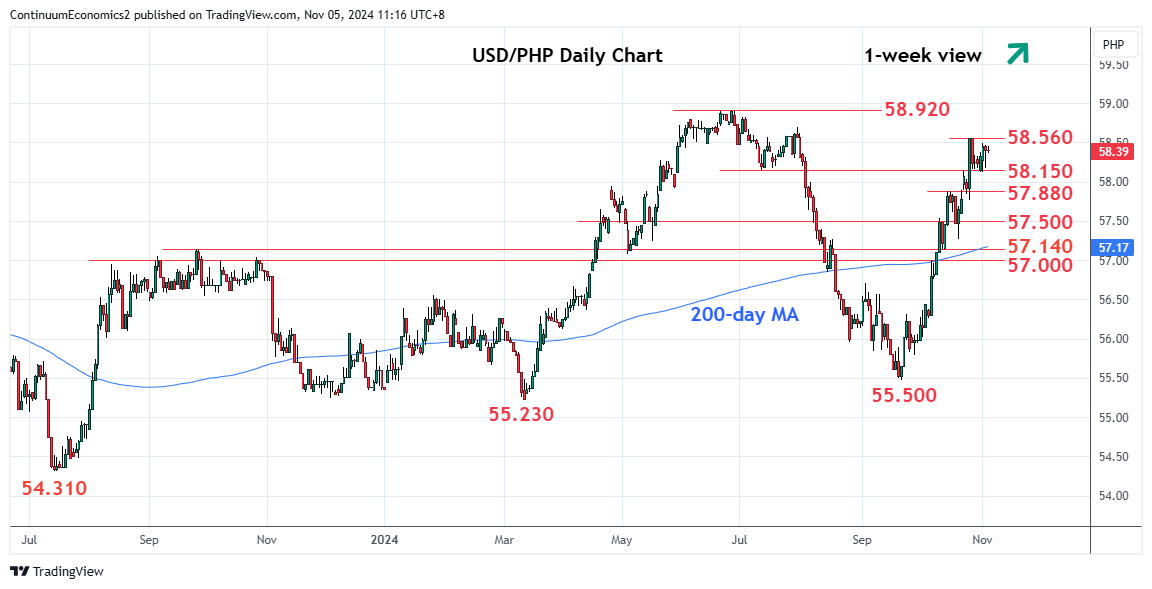

Settled back from the 58.560 October high as prices unwind overbought intraday and daily studies

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 58.980 | * | Nov 2022 high | S1 | 58.150 | * | Jul low, congestion | |

| R3 | 58.920 | ** | 26 Jun YTD high | S2 | 58.000 | * | figure | |

| R2 | 58.700 | * | 30 Jul high | S3 | 57.880 | ** | 15 Oct high | |

| R1 | 58.560 | * | Oct high | S4 | 57.500 | * | congestion |

Asterisk denotes strength of level

03:30 GMT - Settled back from the 58.560 October high as prices unwind overbought intraday and daily studies. However, bullish momentum from the September low keep focus on the upside and see room for break higher to open up further extension to retest the 58.700 resistance. Beyond his will see scope to retest the 58.920, June YTD high. Deep overbought daily studies suggest reaction here likely with pullback to see support starting at 58.150 and the 58.000 level. Break of these will expose strong support at the 57.880, mid-October high. Would take break here to turn focus lower to retrace September/October rally to the 57.600/500 congestion area.