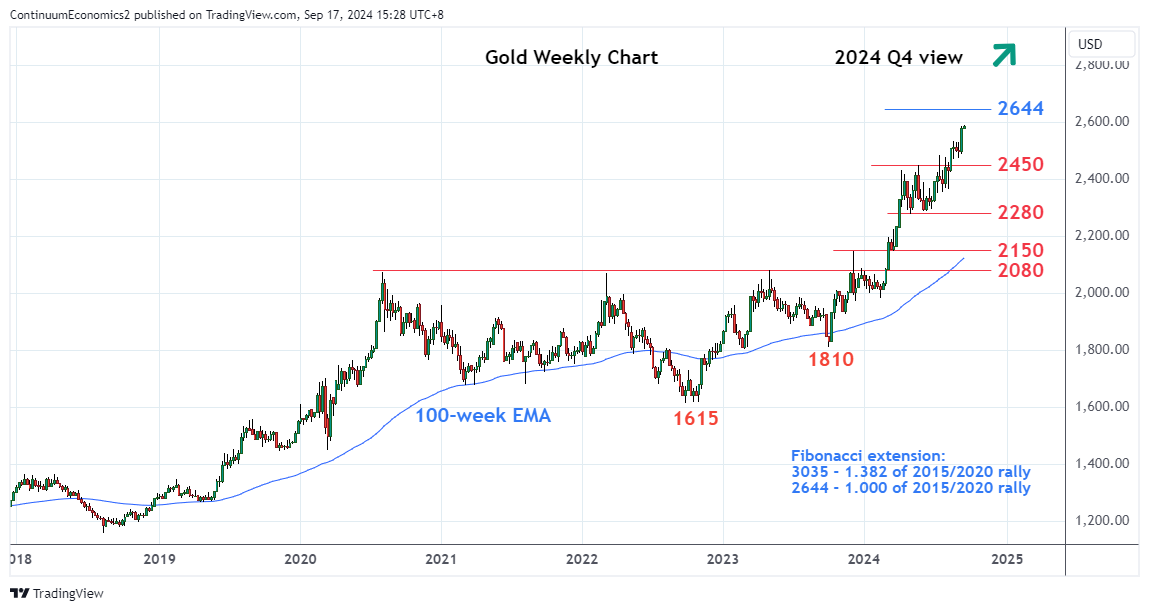

Consolidation within the 2450/2280 area has given way to break to new record high in Q3

Consolidation within the 2450/2280 area has given way to break to new record high in Q3 with bullish extension reaching towards the 2600 level. Break above here will see scope to target 2644, equality Fibonacci extension target of the 2015/2020 rally.

Gains beyond these will further extend the bullish structure and see room for continuation to the 2800 level. However, the deep overbought daily and weekly studies caution corrective pullback. Above the latter, if seen, will see further extension of the bull trend to the 3000 psychological level. Beyond this, but not expected, will see room to the 3035, 1.382 Fibonacci extension target.

Meanwhile, support is raised to the 2450/2400 congestion area where renewed buying interest can be expected. Failure to hold this area will delay bulls and open up deeper correction to the 2280/2200 congestion area.