Published: 2025-06-11T13:29:46.000Z

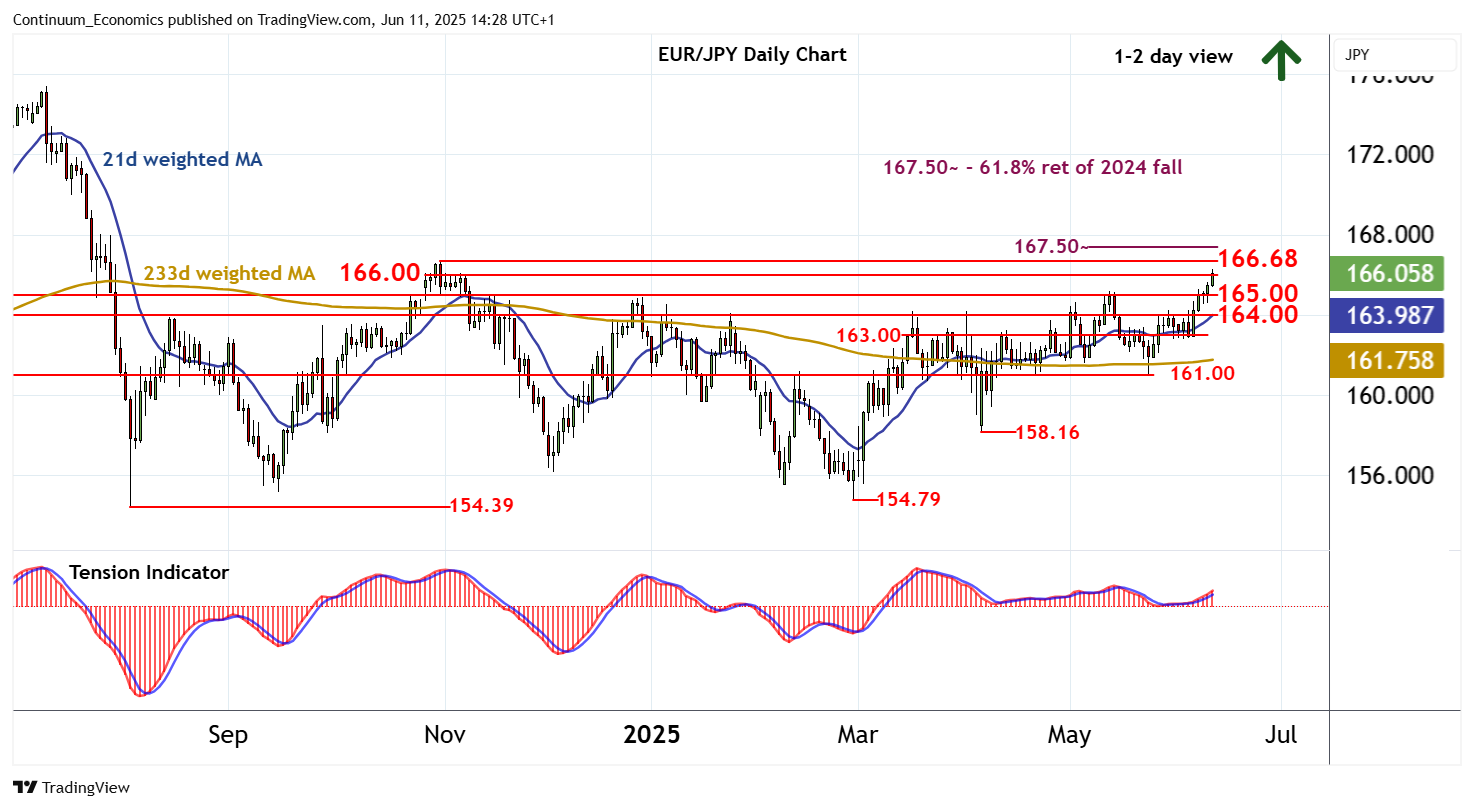

Chart EUR/JPY Update: Posting fresh 2025 year highs

Senior Technical Strategist

1

The anticipated test of congestion resistance at 166.00 has given way to a break to a fresh 2025 year high at 166.29

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 168.00 | ** | break level | S1 | 165.00 | * | break level | |

| R3 | 167.50~ | ** | 61.8% ret of 2024 fall | S2 | 164.00 | ** | break level | |

| R2 | 166.68 | ** | 31 Oct (m) high | S3 | 163.00 | * | break level | |

| R1 | 166.00 | * | congestion | S4 | 162.00 | * | congestion |

Asterisk denotes strength of level

14:20 BST - The anticipated test of congestion resistance at 166.00 has given way to a break to a fresh 2025 year high at 166.29, before settling back into consolidation around 166.00. Intraday studies are positive and the daily Tension Indicator is rising, highlighting room for continuation of February gains towards the 166.68 monthly high of 31 October. Flat overbought daily stochastics could limit any initial tests in consolidation, before rising weekly charts prompt a break and extend August 2024 gains towards the 167.50~ Fibonacci retracement. Meanwhile, a close below support at 165.00, if seen, would help to stabilise price action and prompt consolidation around 164.00.