Published: 22/01/25 at 02:36 UTC

Chart USD/THB Update: Still heavy

Technical Analyst

-

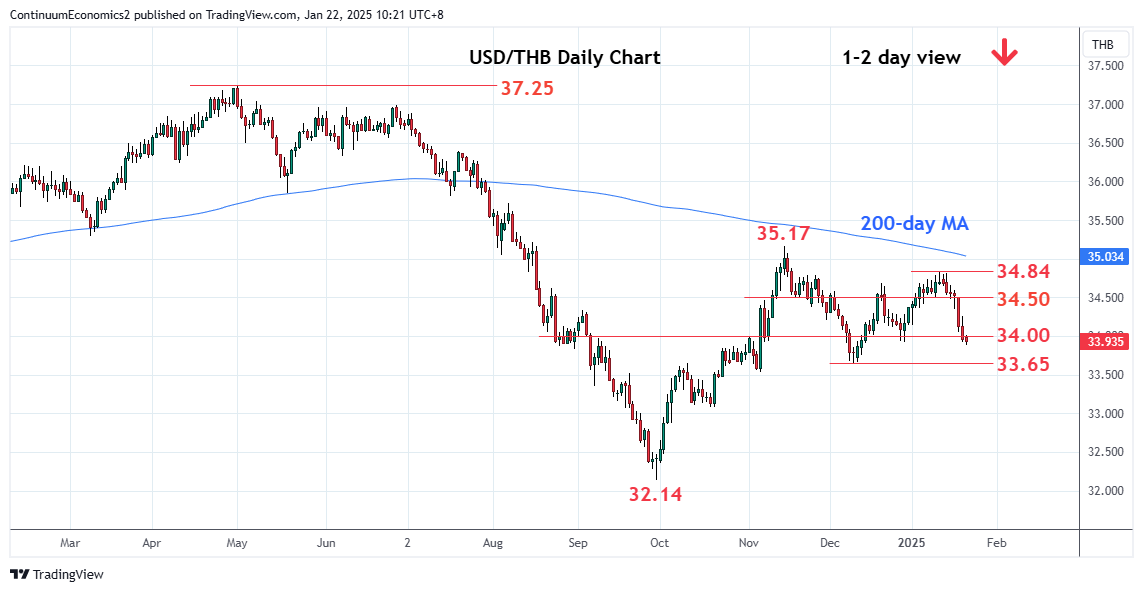

Prices remains under pressure and break of support at the 34.00/33.92 area further extend losses from the 34.84 high

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 34.68 | * | Dec high | S1 | 33.65 | ** | 10 Dec low, 50% | |

| R3 | 34.50 | ** | congestion | S2 | 33.50 | * | congestion | |

| R2 | 34.35 | * | 17 Jan low | S3 | 33.30 | * | 61.8% Sep/Nov rally | |

| R1 | 34.20 | * | congestion | S4 | 33.08 | * | 18 Oct low |

Asterisk denotes strength of level

02:35 GMT - Prices remains under pressure and break of support at the 34.00/33.92 area further extend losses from the 34.84 high. However, oversold intraday studies suggest scope for corrective bounce though upside likely to remain limited. Negative daily studies weighs and suggest room for further losses to retrace the September/November rally. Lower will see room to the strong support at the 33.65 low of 10 December and 50% Fibonacci level. Meanwhile, resistance is lowered to the 34.20/34.35 congestion area which is expected to cap.