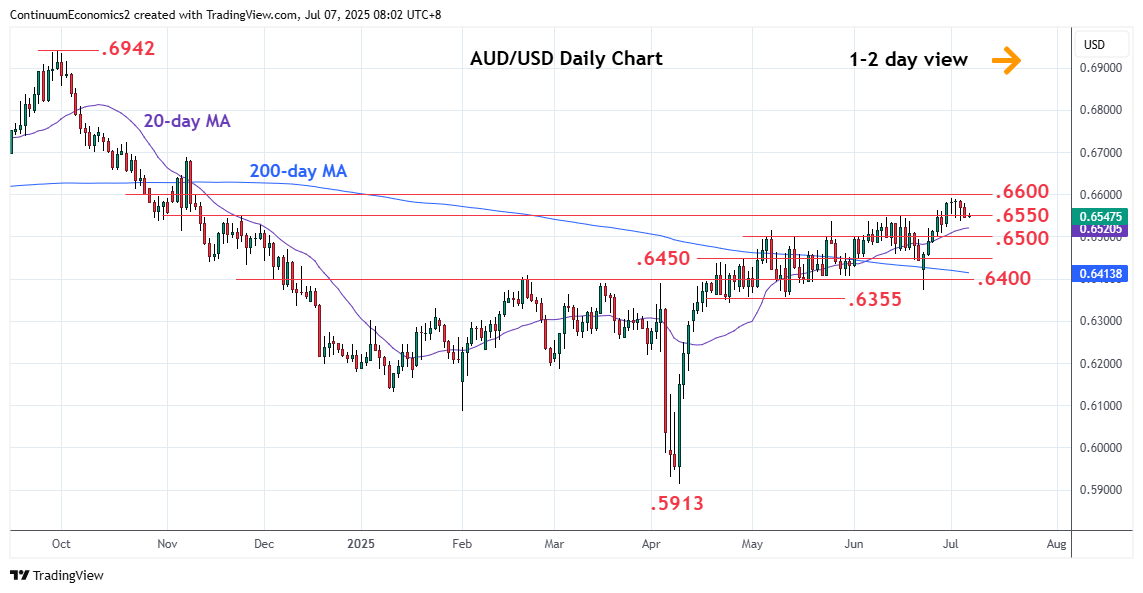

Leaning lower from the .6590 current year high to trade around the .6550 congestion

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.6700 | * | 76.4% Sep/Apr fall | S1 | 0.6500 | * | congestion | |

| R3 | 0.6688 | * | Nov 2024 high | S2 | 0.6450 | * | congestion | |

| R2 | 0.6650 | * | congestion | S3 | 0.6400 | ** | congestion | |

| R1 | 0.6600 | * | congestion | S4 | 0.6372 | ** | Jun low |

Asterisk denotes strength of level

00:10 GMT - Leaning lower from the .6590 current year high to trade around the .6550 congestion. Daily studies have turned lower from overbought areas and threatens deeper pullback to retrace strong gains from the .6372, June low. Lower will see room to the .6500 level and possibly .6450 congestion. However, bullish gains from the April low are expected to give way to renewed buying pressure later for retest of the .6590 high. Clearance here and the .6600 level will see room to extend gains to the .6650 congestion and .6688 high of November 2024.