Published: 2024-09-18T09:16:53.000Z

Chartbook: DAX Chart: Minor pullback giving way to further range-extension. Background studies improving

Senior Technical Strategist

2

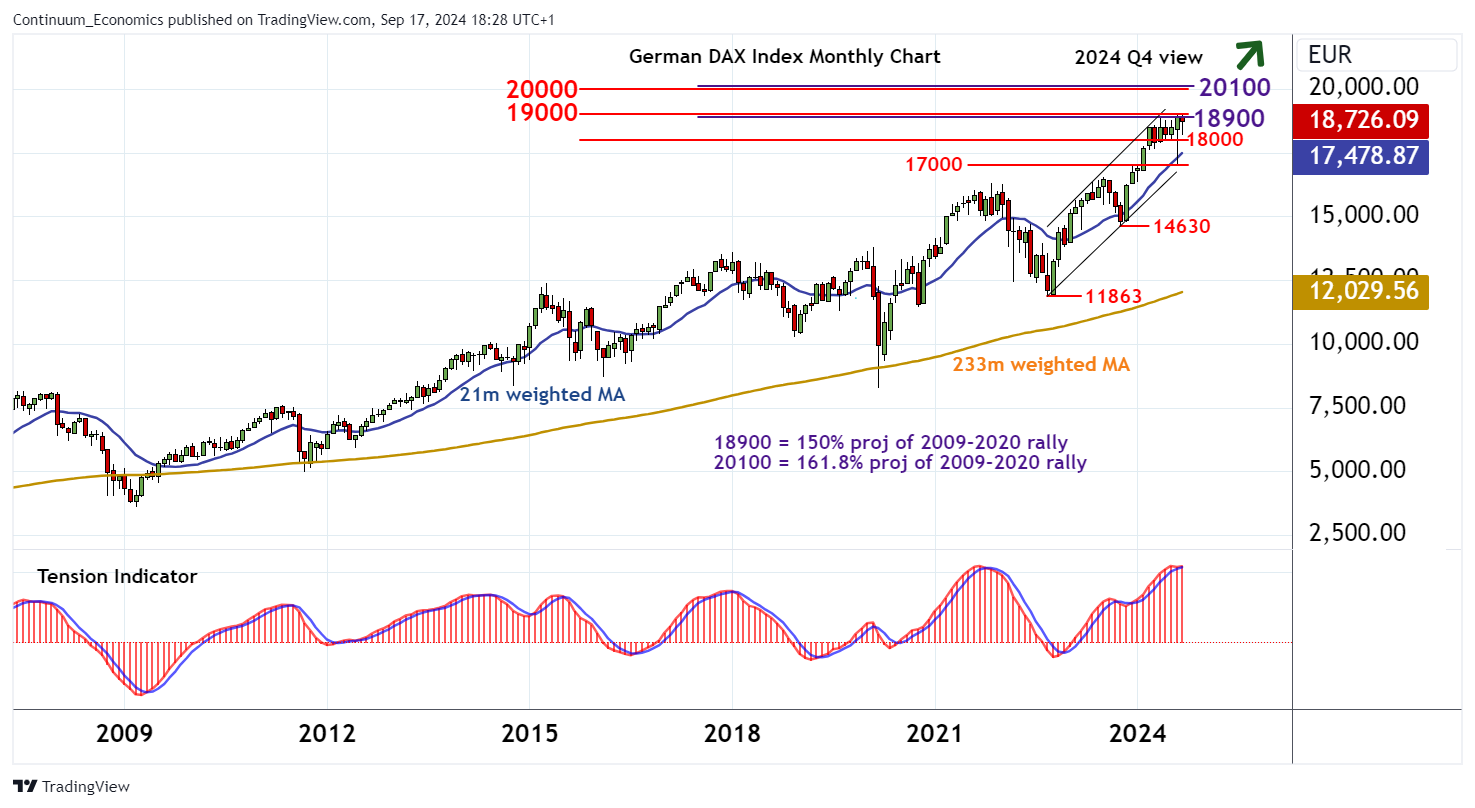

The anticipated break below congestion around 18000 has bounced from support at 17000

The anticipated break below congestion around 18000 has bounced from support at 17000.

Steady gains have met fresh selling interest within resistance at the 18900 Fibonacci projection and 19000, with prices once again trading in multi-month range extension above 18000.

Flat weekly stochastics are ticking lower, highlighting potential for a fresh test of 18000, but the flat/positive weekly Tension Indicator is expected to prompt fresh buying interest towards here.

A close below 18000 would add weight to sentiment and prompt a deeper pullback towards 17000. But a further close beneath here is needed to confirm a significant distribution top in place above 18000 and signal a deeper correction of the rally from the 11863 year low of September 2022.

Meanwhile, resistance is within 18900 - 19000.

Following further corrective/cautious trade the rising monthly Tension Indicator and rising multi-month studies are expected to prompt further gains.

A later close above here will turn sentiment outright positive and open up strong psychological resistance at 20000 and the 20100 projection.

This area should cap any initial tests, before positive multi-month charts prompt further gains.