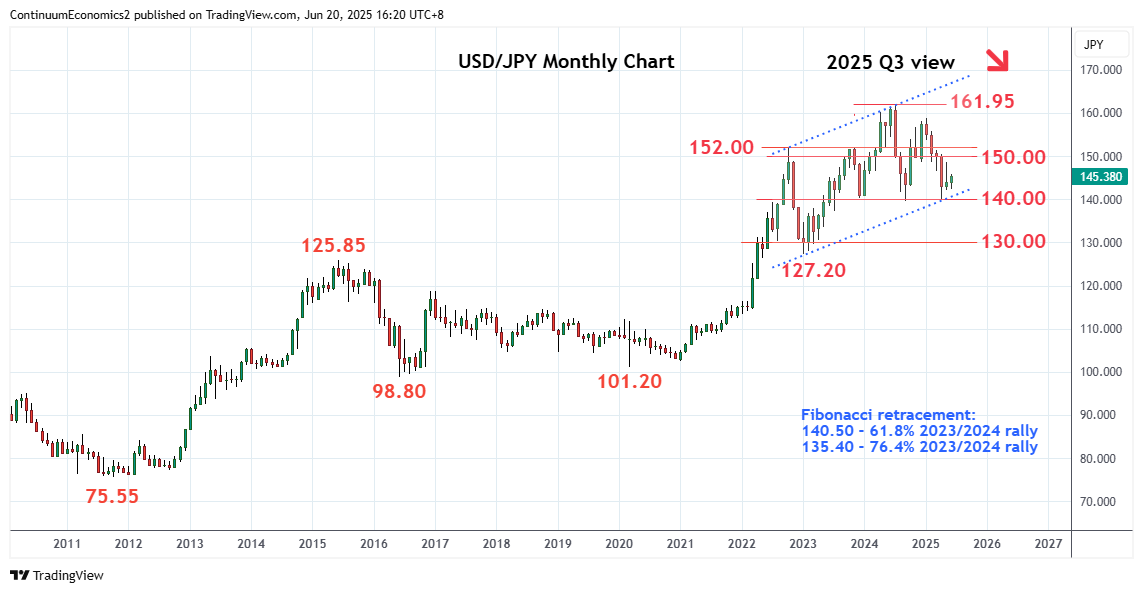

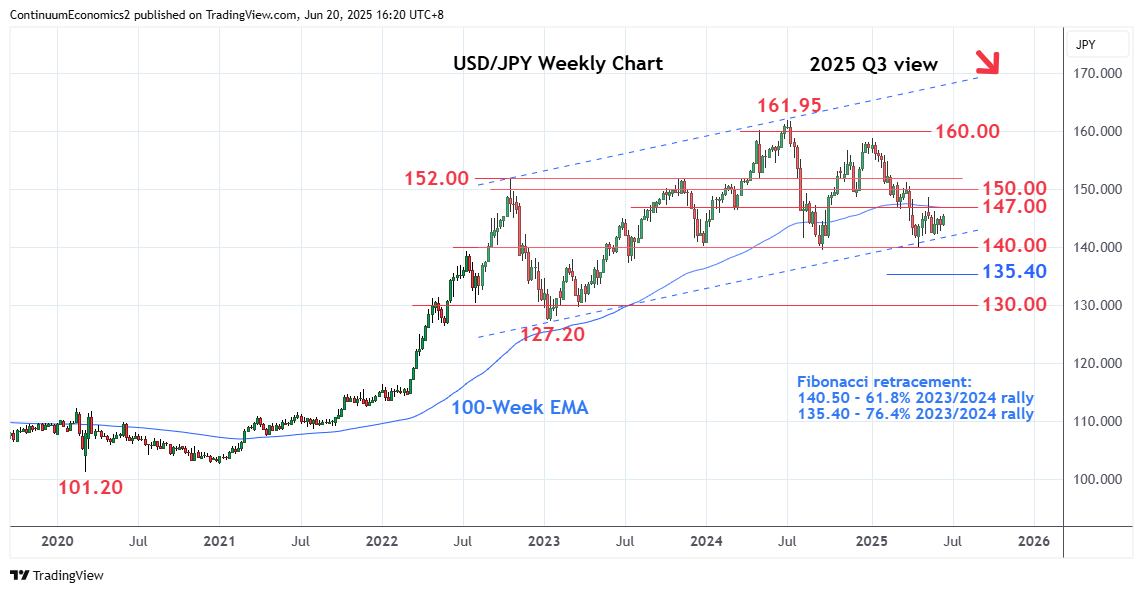

Chartbook: Chart USD/JPY: Consolidating above 140.00, room for break later

Sharp losses from the January high has seen losses to retest the critical 140.00/139.60 support and 2024 year low

Sharp losses from the January high has seen losses to retest the critical 140.00/139.60 support and 2024 year low as well as channel support from the 2023 year low.

Rebound there see prices consolidating losses from the January current year high just beneath the 159.00 level. This is expected to give way to selling pressure later and where break will confirm a broad top pattern at the 161.95, July 2024 multi-year high. Lower will see room to 137.00 congestion area then 135.40, 76.4% Fibonacci level. Break here still see room for further extension to the 130.00 psychological level and 127.20, 2023 year low.

Meanwhile, resistance is at the 147.00 congestion and this extends to the 148.65, May corrective high. Break above these will delay bearish extension and open up room for stronger corrective bounce to the 150.00 figure and strong resistance at 152.00, the 2022/2023 year highs, which is expected to cap.