Published: 2024-09-24T12:10:58.000Z

Chartbook: Chart USD/CHF: Room for still lower in both USD- and CHF-driven trade

Senior Technical Strategist

1

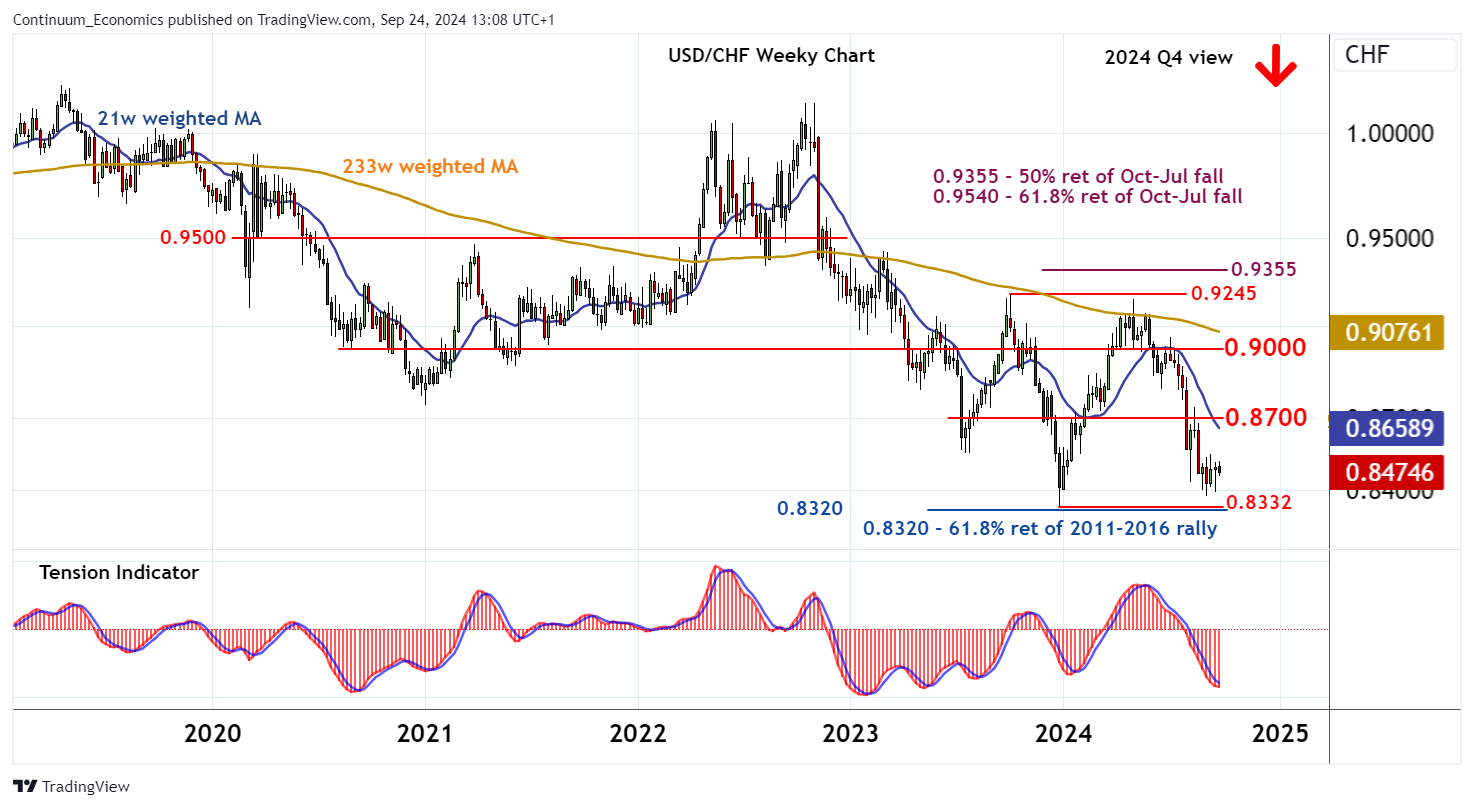

The anticipated break below congestion around 0.8500 is meeting expected buying interest above critical support within congestion around 0.8300 and the 0.8320 multi-year Fibonacci retracement

The anticipated break below congestion around 0.8500 is meeting expected buying interest above critical support within congestion around 0.8300 and the 0.8320 multi-year Fibonacci retracement.

Monthly stochastics continue to point lower and the monthly Tension Indicator is also under pressure, highlighting room for still deeper USD- and CHF-driven losses into 2024 Q4.

A close below 0.8300/20 will add fresh weight to already bearish price action and confirm continuation of losses from the 1.0350~ multi-year high of December 2016.

Focus will then turn to psychological support at 0.8000, but mixed longer-term readings should limit any deeper losses in short-covering/consolidation above the 0.7850 retracement.

Meanwhile, resistance is at congestion around 0.8700.

In the coming weeks, a test cannot be ruled out, as oversold weekly studies unwind.

But an unexpected close above here is needed to turn sentiment neutral and delay anticipated continuation below critical support at 0.8300/20.

Subsequent focus will then turn to 0.9000, but this latter level should cap any tests.