Published: 2025-05-21T06:52:03.000Z

Chart USD/CHF Update: Extending losses

Technical Analyst

1

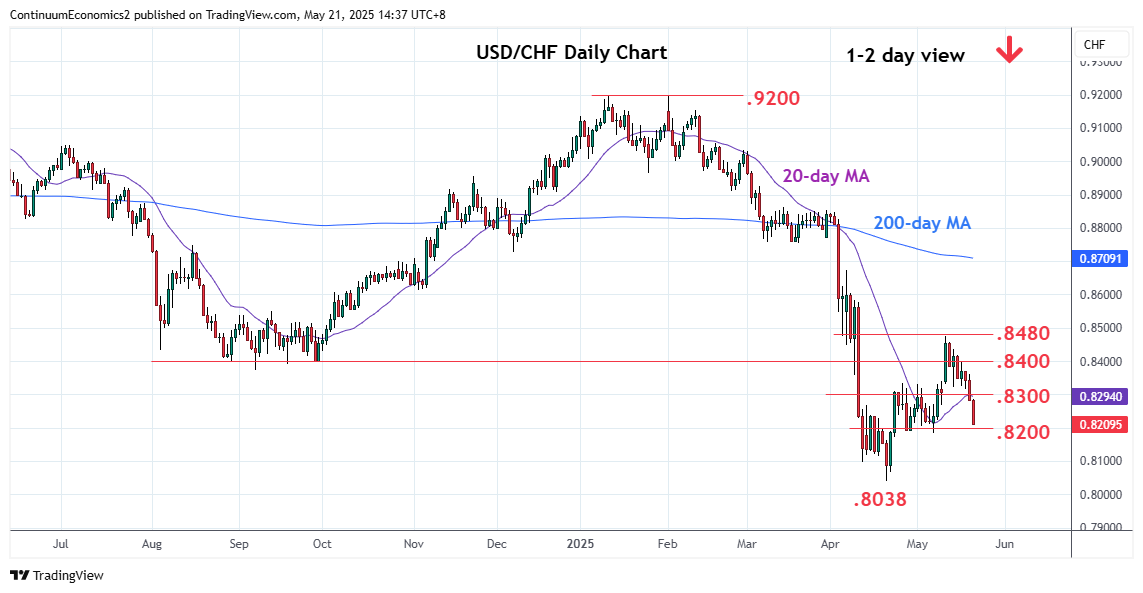

Sharply lower following break of the .8300 level as prices extend rejection from the .8480, 38.2% Fibonacci level

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.8600/20 | * | congestion, 50% | S1 | 0.8200 | * | congestion | |

| R3 | 0.8475/80 | ** | 12 May high, 38.2% | S2 | 0.8100 | * | 11 Apr low | |

| R2 | 0.8400 | ** | congestion | S3 | 0.8038 | ** | 21 Apr YTD low | |

| R1 | 0.8300/30 | * | congestion | S4 | 0.8000 | * | congestion from Aug 2011 |

Asterisk denotes strength of level

06:45 GMT - Sharply lower following break of the .8300 level as prices extend rejection from the .8480, 38.2% Fibonacci level. Negative daily studies are unwinding overbought readings and see support at .8200 within reach. Break here will return focus to the .8100 level and .8038, 21 April YTD low. Would expect reaction at the latter but further losses cannot be ruled out. Meanwhile, resistance is lowered to the .8300/30 congestion which is expected to cap and sustain losses from the .8480, corrective high of last week.