Chartbook: Chart USD Index DXY: Poised for further losses into the coming quarter

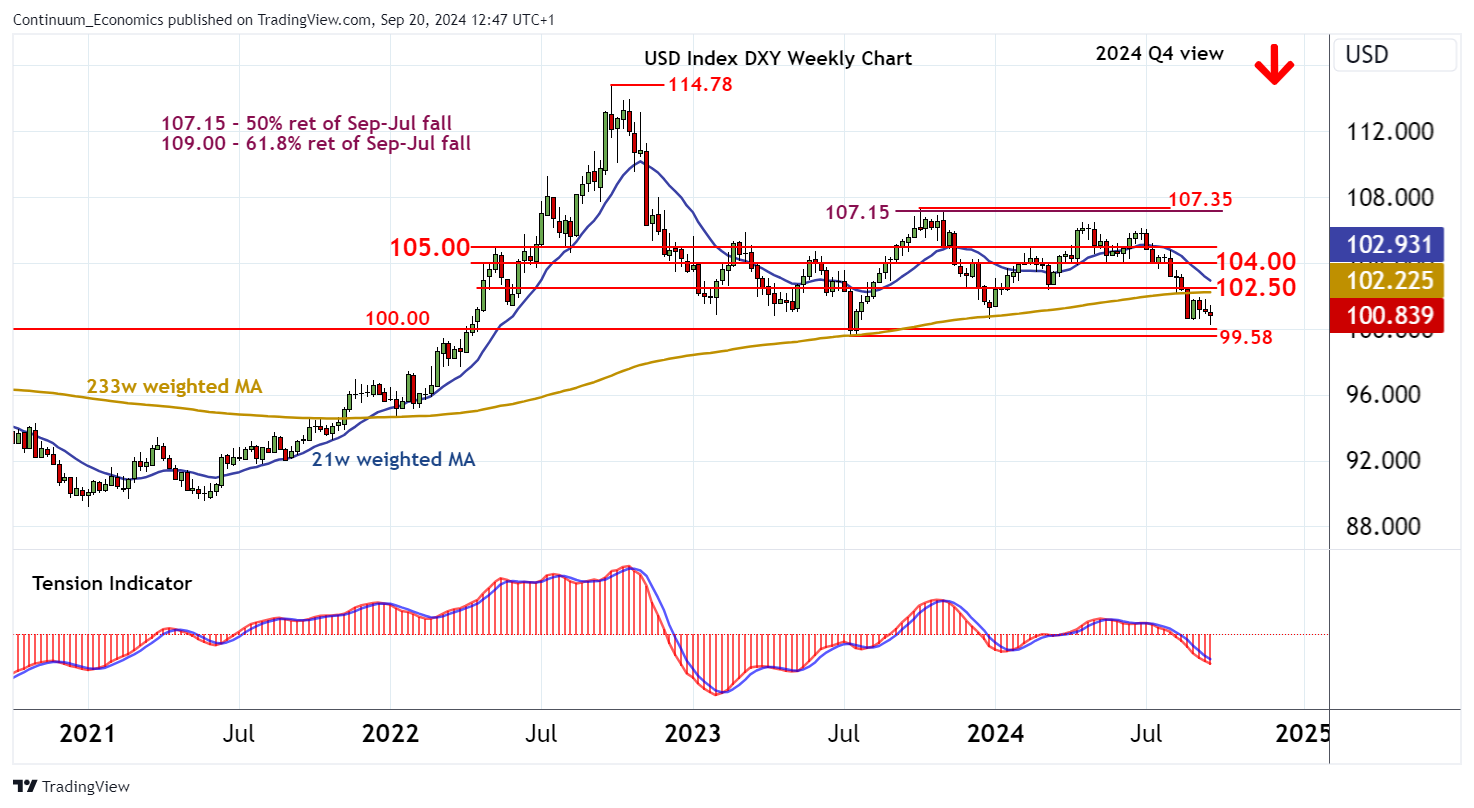

The anticipated break below congestion around 104.00 has extended

The anticipated break below congestion around 104.00 has extended,

with steady selling interest adding weight to price action and putting focus on support at the 99.58 year low of July 2023 and congestion around 100.00.

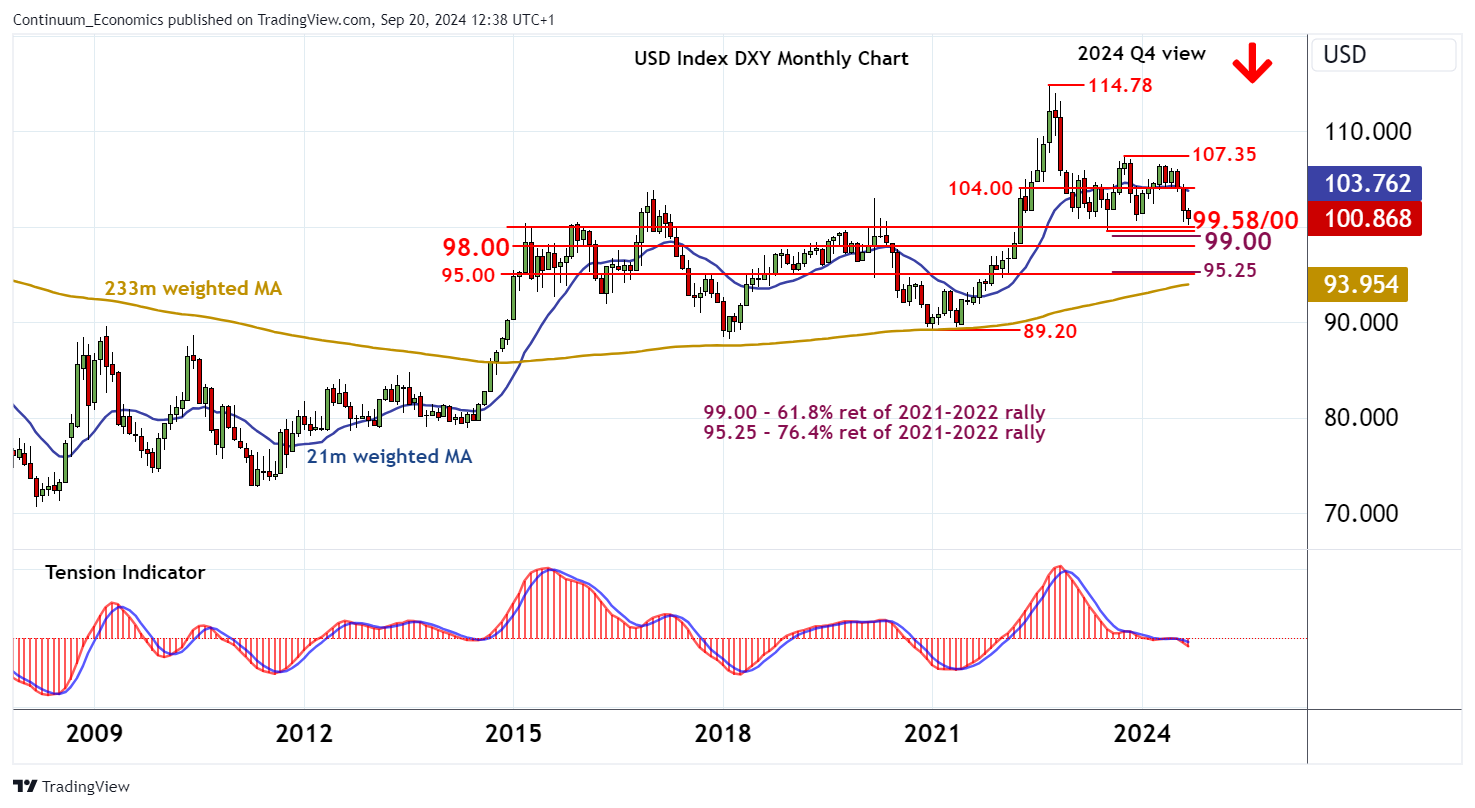

Monthly stochastics have turned down and the monthly Tension Indicator is also coming under pressure, highlighting a deterioration in sentiment and room for further losses into 2024 Q4.

A close beneath here will confirm completion of a multi-month distribution pattern capped by the 107.35 year high of October 2023, and extend September 2022 losses towards the 99.00 Fibonacci retracement. Just beneath here is congestion around 98.00, with potential for a further break and continuation towards the 95.25 retracement and congestion around 95.00.

Already oversold monthly stochastics could limit any initial tests in consolidation, before bearish longer-term studies prompt a break.

Meanwhile, resistance is at the 102.50 break level.

A close above here, if seen, would turn sentiment neutral and delay lower levels, as prices then settle into consolidation beneath congestion resistance within the broad 104.00 - 105.00 area.

A further close above here would open up critical resistance at the 107.15 Fibonacci retracement and 107.35, but this area should cap any unexpected tests.