FX Daily Strategy: N America, May 23rd

PMIs the focus for Thursday

More relative US weakness could undermine the USD

GBP well bid and could benefit from election talk

JPY weakness could trigger intervention very soon

PMIs the focus for Thursday

More relative US weakness could undermine the USD

GBP well bid and could benefit from election talk

JPY weakness could trigger intervention very soon

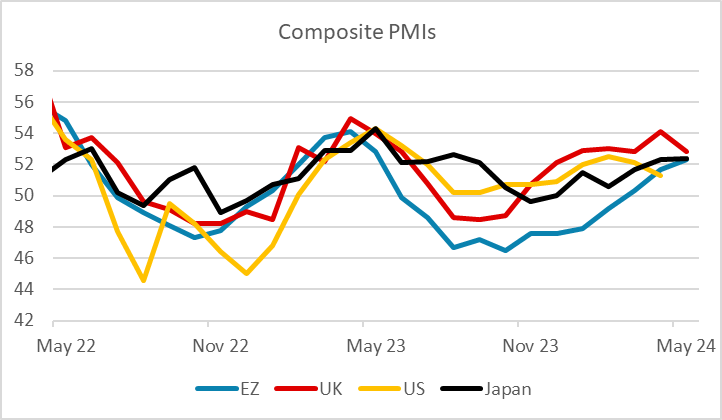

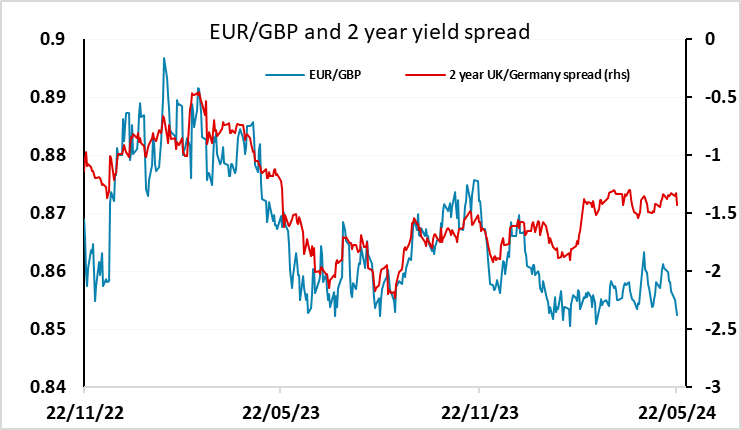

Eurozone PMI came in slightly above expectations driven by strength in manufacturing. Services lower on the month but still relatively healthy. EUR not much changed having already edged higher after the German data released earlier, but EUR/USD favoured ahead of this afternoon’s US numbers which will need to beat consensus to prevent a further relative deterioration in the US PMIs. Disappointing UK PMI with services dropping sharply. Although manufacturing improved, the composite is significantly lower than expected. EUR/GBP bouncing from 0.85 but upside looks quite limited with a June rate cut looking all the more unlikely given the July 4 election.

The consensus was looking for another modest rise in the Eurozone composite index while the US index is expected to stay steady, and we have got a small improvement in the EZ index. However, we look for further declines in both the US manufacturing and services indices, and by implication in the composite. The USD could consequently fall back across the board. The reaction will also depend on the US jobless claims data, which saw a sharp rise last week. The solidity of the US labour market has been a big factor underpinning the strength of the USD even when some of the growth numbers were less robust, and any further evidence of deterioration could be expected to undermine the USD.

Wednesday was characterised by a stronger pound and more weakness for the JPY and CHF. GBP strength stopped short of the support area of 0.8492-0.8500 in EUR/GBP, even though the market has now all but priced out the chance of a BoE rate cut in June after the stronger than expected UK CPI numbers. BoE chief economist Pill is due to speak again on Thursday, and may clarify whether a June move is still possible. GBP has fallen back after the eaker than expected PMIs, but downside looks limited with a June rate cut looknig even less liekly given the July 4th election.

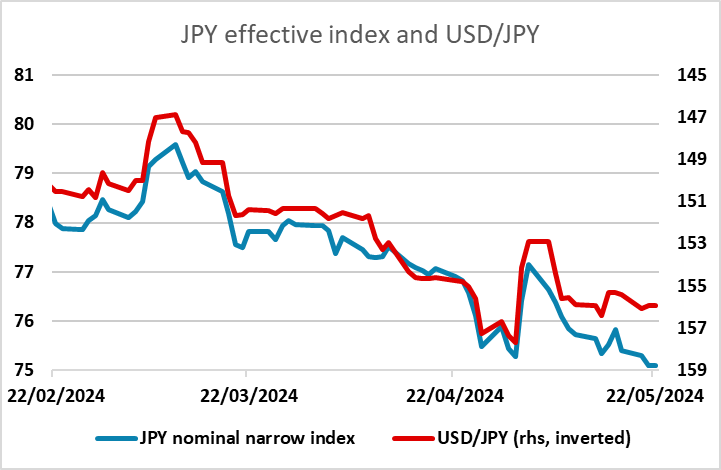

JPY and CHF weakness continues to relate partly to the low level of volatility and the attraction of the carry trade. But the JPY continues to hit new lows in effective terms even though USD/JPY hasn’t quite reached the highs seen in late April. The BoJ aren’t going to stand for this indefinitely. Unless we see an organic decline in USD/JPY by the end of the week, intervention to push it lower looks quite likely – very likely if we print above 157.