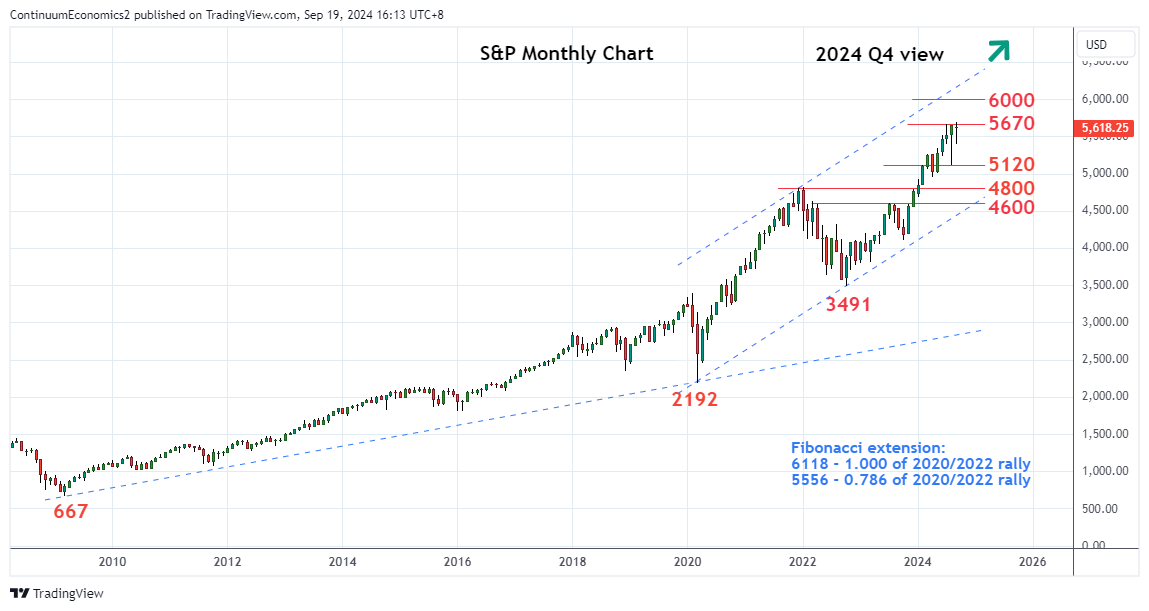

Settled back from the 5670 record high at the start of Q3

Settled back from the 5670 record high at the start of Q3. However, rebound from the August corrective low at 5120 see pressure returning to the upside.

Bullish structure from the October 2022 low keep focus firmly on the upside and clear break of the 5670 high will see room to further extend gains within the channel from the March 2020 year low. However, the deep overbought daily and weekly studies caution corrective pullback though bullish structure suggest correction likely to prove limited. Gains above 5670 high will see possible extension to target the 6000 figure. Higher still, if seen, will see scope to 6118, equality target of the 2020/2022 rally.

Meanwhile, overbought readings on the weekly/monthly studies caution corrective pullback with support starting at the 5400 level and 5265, Q1 high. Below this will see room for deeper pullback to 5120, August corrective low which is expected to underpin and limit corrective pullback. Would take break here to fade the upside pressure and see deeper correction to the 5000 level and possibly the 4800/4600, January 2022/July 2023 highs.