Published: 2024-11-13T16:59:05.000Z

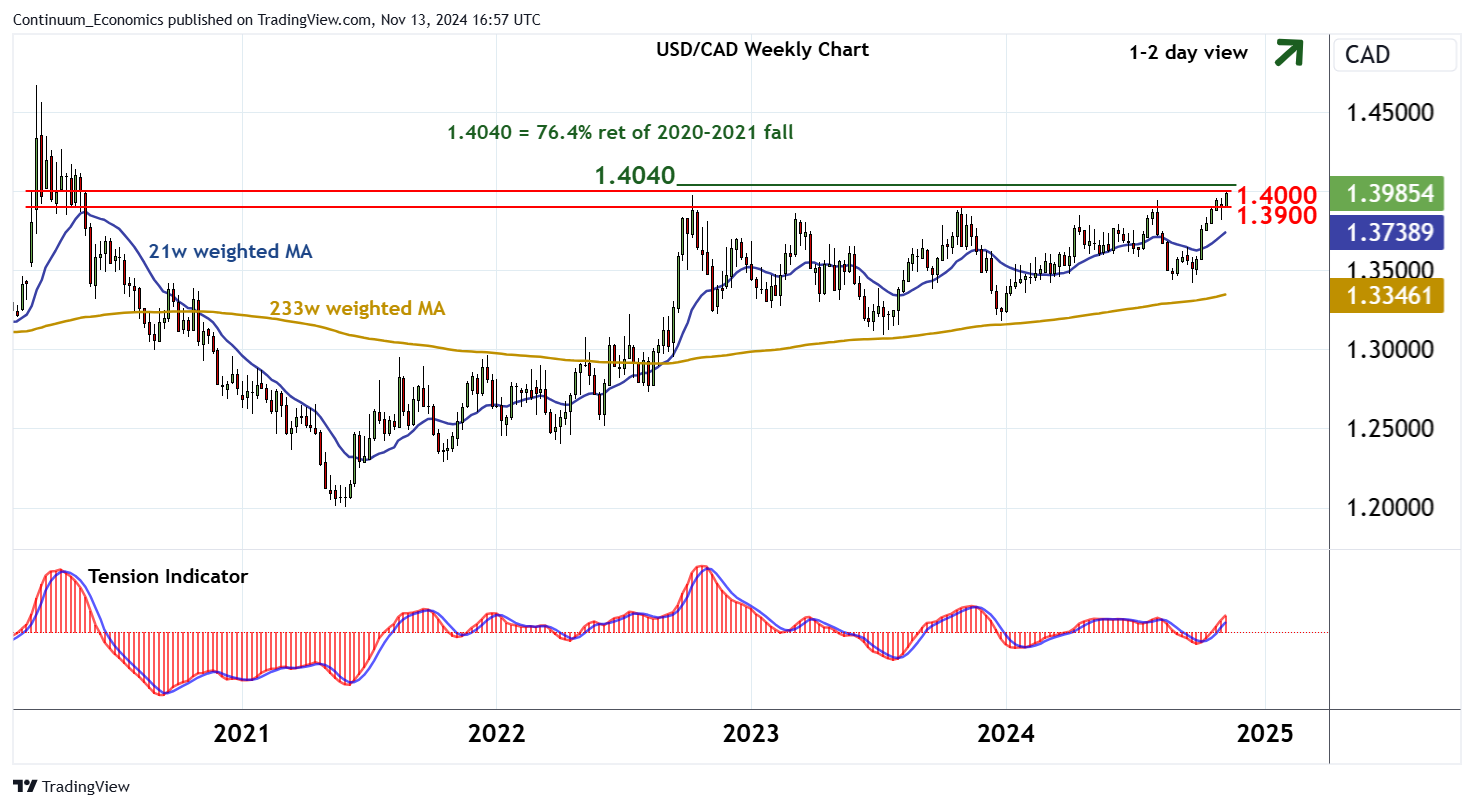

Chart USD/CAD Update: Fresh 2-year highs - strong resistance at the 1.4040 Fibonacci retracement

Senior Technical Strategist

1

The test of the 1.3978 year high of October 2022 has been pushed back from a fresh 2024 year high at 1.4000

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.4100 | * | historic congestion | S1 | 1.3900 | * | congestion | |

| R3 | 1.4040 | * | 76.4% ret of 2020-2021 fall | S2 | 1.3850 | * | congestion | |

| R2 | 1.4000 | * | figure | S3 | 1.3817 | ** | 6 Nov (w) low | |

| R1 | 1.3978 | ** | Oct 2022 year high | S4 | 1.3800 | * | congestion |

Asterisk denotes strength of level

16:35 GMT - The test of the 1.3978 year high of October 2022 has been pushed back from a fresh 2024 year high at 1.4000, with prices currently balanced around 1.3980. Daily readings have ticked higher and the weekly Tension Indicator is rising, highlighting room for further gains in the coming sessions. A break above 1.3978 - 1.4000 will open up strong resistance at the 1.4040 Fibonacci retracement. But already overbought weekly stochastics could limit any initial tests in fresh consolidation. A close above here, however, will extend gains towards historic congestion around 1.4100. Meanwhile, support remains at congestion around 1.3900. A close beneath here, if seen, would open up further congestion around 1.3850. But a close below the 1.3817 weekly low of 6 November is needed to turn sentiment negative and confirm a near-term top in place.