Chartbook: Chart EUR/CHF: Extending range trade

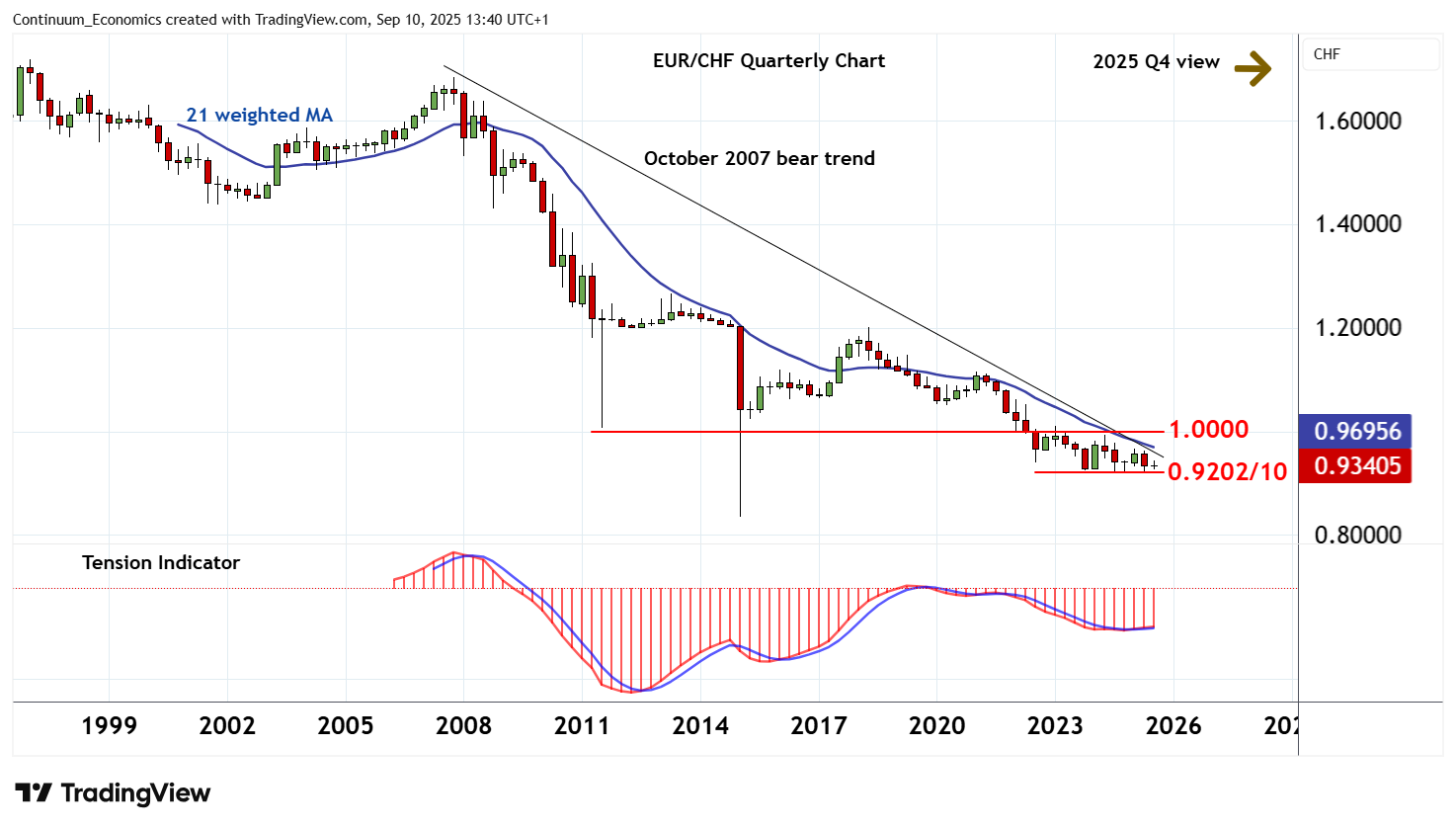

Little change in the previous months, as prices extend cautious trade above critical support at the 0.9202/10 all-time lows from August 2024 - March 2025

Little change in the previous months, as prices extend cautious trade above critical support at the 0.9202/10 all-time lows from August 2024 - March 2025.

Monthly stochastics are flat, highlighting potential for further consolidation into early Q4.

But the rising monthly Tension Indicator is showing early signs of turning down, suggesting consolidation could give way to increased downside risks.

A close below0.9202/10 will add weight to sentiment and extend multi-year losses into fresh historic lows towards psychological support at 0.9000.

However, mixed longer-term charts could prompt renewed buying interest towards here.

Meanwhile, immediate resistance is at congestion around 0.9400 and extends to the 0.9445 monthly high of 18 August.

Bearish weekly stochastics and the deteriorating weekly Tension Indicator are expected to limit any tests of this range in renewed consolidation/selling interest.

However, a close above here would improve sentiment and extend April gains towards congestion around 0.9500. Further continuation would confirm a stronger bounce as focus then turns to critical resistance at congestion around 0.9600 and the 0.9660 current year high of 14 March.