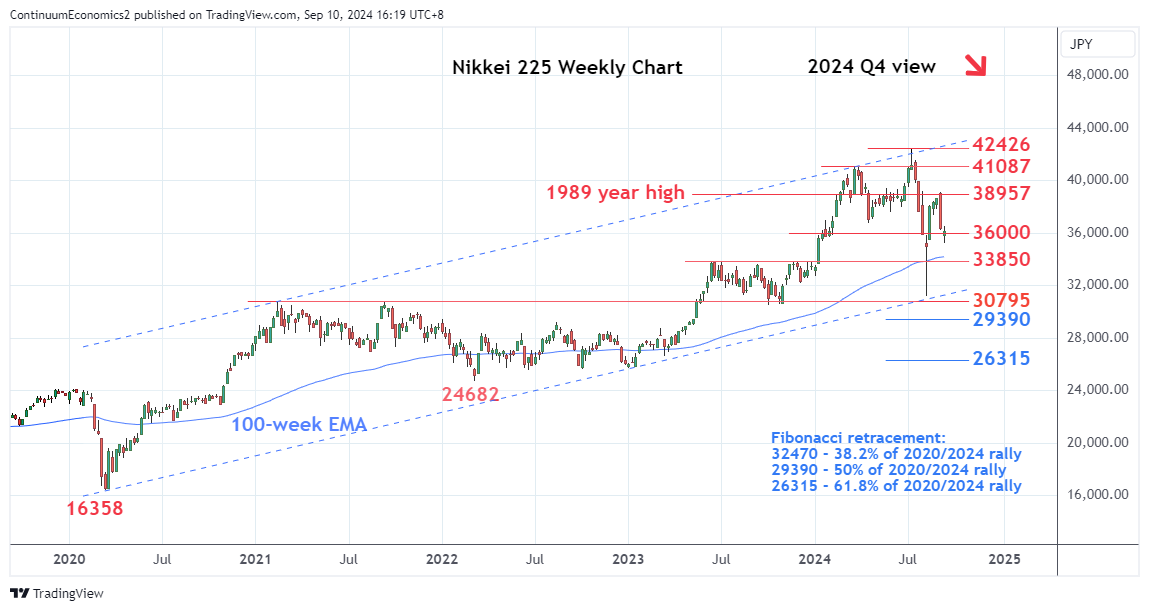

Volatile trade at the start of Q3 saw the index pushing above the March high to reach fresh all-time high in early-July at 42426

Volatile trade at the start of Q3 saw the index pushing above the March high to reach fresh all-time high in early-July at 42426. Subsequent rejection from this high and channel resistance from the 2020 saw market giving back all the gains for the year before an equally strong rally in August to retest 1989 year high at 38957 and the 39000 level.

Pullback from the latter now see risk for break of support at the 36000 level and the 33853, 2023 year high. Below this will threaten the August YTD low at 31156 and where break will see deeper pullback to extend losses from the July all-time high. Break will open up room to the 30795 support and 30500 congestion area as well as channel support from the 2020 year low. Lower still, will see scope to 29390, the 50% Fibonacci retracement of the 2020/2024 rally, then the 28000 congestion.

Resistance at the 38957/39000 area now expected to cap and contain corrective bounce. Only break here will fade the bearish pressure and open up the 41087 and 42426, March and July highs to retest.