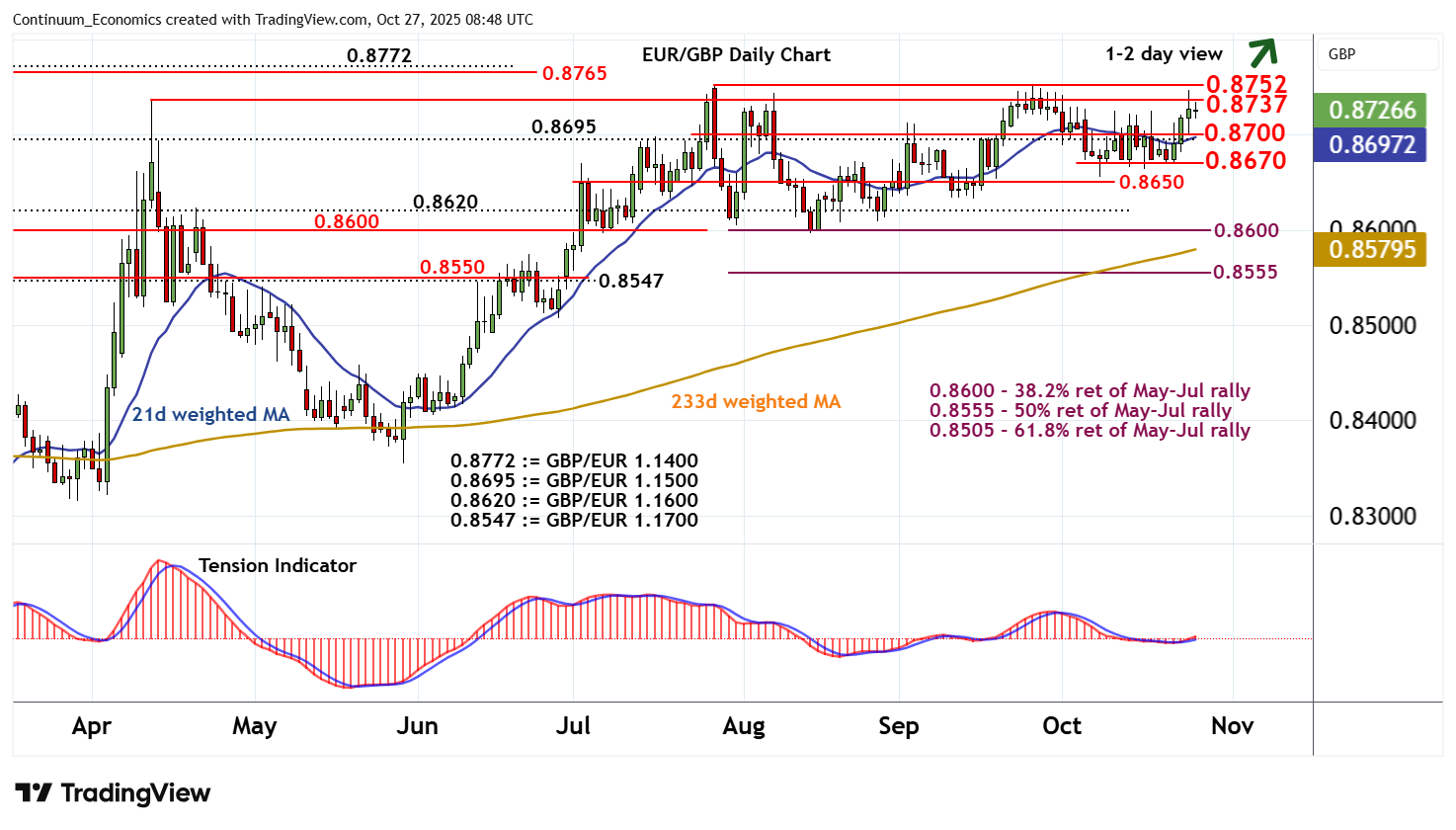

Chart EUR/GBP Update: Consolidating test of critical resistance at 0.8737/52

The anticipated test of critical resistance at the 0.8737 monthly high of 11 April and the 0.8752 current year high of 28 July has been pushed back from 0.8745

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.8772 | * | GBP/EUR 1.1400 | S1 | 0.8695/00 | ** | GBP/EUR 1.1500; cong | |

| R3 | 0.8765 | ** | November 2023 high | S2 | 0.8670 | recent range lows | ||

| R2 | 0.8752 | ** | 28 Jul YTD high | S3 | 0.8650 | ** | congestion | |

| R1 | 0.8737 | ** | 11 Apr (m) high | S4 | 0.8620 | * | GBP/EUR 1.1600 |

Asterisk denotes strength of level

08:40 GMT - The anticipated test of critical resistance at the 0.8737 monthly high of 11 April and the 0.8752 current year high of 28 July has been pushed back from 0.8745, as intraday studies turn down, with prices currently balanced around 0.8725. Rising daily stochastics and the positive daily Tension Indicator highlight room for a retest. But mixed weekly charts should limit any initial tests in renewed consolidation. A close above here, however, will turn sentiment positive and extend December 2024 gains initially towards 0.8765/72. Meanwhile, support remains at 0.8695/00 and extends to the 0.8670 recent range lows. This range should underpin any immediate setbacks.