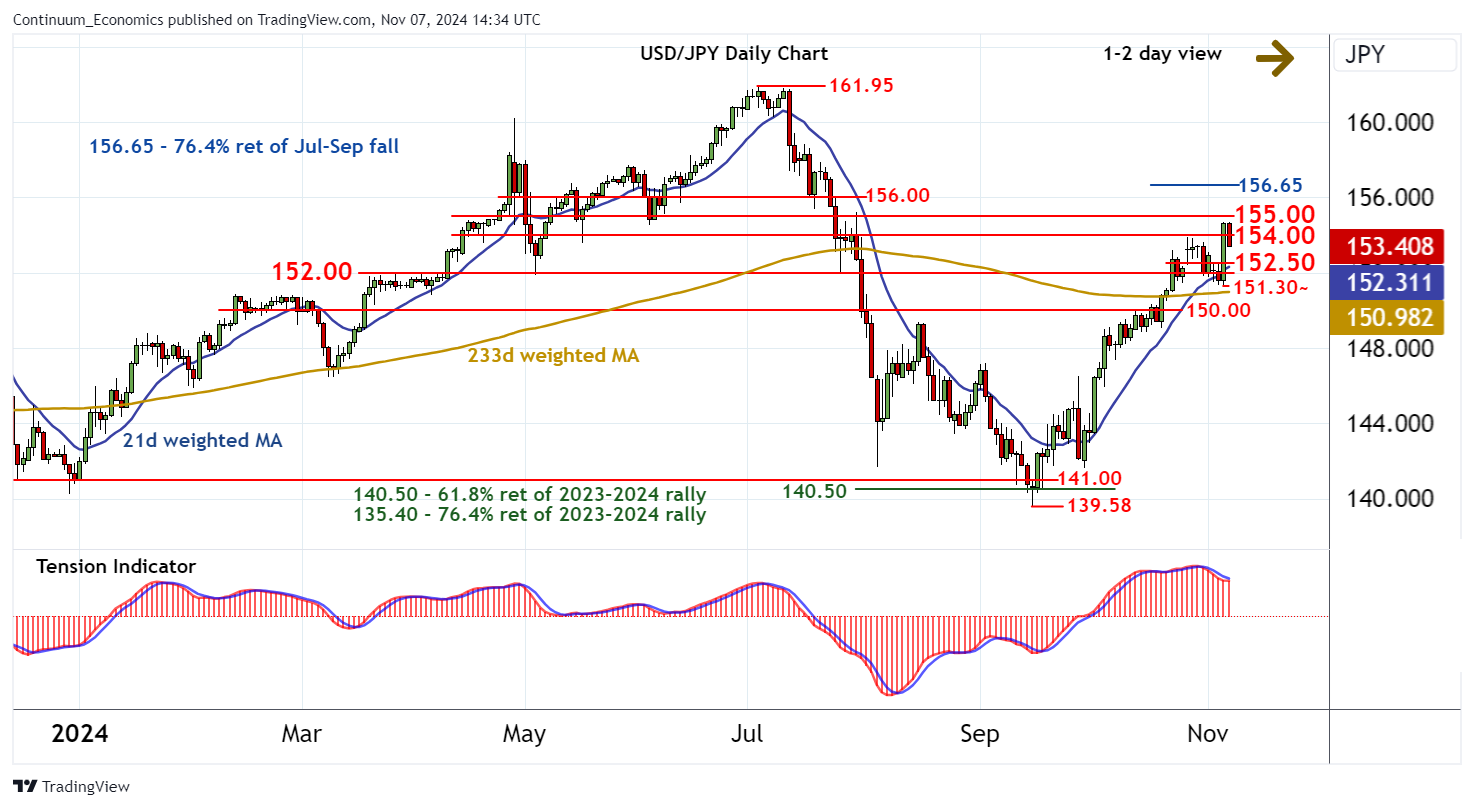

Chart USD/JPY Update: Turning away from 155.00

Consolidation beneath congestion resistance at 155.00 is giving way to a pullback in both USD- and JPY-driven trade

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 156.65 | ** | 76.4% ret of Jul-Sep fall | S1 | 152.50 | * | intraday break level | |

| R3 | 156.00 | * | congestion | S2 | 152.00 | ** | break level | |

| R2 | 155.00 | congestion | S3 | 151.30~ | 6 Nov low | |||

| R1 | 154.00 | * | break level | S4 | 150.00 | ** | break level |

Asterisk denotes strength of level

14:20 GMT - Consolidation beneath congestion resistance at 155.00 is giving way to a pullback in both USD- and JPY-driven trade, with the break below 154.00 currently balanced around 153.50. Negative intraday studies highlight potential for further losses towards support within the 152.00/50 area. But improving daily readings and rising weekly charts are expected to limit any tests in fresh buying interest/consolidation. A close below the 151.30~ low of 6 November, if seen, would turn sentiment negative and extend losses towards 150.00. Meanwhile, a close above 155.00, not yet seen, would turn price action positive and extend September gains beyond congestion around 156.00 towards the 156.65 Fibonacci retracement.