Published: 2024-05-22T13:22:05.000Z

Preview: Due May 23 - U.S. May S&P PMIs - Slippage seen, particularly in Manufacturing

Senior Economist , North America

-

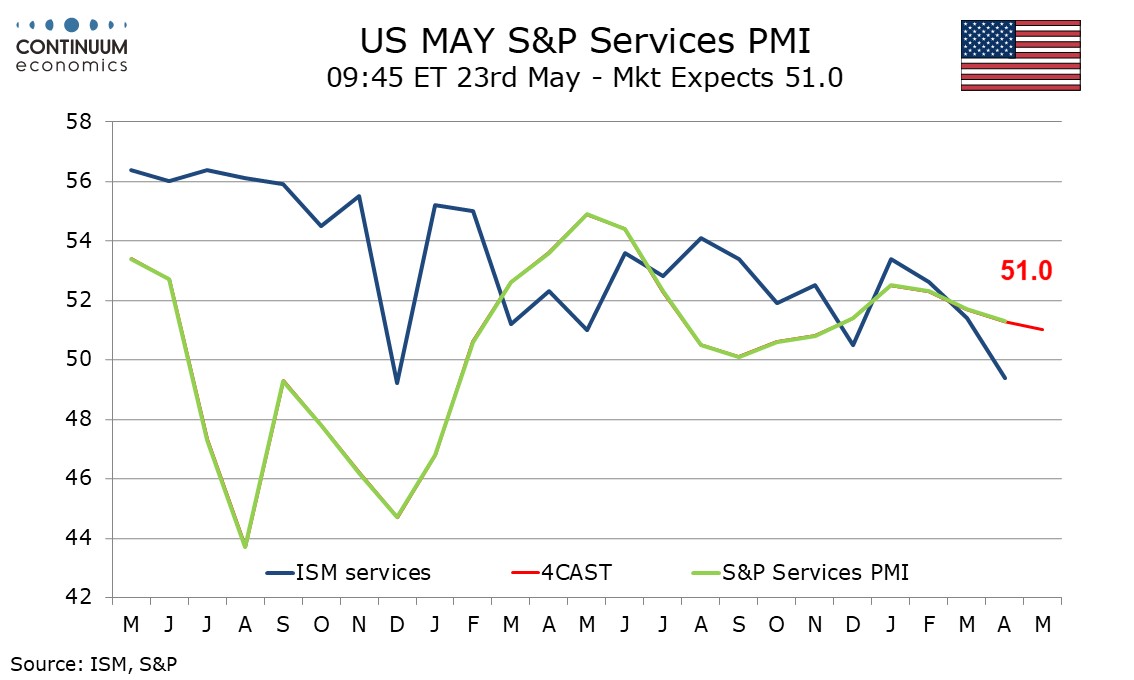

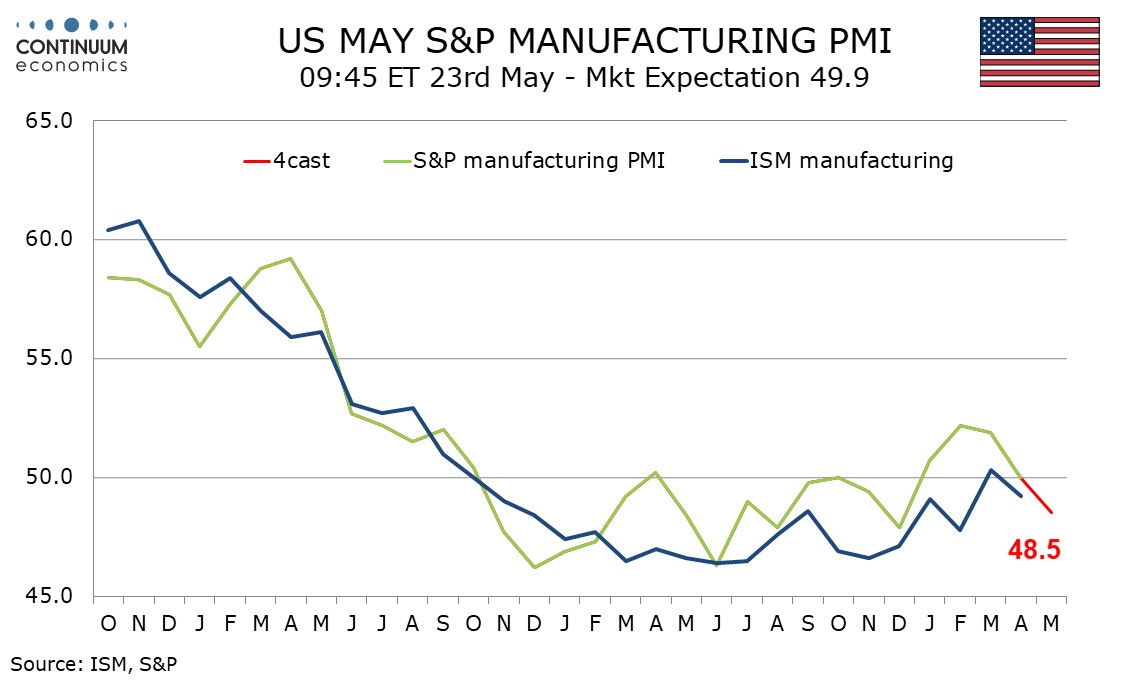

We expect May’s S and P PMIs to show slippage, manufacturing quite significantly to 48.5 from 50.0, but services only marginally to 51.0 from 51.3.

Manufacturing will be seeing a third straight dip from a high of 52.2 seen in February. ISM manufacturing data has seen some recent improvement but slipped back in April. May surveys released so far showed the Empire State’s remaining weak and the Philly Fed’s less positive, and quite weak in the details.

The ISM and S and P services indices are less correlated than the manufacturing indices, though both have seen recent slippage. Rising bond yields may have been behind the slippage, particularly for the S and P data, and a move off the highs in yields suggests limited downside potential in May. We do not expect April’s move in the ISM services index below the neutral 50 to be matched..