Chartbook: Chart EUR/USD: Poised to extend gains from September 2022

Cautious trade has given way to a steady drift higher

Cautious trade has given way to a steady drift higher,

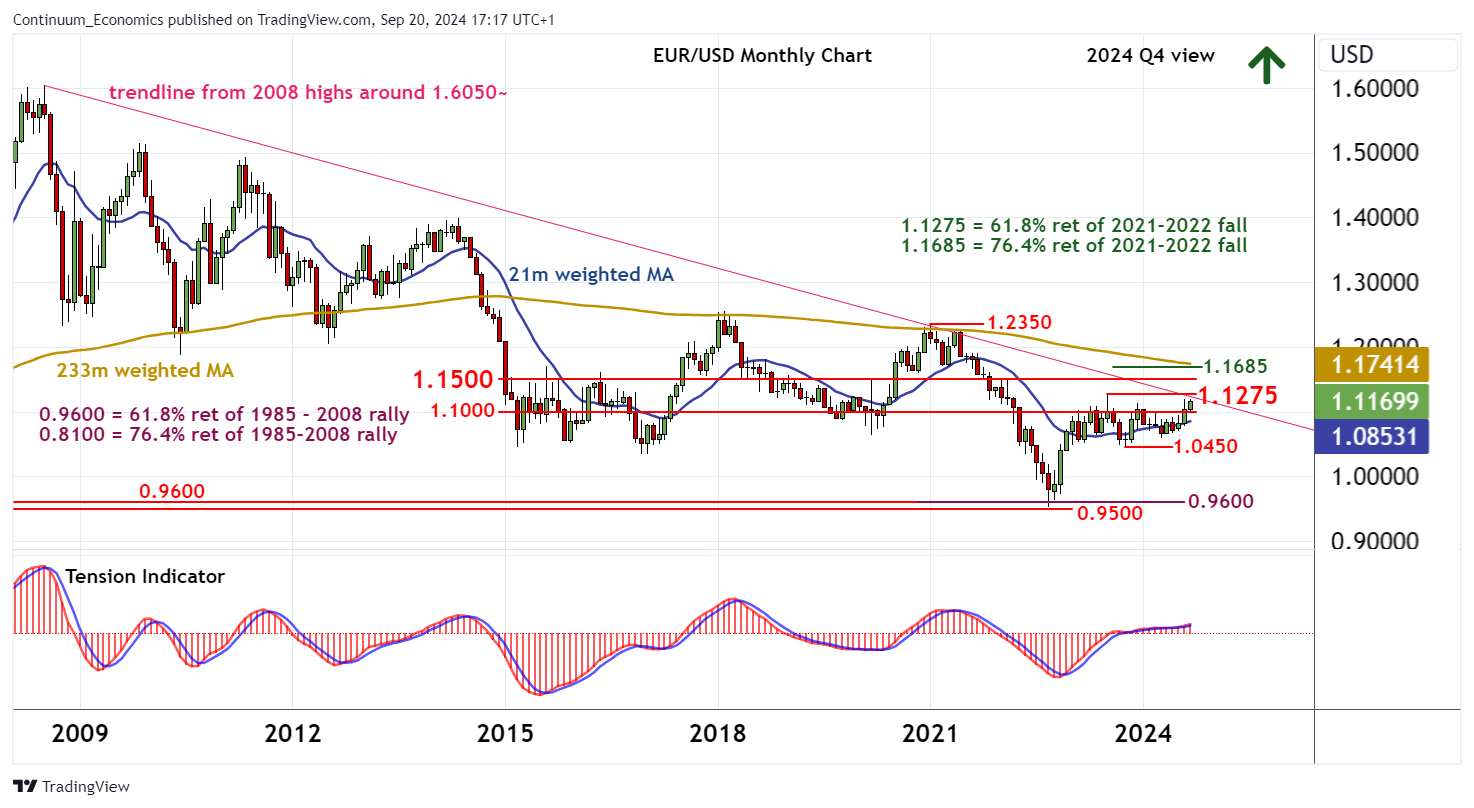

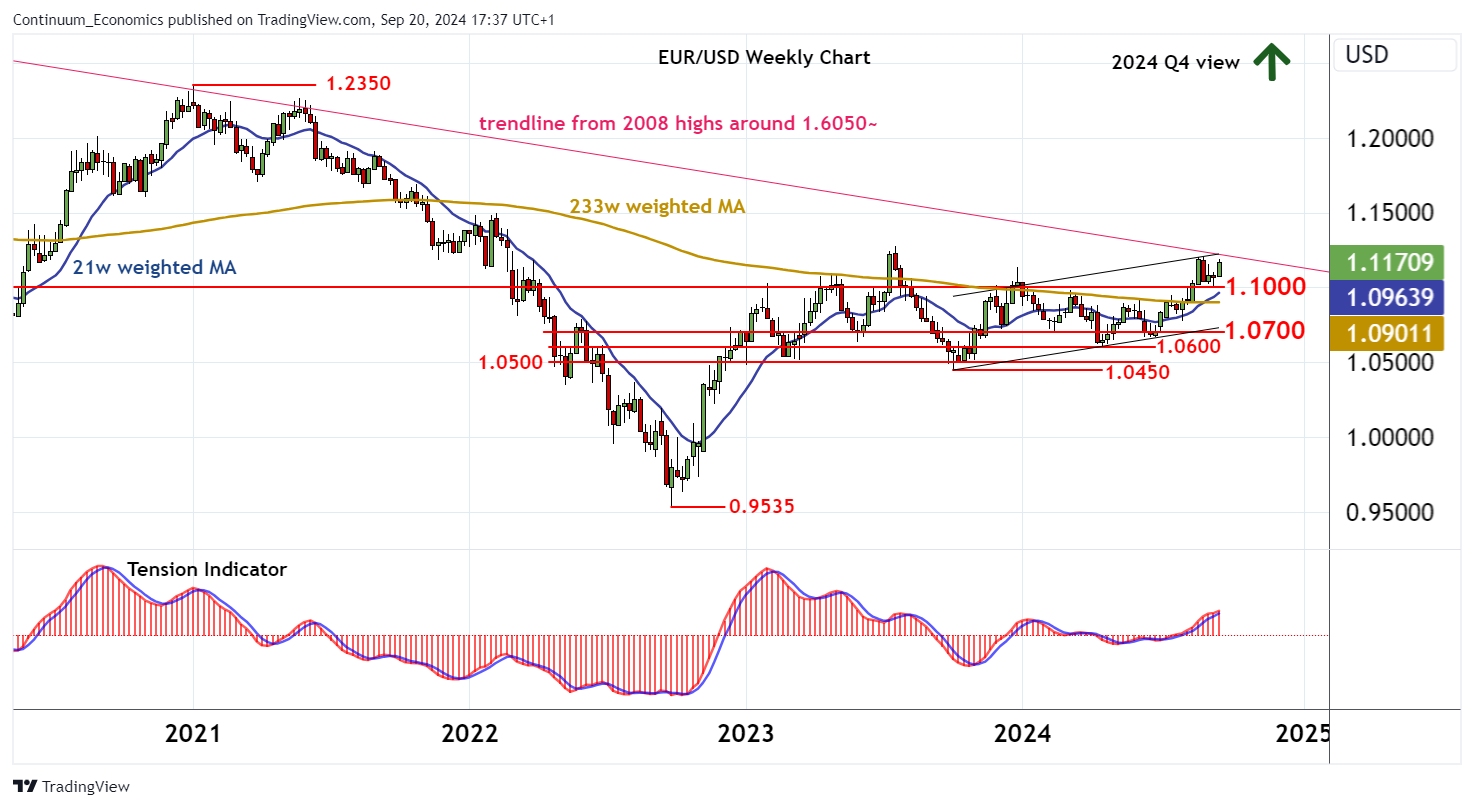

with the break above 1.1000 improving sentiment and putting focus on critical resistance at the 1.1275 year high of July 2023 and Fibonacci retracement.

Monthly stochastics are rising and the monthly Tension Indicator has ticked higher, highlighting room for further strength into 2024 Q4.

A close above 1.1275 will confirm completion of a multi-month accumulation pattern, supported at the 1.0450 year low of October 2023, and extend gains from the 0.9500~ multi-year low of September 2022 beyond the falling multi-year trendline towards congestion around 1.1500. Still higher is the 1.1685 retracement, but already overbought monthly stochastics could limit any initial tests in fresh consolidation, before rising longer-term charts prompt a further break.

Meanwhile, support is at congestion around 1.1000.

A close beneath here would turn sentiment neutral and prompt a pullback towards further congestion around 1.0700.

Just lower is further congestion around 1.0600, but rising monthly charts should limit any unexpected tests of this area in consolidation/buying interest.

A close below 1.0450 would turn sentiment outright negative and confirm a more significant, multi-month correction of the 2022-2023 rally.