View:

France and Japan: Debt Fuelled Growth Problem

May 16, 2024 10:30 AM UTC

Most of the surge in debt/GDP in Japan and 40% in France is due to higher government debt and this should not be a binding constraint provided that large scale QT is avoided – we see the ECB slowing QT in 2025 and are skeptical about BOJ QT in the next few years. The adverse impact of higher deb

Asset Allocation 2024: Tricky Seven Months Remaining

May 10, 2024 1:06 PM UTC

Fed easing expectations for 2025 and 2026 can shift from a terminal 4% Fed Funds rate towards 3%, as the U.S. economy slows due to lagged tightening effects. Combined with Fed easing starting in September this should mean a consistent decline in 2yr yields. However, 10yr U.S. Treasury yields wil

China Equities: A Tactical Play

May 8, 2024 2:20 PM UTC

China equities can see a tactical bounce of 5-10% in the coming months. Cheap valuations and underweight global fund positions means that the scale of pessimism only has to get less bad on the economy and China authorities attitude towards businesses. While we see a tactical opportunity, we do

FOMC Preview For May 1: Signaling Concern on Inflation, Tapering Quantitative Tightening

April 25, 2024 7:04 PM UTC

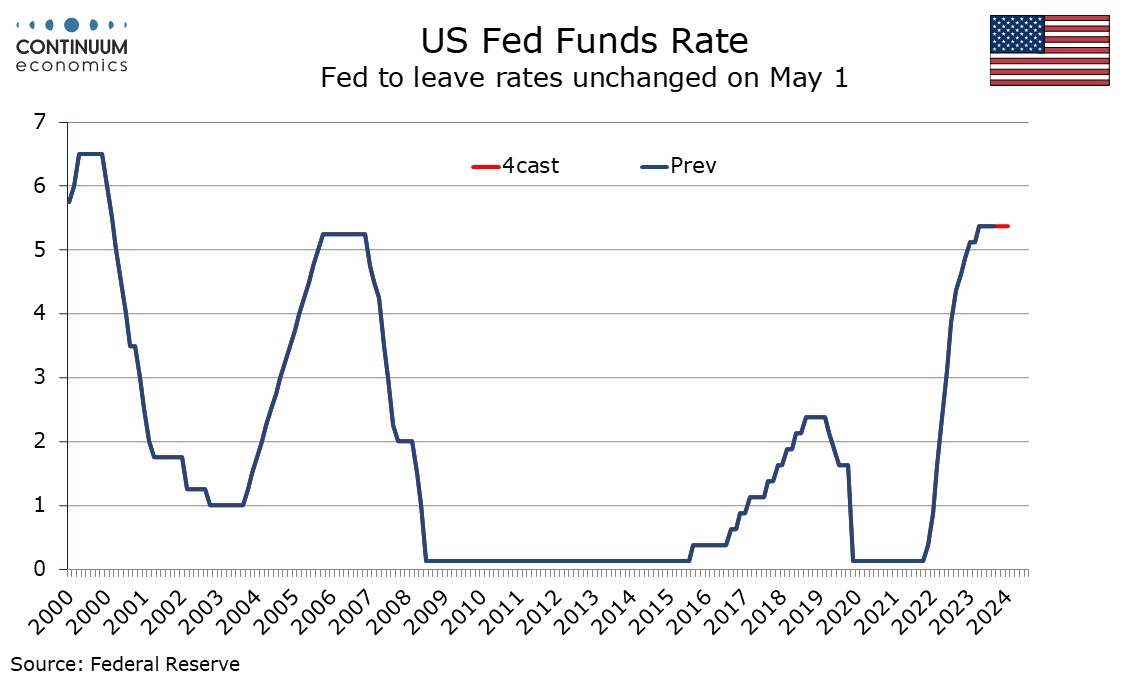

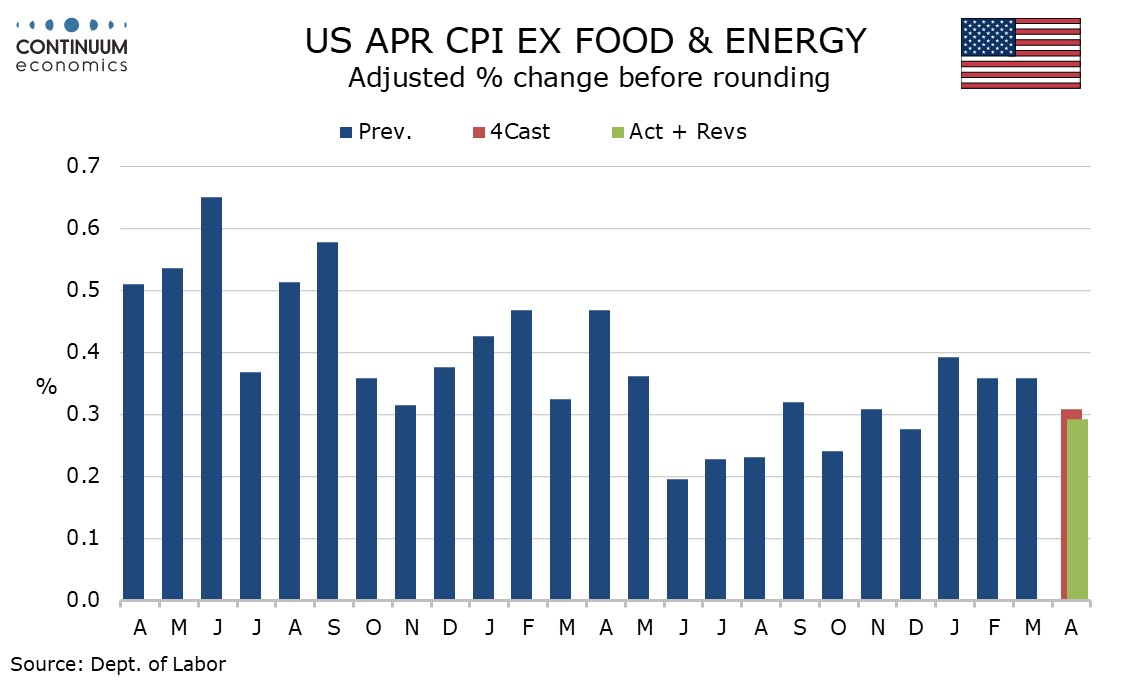

Bottom Line: The FOMC meets on May 1 and rates look sure to remain at the current 5.25%-5.50% target range. The statement is likely to see some adjustments to reflect recent disappointment on inflation while repeating that more confidence on inflation moving towards target is needed before easing. I

Bank of Canada Minutes Look to Gradual Easing, Divided on When to Start

April 24, 2024 6:44 PM UTC

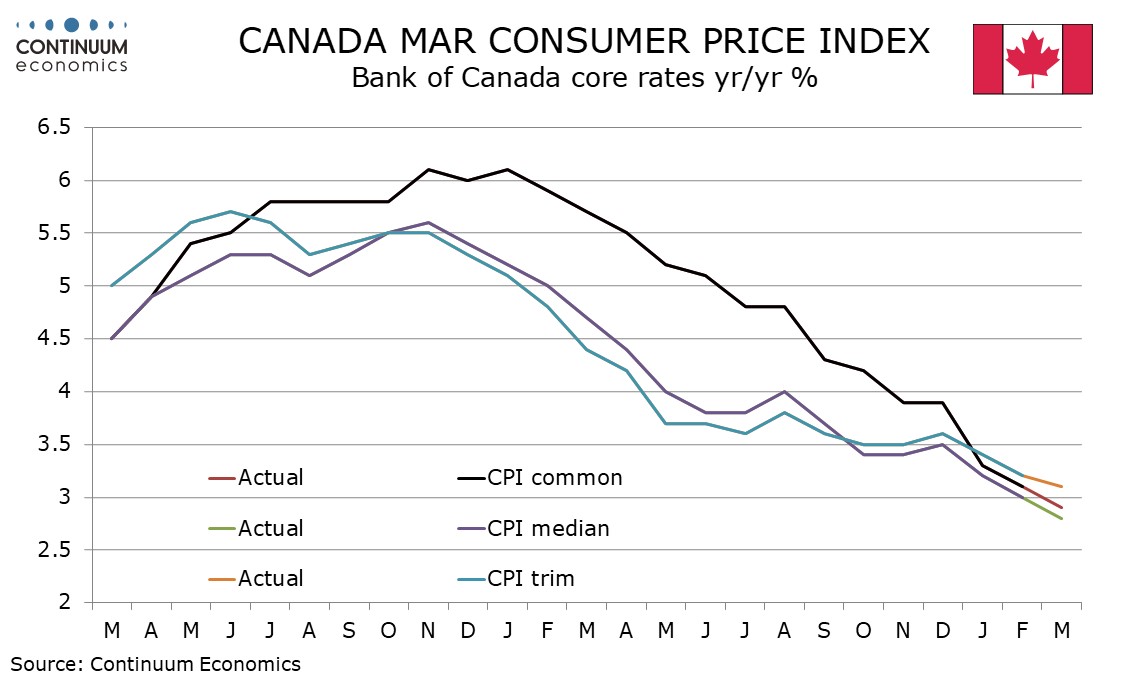

Bank of Canada minutes from the April 10 meeting confirm a greater confidence on inflation falling, though there is disagreement within the Governing Council over when policy easing will become appropriate. There was agreement that easing would probably be gradual given the risks to the outlook and

The Pulse of the Nation: Insights into India's 2024 Election

April 22, 2024 7:54 AM UTC

As India braces itself for the upcoming elections, the political landscape is rife with anticipation, strategy, and uncertainty. With the ruling Bharatiya Janata Party (BJP) seeking to consolidate its power and a diverse coalition of opposition forces vying for a chance to unseat them, the stage is

FOMC Minutes from May 1 to Suggest Restrictive for Longer

May 20, 2024 7:15 PM UTC

FOMC minutes from May 1 are due on May 22. The minutes are likely to be a more hawkish than those from the March 20 meeting released on April 10, given the strength of data released between the two meetings. Restrictive policy for longer so likely to be the message, but with no clear timetable. Soft

Preview: Due May 31 - Canada Q1/March GDP - A stronger quarter assisted by the end of strikes

May 20, 2024 3:52 PM UTC

We expect Q1 Canadian GDP to rise by 2.0% annualized, a little above a 1.5% estimate made with the Bank of Canada’s April Monetary Policy Report. We expect an unchanged monthly total for March, with Q1’s growth inflated by a January rebound from a strike-depressed Q4.

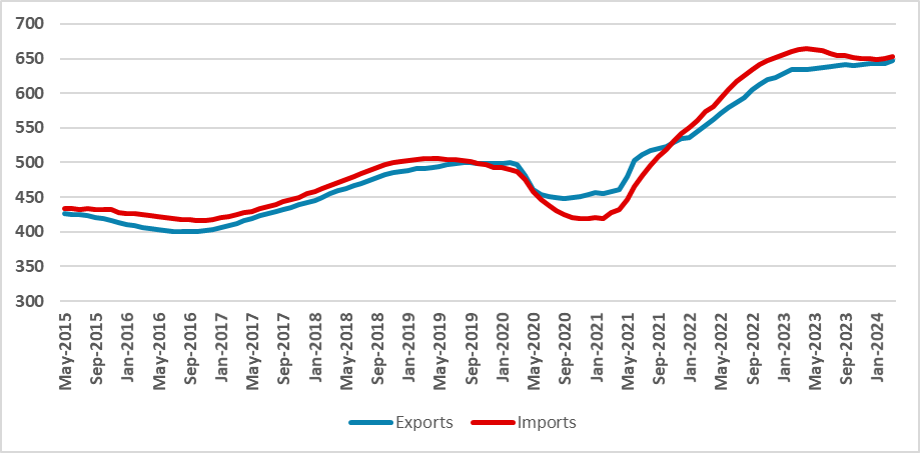

Mexico: Exports Loosing Traction

May 20, 2024 2:38 PM UTC

At the beginning of the year, Mexico's exports are losing traction, stagnating as imports surpass exports. This could be due to adjustments to U.S. demand and inflation effects. With internal demand cooling and the U.S. economy decelerating, growth may shift to Mexico’s internal economy, bolstered

Preview: Due May 21 - Canada April CPI - Headline stable but core rates falling

May 20, 2024 12:15 PM UTC

April CPI will be closely watched as the last CPI release before the June 5 Bank of Canada meeting. We expect the yr/yr pace to be unchanged at March's 2.9% pace which was also the pace in January before February saw a brief dip to 2.8%. However we expect continued steady downward progress in the Bo

ECB: June Rate Cuts Too Trigger More Rate Cut Expectations for 2024/25

May 20, 2024 10:50 AM UTC

However much the Council will resist fueling discussion of possible easing path, confirmation of a 1 cut normally increases speculation over further easing in subsequent quarters and we see 25bps in June followed by 25bps in September and December. The market could discount some more easing over t

Asia Open - Overnight Highlights

May 20, 2024 12:00 AM UTC

EMERGING ASIA

EM currencies perform mostly weaker against the USD as the greenback recoup partial post CPI losses. KRW saw the largest losses of 0.74%, followed by TWD 0.32%, PHP 0.25%, IDR 0.19%, THB 0.18%, CNH 0.15%, MYR 0.1%, CNY 0.04% and HKD 0.01%; the biggest winners are INR 0.20% and SGD 0.07%