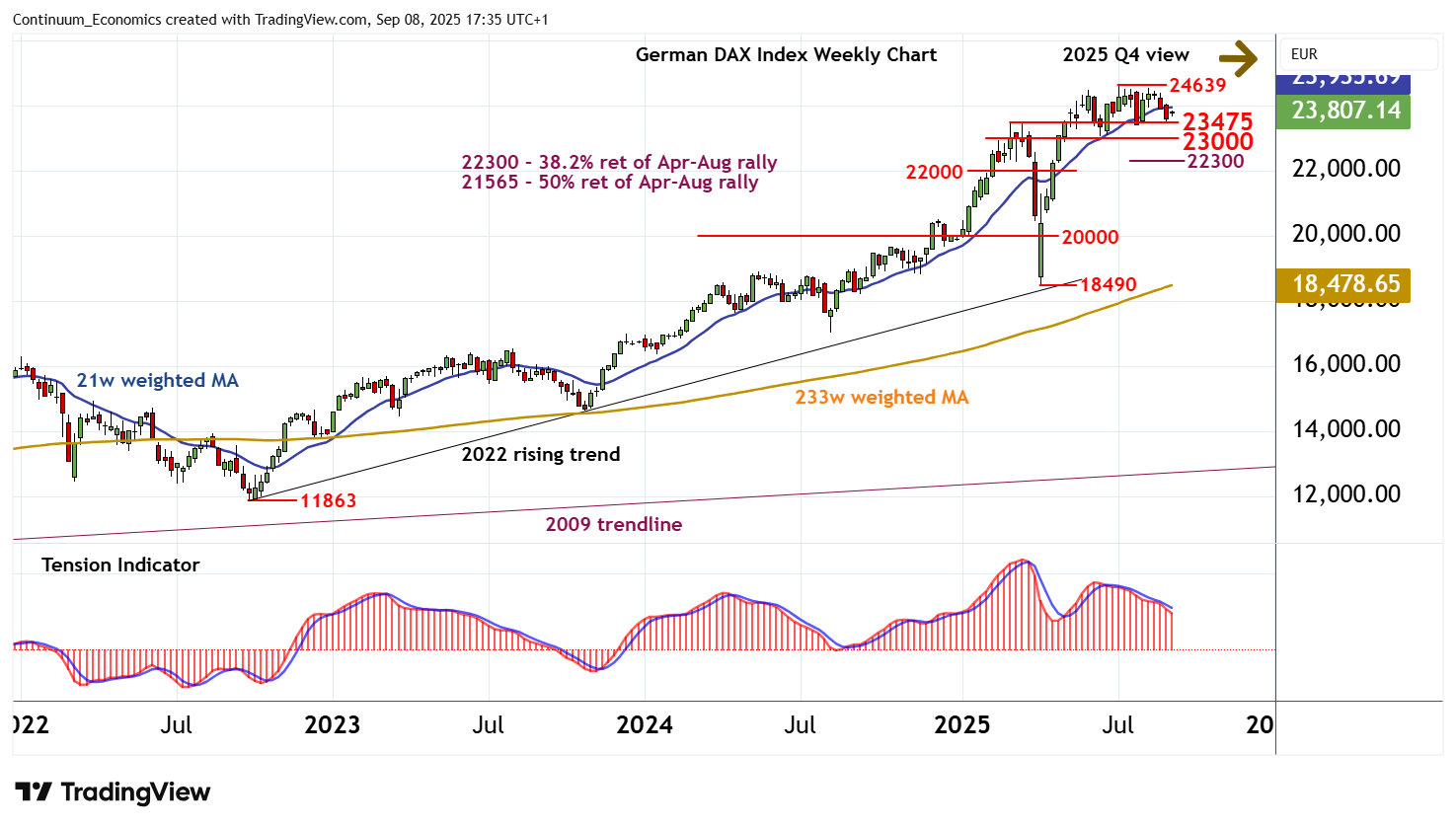

Chartbook: DAX Chart: Potential for a corrective pullback before higher levels unfold

After posting fresh marginal contract highs at 24639, prices have settled lower into range extension above support at the 23475 high of March and congestion around 23000

After posting fresh marginal contract highs at 24639, prices have settled lower into range extension above support at the 23475 high of March and congestion around 23000.

Weekly stochastics and the weekly Tension Indicator are falling, highlighting a more cautious tone into the coming weeks, with risk of a deeper correction.

A break below 23000 will add weight to sentiment and signal a near-term top in place at 23475, as selling interest increases.

A deeper correction of the April rally will then focus on the 22300 Fibonacci retracement and congestion around 22000. But already oversold weekly stochastics could prompt fresh buying interest/consolidation within this range.

Meanwhile, resistance is at congestion around 24000 and extends to 24639.

A tick lower in overbought monthly stochastics and the deteriorating positive monthly Tension Indicator are expected to limit any immediate tests of this range in fresh consolidation/selling interest.

However, longer-term charts are mixed/positive, suggesting a later break above here following cautious trade.

A close above 24639 will turn sentiment positive once again and extend gains beyond strong resistance at the 24850 Fibonacci projection and psychological barrier at 25000 towards the 26000 projection.