Chartbook: DAX Chart: Pressuring channel resistance - studies mixed/positive

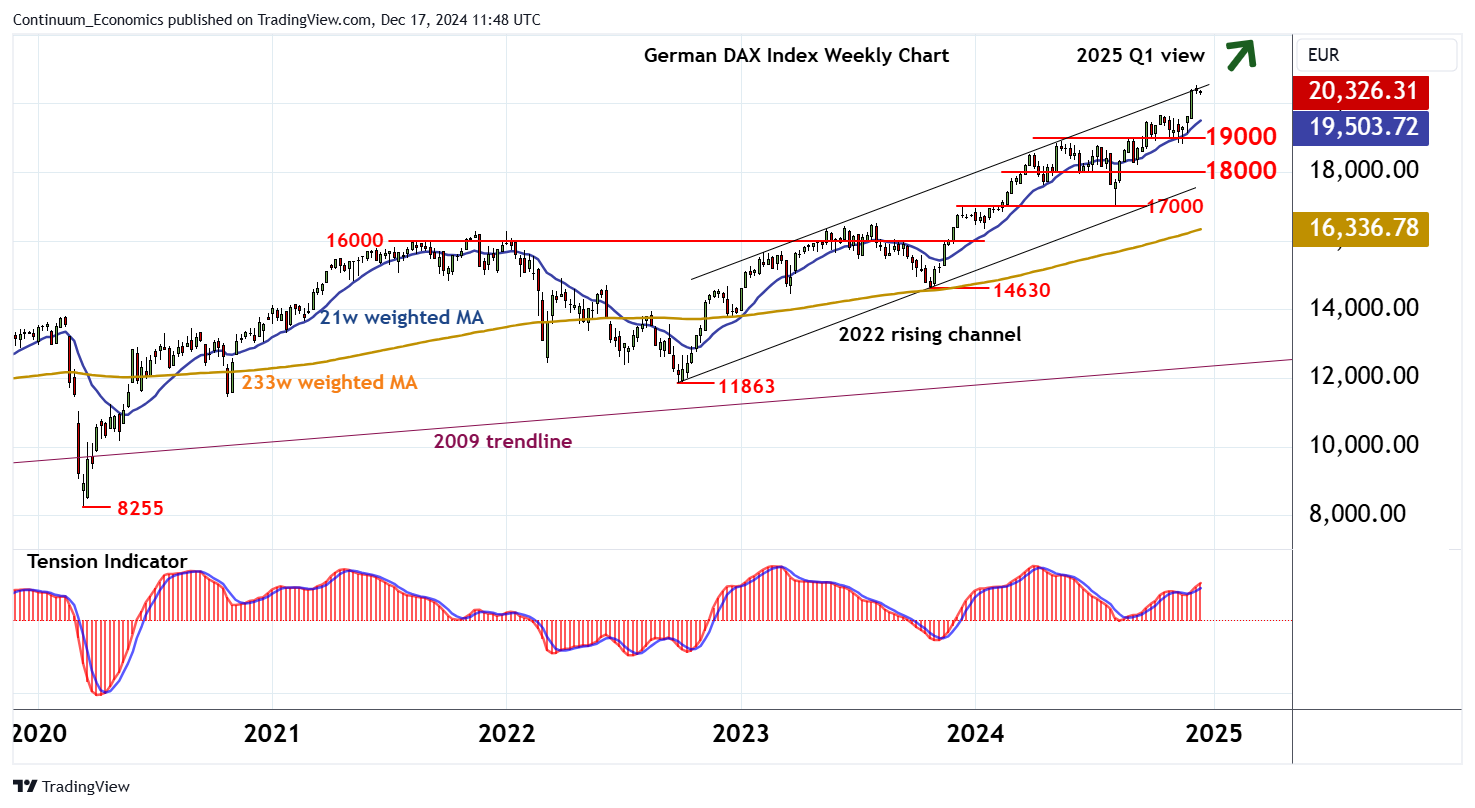

Anticipated consolidation met strong buying interest just below support at 19,000

Anticipated consolidation met strong buying interest just below support at 19,000,

before prices turned higher once again.

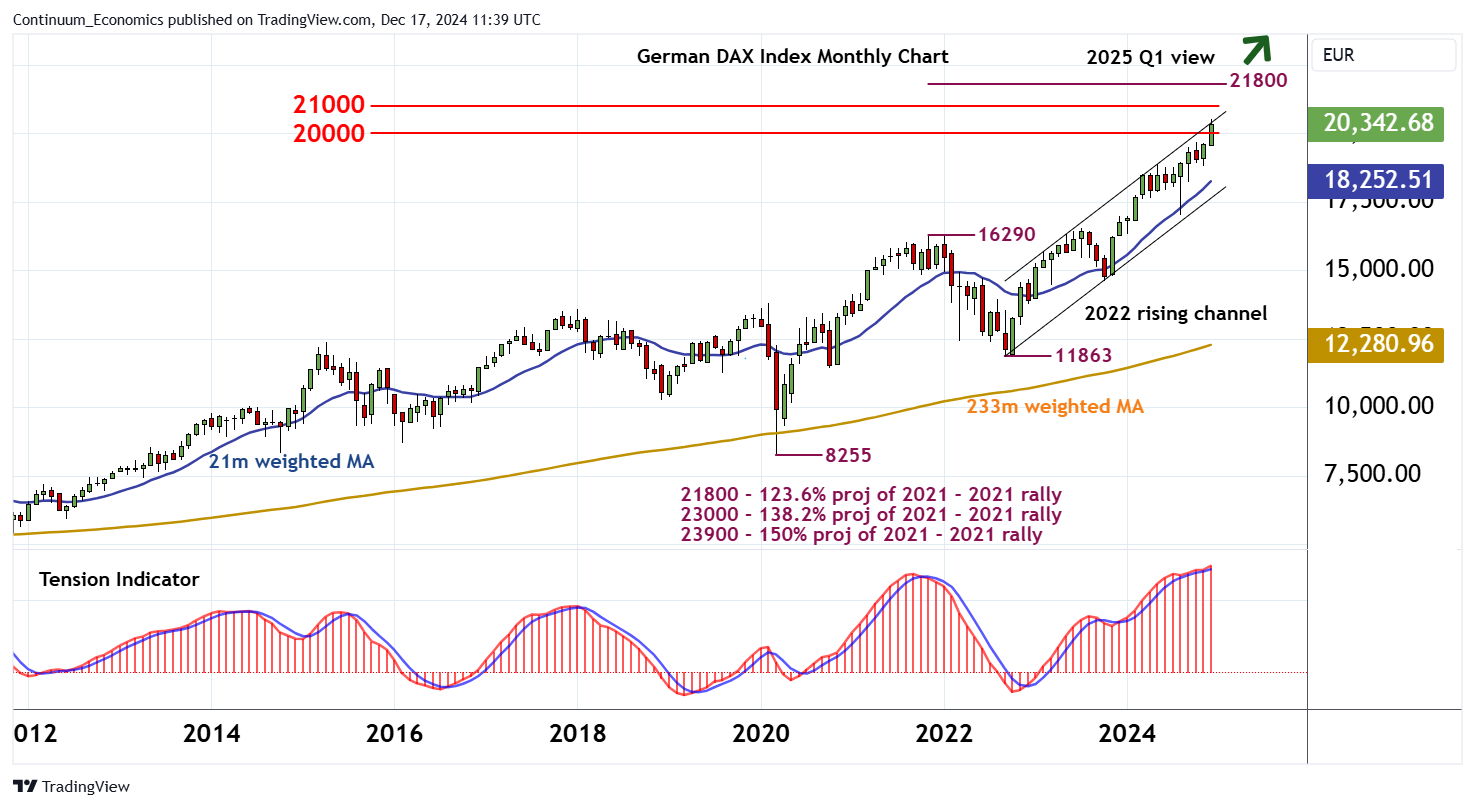

The break above psychological resistance at 20,000 has improved sentiment and reached the top of the 2022 rising channel, currently around 20,500~, where flattening overbought monthly stochastics are prompting minor reactions.

The monthly Tension Indicator continues to strengthen, and longer-term charts are also rising, pointing to potential for still further strength into the coming weeks.

A break above channel resistance will help to improve sentiment and open up 21,000. However, overbought monthly stochastics could prompt profit-taking towards here and limit any immediate break to the 21,800 multi-month Fibonacci projection.

Meanwhile, support is raised to the 19,000 break level.

A close beneath here, if seen, would turn sentiment neutral and prompt consolidation within the broad multi-week congestion pattern above 18,000.

Continuation beneath here would add weight to sentiment, but a close below channel support is needed to turn sentiment outright negative and confirm a more significant pullback.