BI Holds Rates as Rupiah Takes Centre Stage

Bank Indonesia kept its policy rate unchanged at 5.75% in April, prioritising currency stability over immediate growth support. Despite subdued inflation and earlier indications of easing, the central bank is holding off on rate cuts amid heightened global uncertainty and rupiah weakness following U.S. tariff announcements. With growth risks rising and the rupiah under pressure, BI is expected to remain cautious until trade tensions ease and market conditions stabilise.

As anticipated, Bank Indonesia (BI) held its benchmark interest rate at 5.75% for the third consecutive meeting on April 23rd, opting for caution as the rupiah (IDR) faces renewed pressure and global trade tensions intensify. The deposit facility and lending facility rates were also left unchanged at 5.00% and 6.50%, respectively.

The central bank’s decision reflects a growing emphasis on stabilising the exchange rate, which has come under strain in recent weeks. The rupiah depreciated sharply after the Eid holiday, triggered by the announcement of sweeping U.S. tariffs, before stabilising at around IDR 16,860/USD. The currency has weakened over 4% year-to-date, prompting continued FX interventions by BI in both onshore and offshore markets.

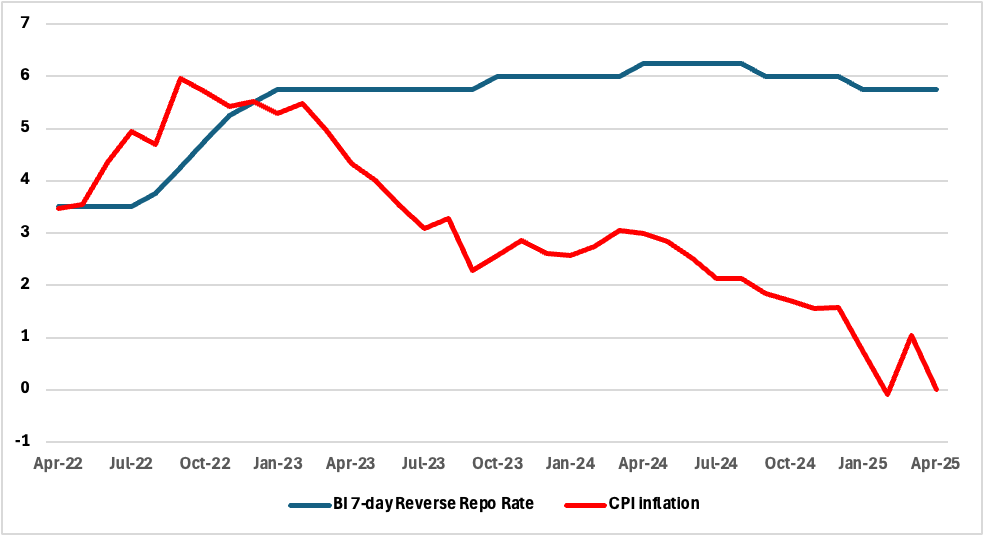

Figure 1: Bank Indonesia Policy Rate and Consumer Inflation (%)

Source: Continuum Economics

While inflation has remained well below the 2.5% ±1% target range—just 1.03% y/y in March—Bank Indonesia has refrained from cutting rates, despite earlier suggestions that room existed to ease. The shift in tone underscores a temporary reordering of priorities: short-term stability now takes precedence over stimulus.

BI maintained its 2025 GDP growth target at 4.7–5.5%, though Governor Perry Warjiyo acknowledged that growth may come in below the midpoint of this range. This is aligned with our expectation of 5% growth in 2025. Meanwhile, the IMF, in its latest update, revised down Indonesia’s growth forecast to 4.7% for both 2025 and 2026. Slower household consumption, fiscal consolidation, and weaker external demand—especially from China, Indonesia’s largest trade partner—are weighing on the outlook.

External risks have become more prominent. The U.S.’s proposed 32% reciprocal tariffs on Indonesian goods, currently paused for 90 days, could reduce GDP by up to 0.5 percentage points, according to Finance Minister Sri Mulyani. Indonesia has sent a delegation to Washington to negotiate, and trade-related uncertainty is expected to linger over coming months.

While macro indicators such as inflation would normally justify easing, the central bank is unlikely to act until exchange rate pressures subside and external risks become more predictable. We now expect BI to resume rate cuts only in the second half of 2025, with 25bps of easing possible once global and domestic stability return. For now, BI appears committed to a strategy of currency defence, even at the cost of delaying growth support.