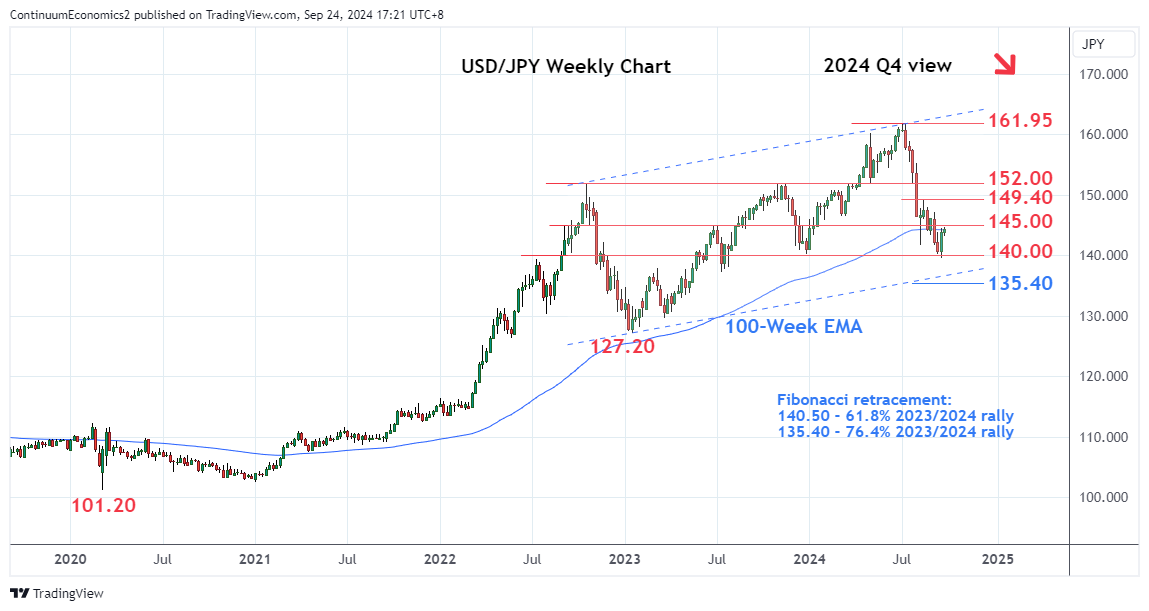

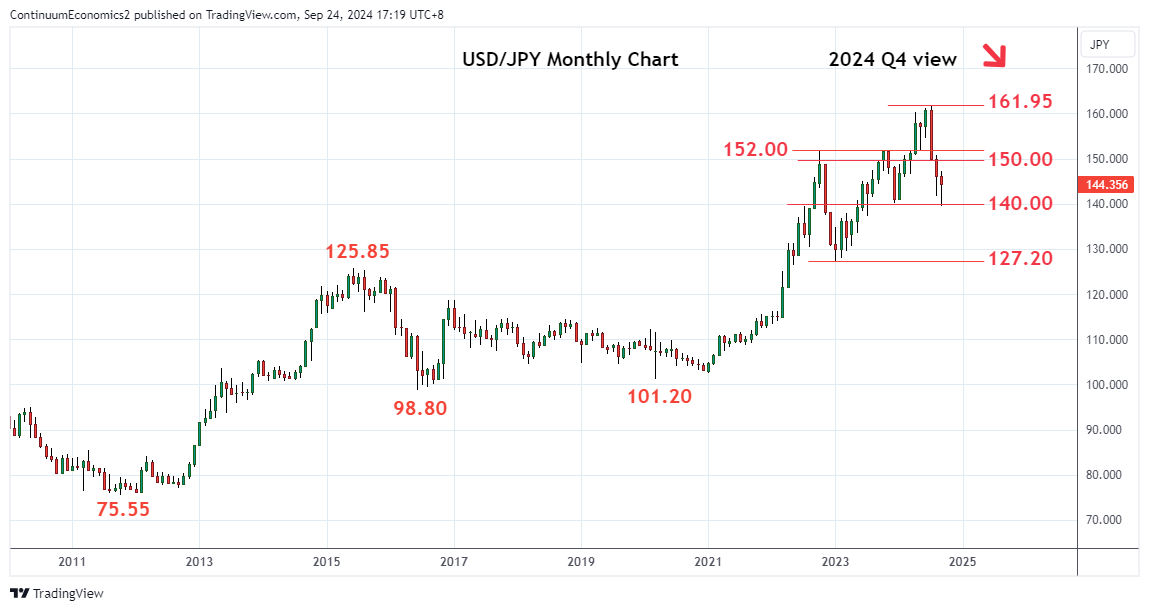

Reversal from the 161.95 multi-year high at the start of Q3 saw sharp losses to reach the 140.00 level

Reversal from the 161.95 multi-year high at the start of Q3 saw sharp losses to reach the 140.00 level. Bounce at the latter see prices correcting of deep oversold daily and weekly studies.

Gains above the 144.00 level see room for stronger correction to the 145.00/146.00 congestion area. Higher still, will see scope to the 147.20/148.00 resistance and congestion area. Gains beyond this, if seen, will open up room to the strong resistance at the 149.40/150.00 resistance which is expected to cap and sustain losses from the July YTD high.

Correction is expected to give way to renewed selling pressure later for retest of the 140.00 level. Below here will see scope for deeper pullback to retrace the 2023/2024 rally to the 137.00 support. Below the latter will open up further losses to the 135.40, 76.4% Fibonacci retracement. Break of the latter will see room for deeper correction of the broader bull trend from the 2020 year low and see scope to the 130.00 figure then the 127.20, 2023 year low.