Published: 2024-10-04T10:02:57.000Z

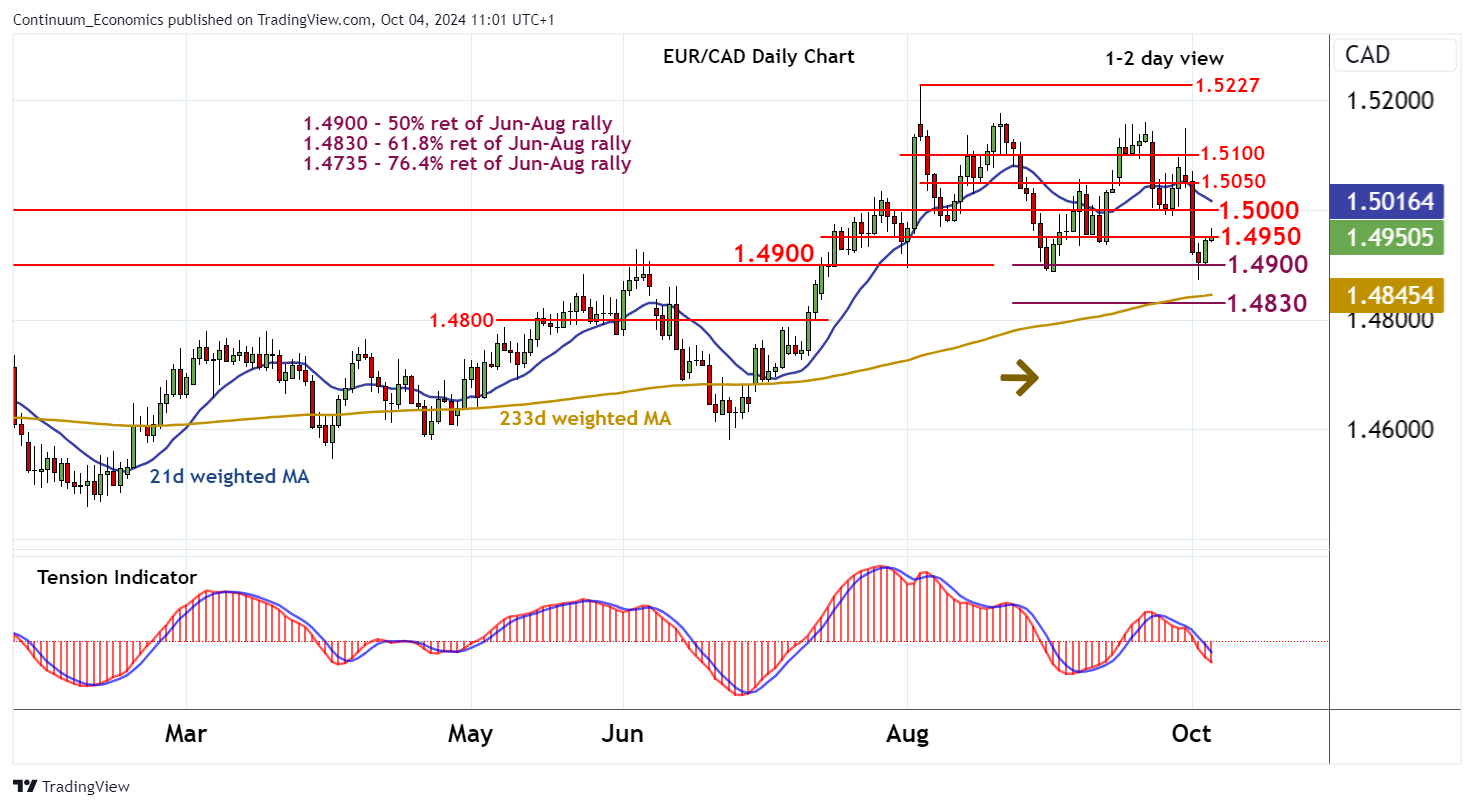

Chart EUR/CAD Update: Limited tests higher

Senior Technical Strategist

1

Little change, as overbought intraday studies keep near-term sentiment cautious

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.5100 | * | break level | S1 | 1.4900 | ** | 50% ret of Jun-Aug rally | |

| R3 | 1.5050 | break level | S2 | 1.4875 | 2 Oct low | |||

| R2 | 1.5000 | * | congestion | S3 | 1.4830 | ** | 61.8% ret of Jun-Aug rally | |

| R1 | 1.4950 | congestion | S4 | 1.4800 | * | congestion |

Asterisk denotes strength

10:45 BST - Little change, as overbought intraday studies keep near-term sentiment cautious and extend consolidation beneath congestion resistance at 1.4950. Oversold daily stochastics are turning higher, suggesting potential for a fresh test above here. But the bearish daily Tension Indicator and negative weekly charts should limit scope in renewed selling interest towards further congestion around 1.5000. Following cautious/corrective trade, fresh losses are looked for. A later close below 1.4900 will complete a distribution top beneath the 1.5227 current year high of 5 August and confirm continuation of August losses, initially to the 1.4830 retracement.