Published: 2025-06-16T09:37:51.000Z

Chartbook: Chart EUR/CHF: Any tests higher to remain limited - monthly studies under pressure

0

3

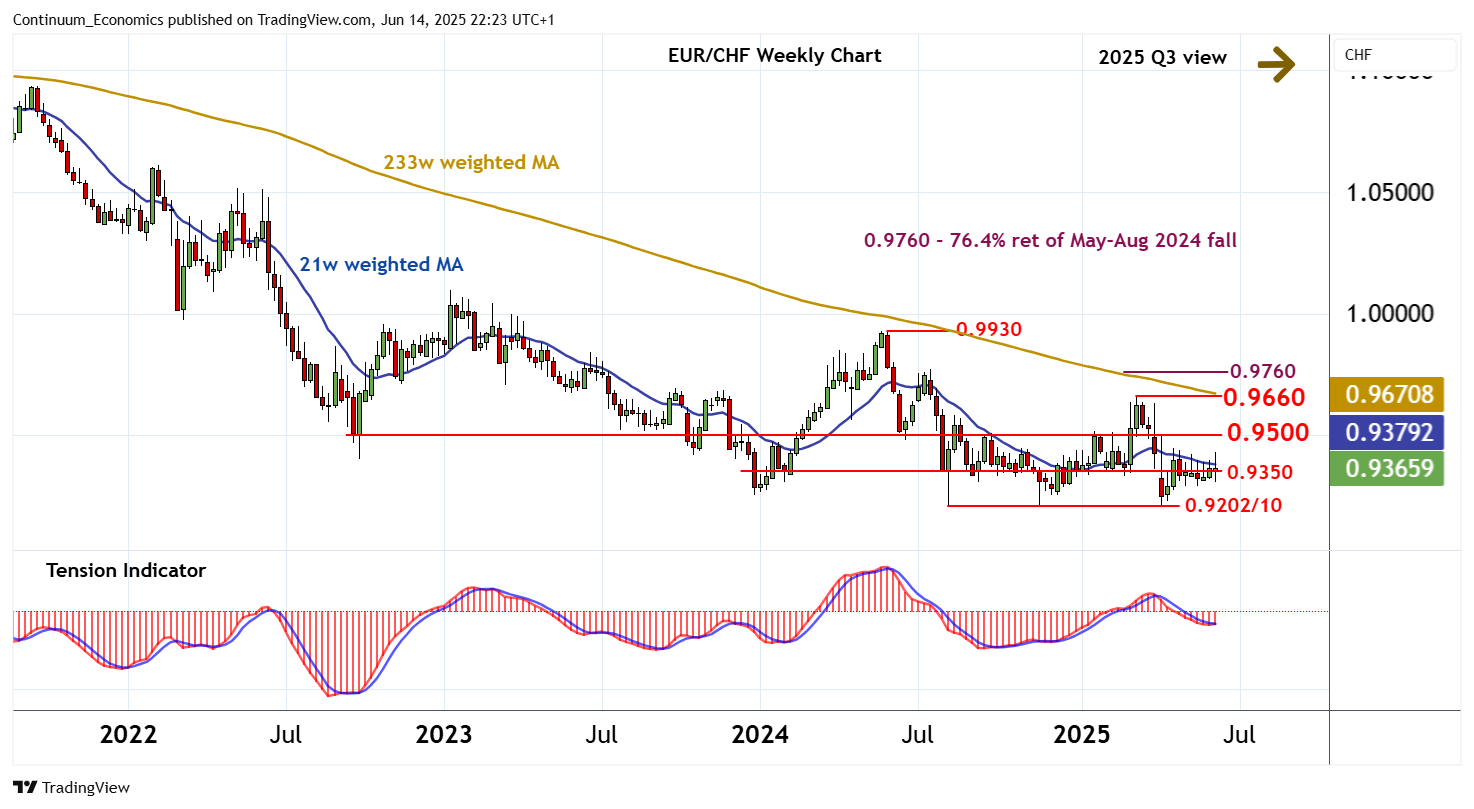

The anticipated break above congestion resistance at 0.9500 has met selling interest at 0.9660

The anticipated break above congestion resistance at 0.9500 has met selling interest at 0.9660,

as increased global risks prompted safe-haven CHF demand.

The subsequent pullback from the 0.9660 current year high of 14 March has given way to a pullback into the broad congestion range from August 2024, with prices currently balanced in consolidation around 0.9350.

Weekly stochastics and the weekly Tension Indicator are rising, highlighting room for a retest of congestion resistance at 0.9500.

A close above here will open up 0.9660.

But any further gains are expected to meet renewed selling interest towards the 0.9760 Fibonacci retracement, as broader monthly studies turn down.

Following any tests higher, selling interest is expected to appear, with focus to turn to critical support at the 0.9202/10 all-time lows from August 2024 - March 2025. A break beneath here will add weight to sentiment and post fresh lows towards psychological support at 0.9000. However, positive longer-term charts could prompt renewed buying interest towards here.