Published: 2024-11-14T16:55:09.000Z

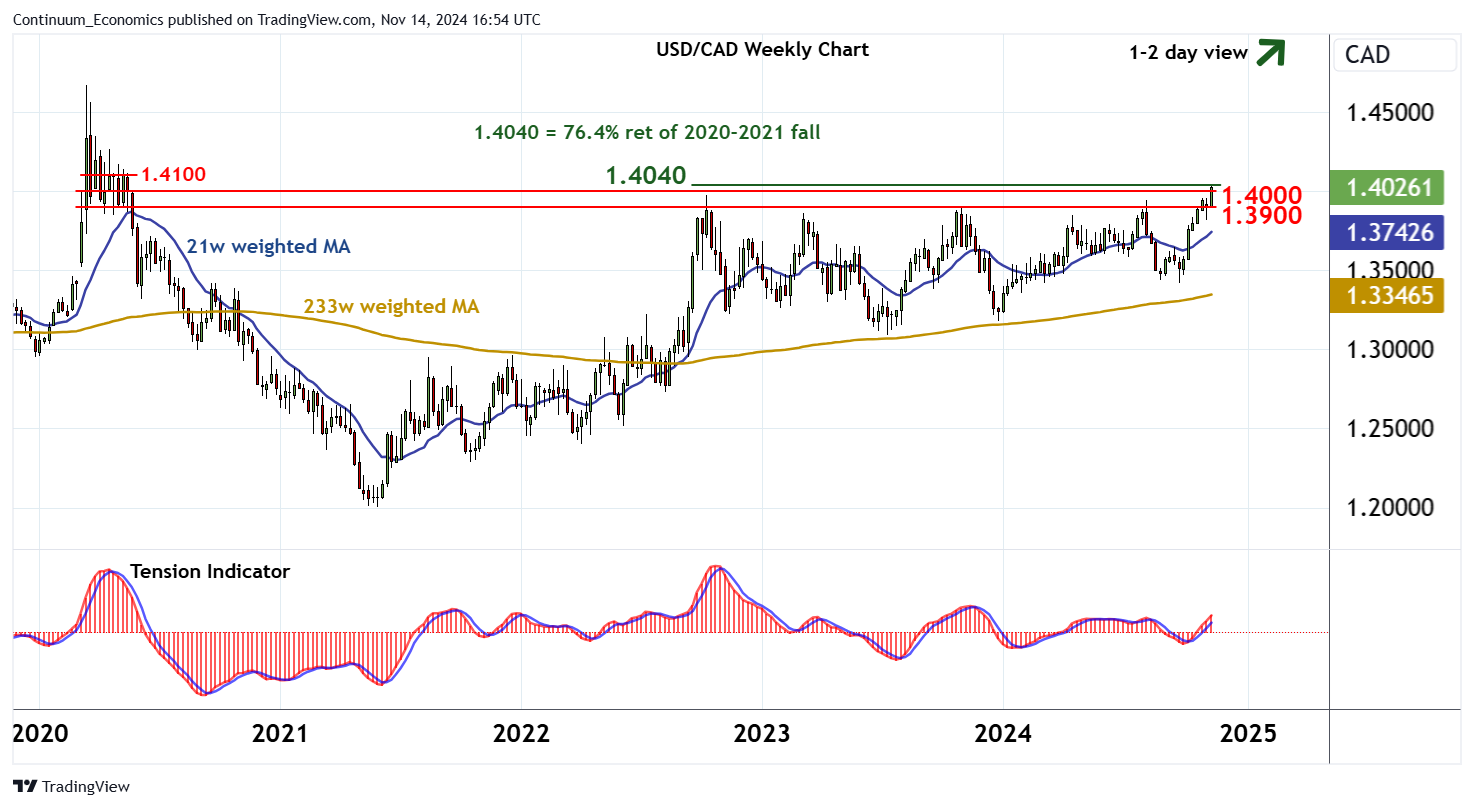

Chart USD/CAD Update: Fresh 2-year highs pressuring strong resistance at the 1.4040 Fibonacci retracement

Senior Technical Strategist

2

Cautious trade is giving way to the anticipated break higher

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.4100 | * | historic congestion | S1 | 1.3900 | * | congestion | |

| R3 | 1.4100 | * | historic congestion | S2 | 1.3850 | * | congestion | |

| R2 | 1.4040 | * | 76.4% ret of 2020-2021 fall | S3 | 1.3817 | ** | 6 Nov (w) low | |

| R1 | 1.4000 | * | figure | S4 | 1.3800 | * | congestion |

Asterisk denotes strength of level

16:35 GMT - Cautious trade is giving way to the anticipated break higher, with prices currently balanced within the 1.4000 - 1.4040 resistance area. Daily readings are edging higher and the weekly Tension Indicator is rising, highlighting room for further gains in the coming sessions. A break above the 1.4040 Fibonacci retracement. Overbought weekly stochastics could limit any initial tests in fresh consolidation. A close above here, however, will extend gains towards historic congestion around 1.4100. Meanwhile, support remains at congestion around 1.3900. A close beneath here, if seen, would open up further congestion around 1.3850. But a close below the 1.3817 weekly low of 6 November is needed to turn sentiment negative and confirm a near-term top in place.