View:

May 20, 2024

Preview: Due May 31 - Canada Q1/March GDP - A stronger quarter assisted by the end of strikes

May 20, 2024 3:52 PM UTC

We expect Q1 Canadian GDP to rise by 2.0% annualized, a little above a 1.5% estimate made with the Bank of Canada’s April Monetary Policy Report. We expect an unchanged monthly total for March, with Q1’s growth inflated by a January rebound from a strike-depressed Q4.

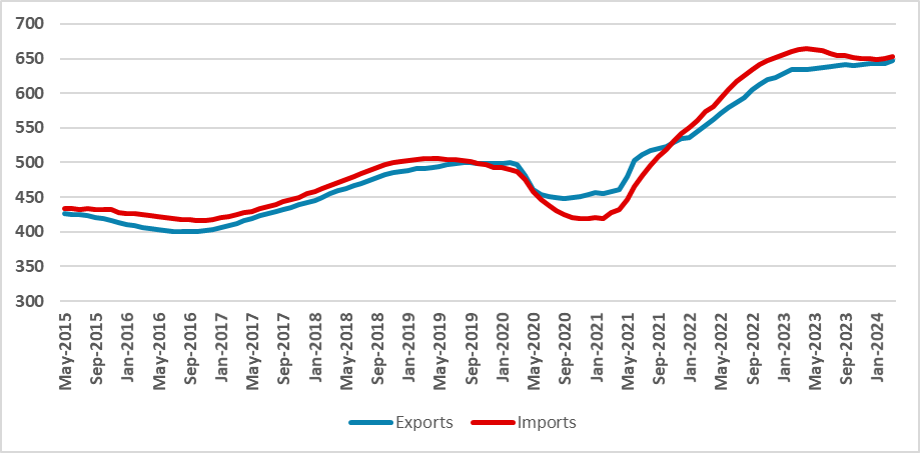

Mexico: Exports Loosing Traction

May 20, 2024 2:38 PM UTC

At the beginning of the year, Mexico's exports are losing traction, stagnating as imports surpass exports. This could be due to adjustments to U.S. demand and inflation effects. With internal demand cooling and the U.S. economy decelerating, growth may shift to Mexico’s internal economy, bolstered

Preview: Due May 21 - Canada April CPI - Headline stable but core rates falling

May 20, 2024 12:15 PM UTC

April CPI will be closely watched as the last CPI release before the June 5 Bank of Canada meeting. We expect the yr/yr pace to be unchanged at March's 2.9% pace which was also the pace in January before February saw a brief dip to 2.8%. However we expect continued steady downward progress in the Bo

ECB: June Rate Cuts Too Trigger More Rate Cut Expectations for 2024/25

May 20, 2024 10:50 AM UTC

However much the Council will resist fueling discussion of possible easing path, confirmation of a 1 cut normally increases speculation over further easing in subsequent quarters and we see 25bps in June followed by 25bps in September and December. The market could discount some more easing over t

Asia Open - Overnight Highlights

May 20, 2024 12:00 AM UTC

EMERGING ASIA

EM currencies perform mostly weaker against the USD as the greenback recoup partial post CPI losses. KRW saw the largest losses of 0.74%, followed by TWD 0.32%, PHP 0.25%, IDR 0.19%, THB 0.18%, CNH 0.15%, MYR 0.1%, CNY 0.04% and HKD 0.01%; the biggest winners are INR 0.20% and SGD 0.07%

May 19, 2024

May 17, 2024

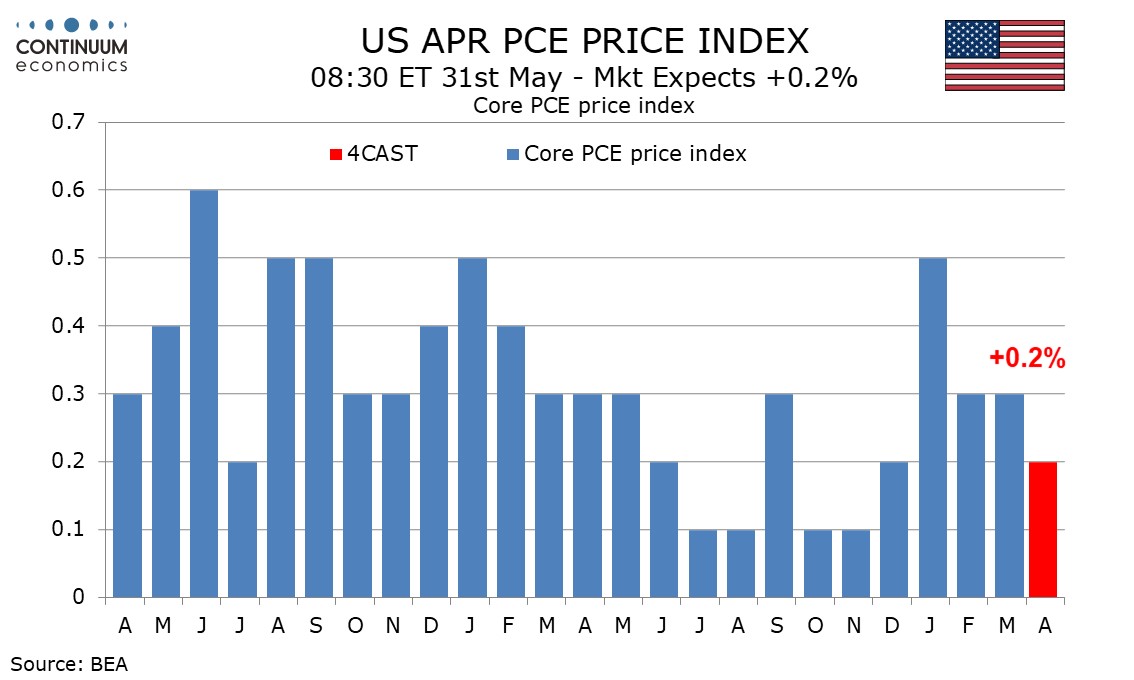

Preview: Due May 31 - U.S. April Personal Income and Spending - Core PCE Prices to round down to 0.2%

May 17, 2024 4:04 PM UTC

April’s core PCE price index looks set to come in close to 0.25% before rounding, though we expect the index to be rounded down to 0.2%, while overall PCE prices are rounded up to 0.3%. We expect a subdued 0.2% increase in personal income to underperform a 0.4% increase in personal spending.