Published: 2024-09-16T09:41:44.000Z

Chartbook: Chart EUR/CHF: Balanced above all-time low - room for lower into the coming months

Senior Technical Strategist

3

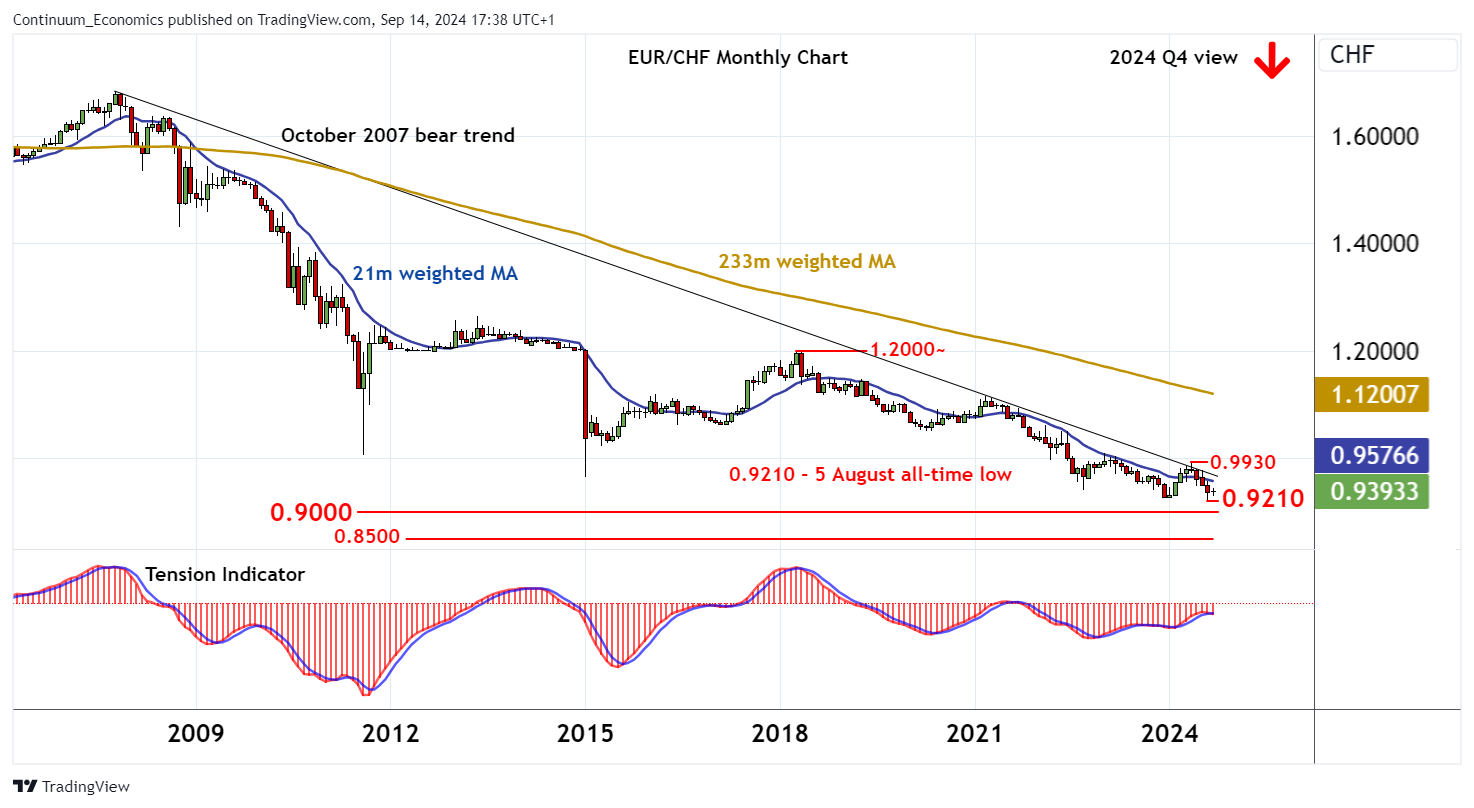

The anticipated pullback from the 0.9930 current year high of May 2024 has extended in CHF-driven trade

The anticipated pullback from the 0.9930 current year high of May 2024 has extended in CHF-driven trade,

with prices falling steadily to post a fresh all-time low just above 0.9200.

Prices are currently trading around 0.9400~, but monthly stochastics and the monthly Tension Indicator continue to track lower, highlighting a bearish tone and room for still deeper losses into 2024 Q4.

A close below 0.9200/10 will add weight to already bearish price action and open up strong psychological support at 0.9000. However, bearish longer-term studies, (not shown), are showing signs of stabilisation, suggesting any immediate tests of 0.9000 could give way to short-covering/consolidation.

A close beneath here, however, would extend losses towards psychological support at 0.8500.

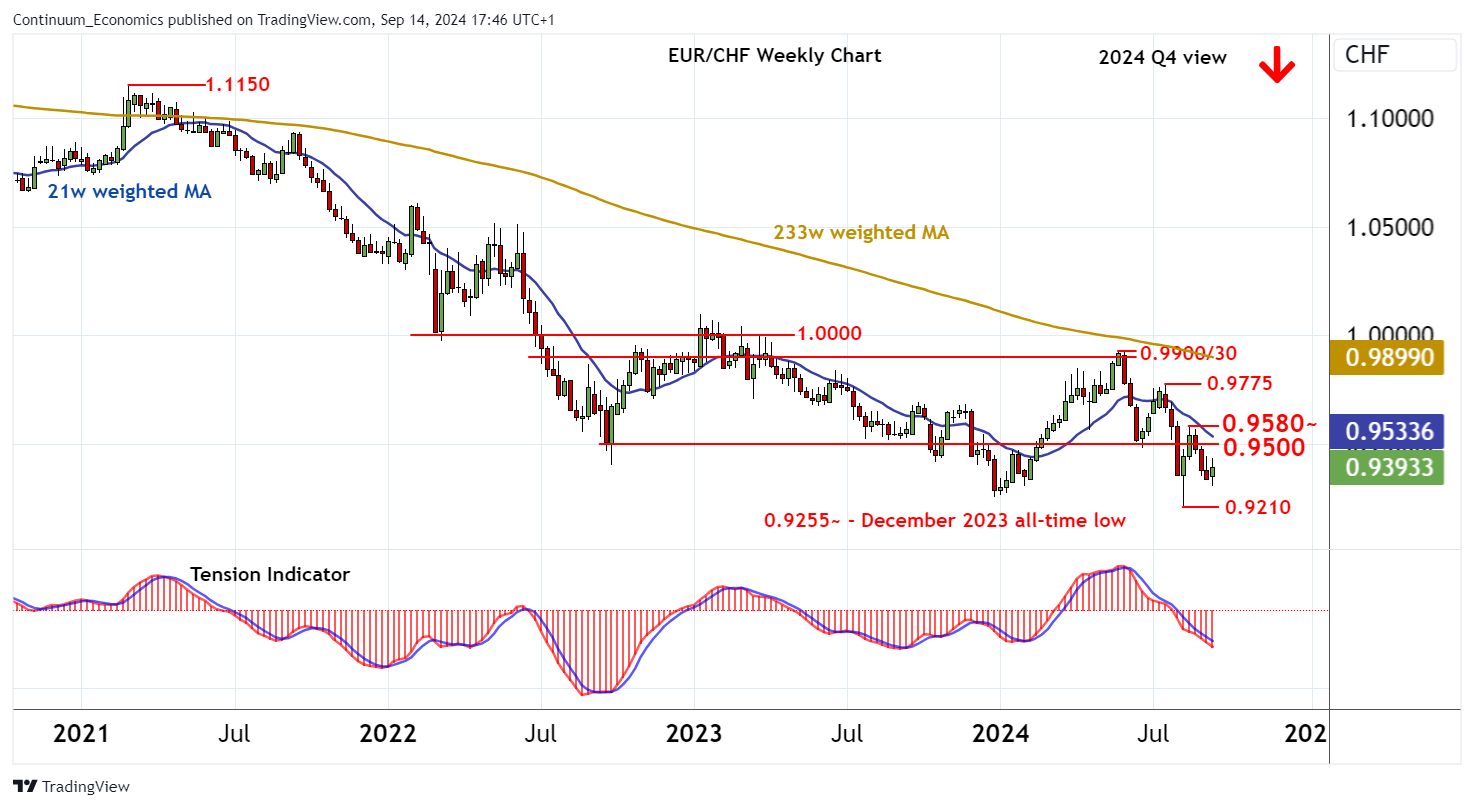

Meanwhile, resistance is at congestion around 0.9500 and extends to the 0.9580~ monthly high of 15 August.

Negative weekly stochastics and the bearish weekly Tension Indicator should limit any corrective bounce in renewed selling interest beneath here.

An unexpected close above here, however, would delay downside development and turn sentiment cautious, as prices then settle into consolidation beneath the 0.9775 monthly high of 15 July.