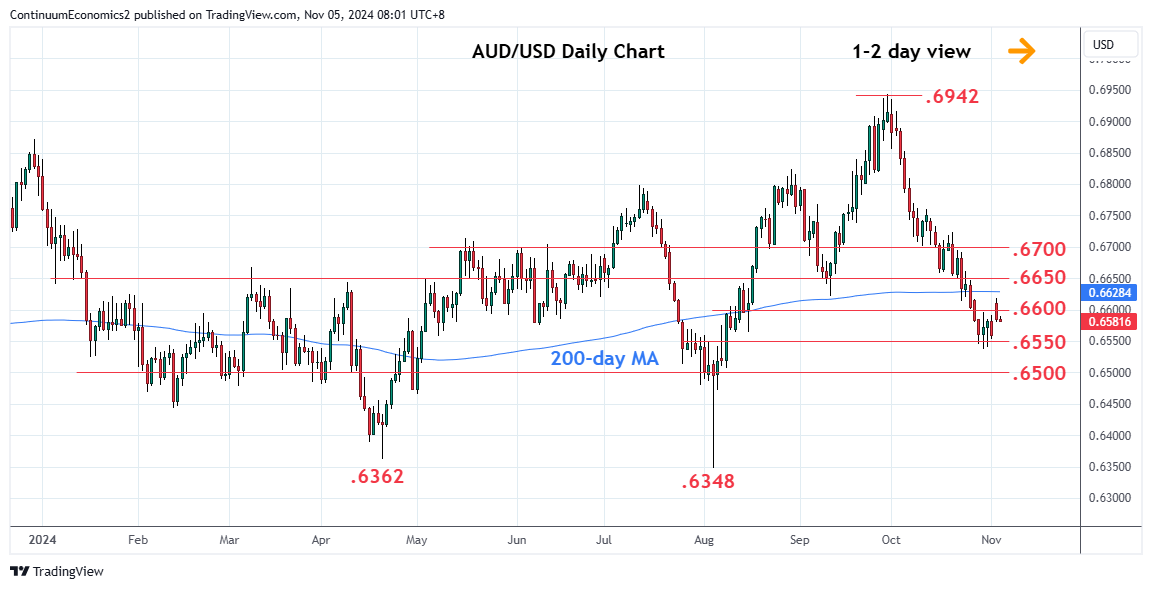

Settled back in consolidation below the .6600 level after the failure to clear .6600/15 resistance

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.6760 | * | 11 Oct high | S1 | 0.6550 | * | congestion | |

| R3 | 0.6700 | * | congestion | S2 | 0.6537 | ** | 30 Oct low | |

| R2 | 0.6650 | * | congestion | S3 | 0.6500 | ** | figure, congestion | |

| R1 | 0.6600/15 | * | figure, 23 Oct low | S4 | 0.6490 | * | 76.4% Aug/Sep rally |

Asterisk denotes strength of level

00:10 GMT - Settled back in consolidation below the .6600 level after the failure to clear .6600/15 resistance. The daily studies remains at oversold area and suggest scope for bounce to retrace the steep losses from the September high. Clear break here is needed to confirm a small bottom in place at the .6500/37 lows and see room for stronger gains to the .6650/.6700 congestion area. Meanwhile, support at the .6550/37 area now protecting the downside. Failure here, if seen, will open up deeper pullback to the .6500 figure and .6490, 76.4% Fibonacci retracement.