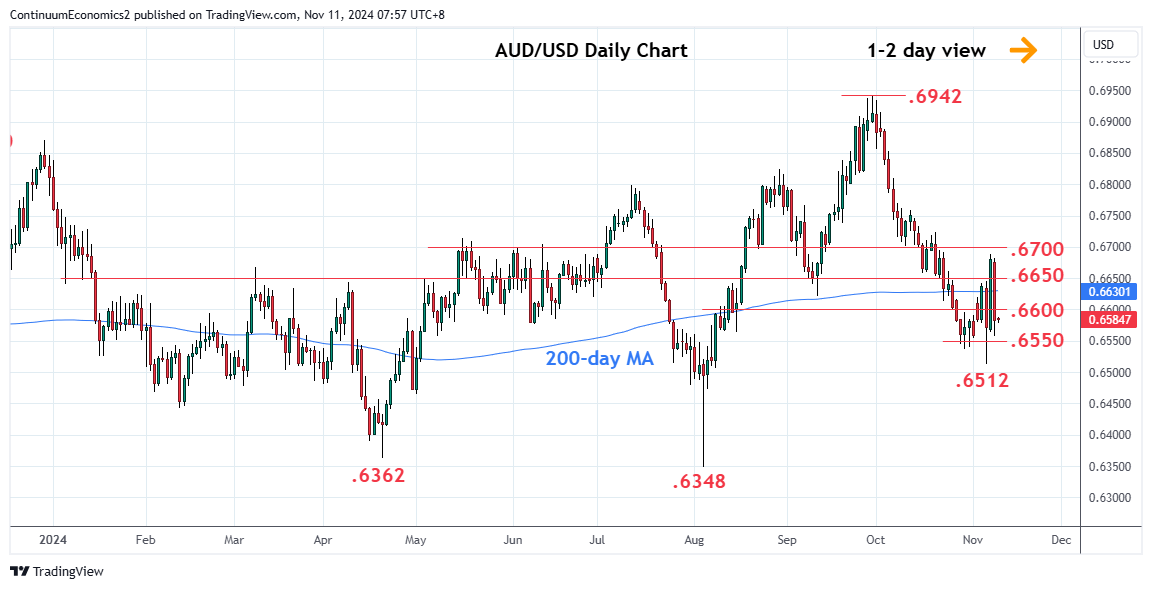

Choppy trade see prices settling back below the .6600 level with mixed daily studies suggesting further ranging action

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.6700/25 | * | congestion, 50% | S1 | 0.6550/37 | * | congestion, 30 Oct low | |

| R3 | 0.6688 | ** | 7 Nov high | S2 | 0.6512 | ** | 6 Nov low | |

| R2 | 0.6650 | * | congestion | S3 | 0.6490 | * | 76.4% Aug/Sep rally | |

| R1 | 0.6600/22 | * | congestion, Sep low | S4 | 0.6450 | * | Feb low |

Asterisk denotes strength of level

00:15 GMT - Choppy trade see prices settling back below the .6600 level with mixed daily studies suggesting further ranging action. Resistance starts at the .6600/22 area and only above here will expose the .6650 congestion then the .6688 high to retest. However, the latter expected to cap and lower high sought to further pressure the downside later. Break of the .6550/37 support will expose the .6512 low to retest and see scope for extension of losses from the September high. Lower will see room to .6490, 76.4% Fibonacci retracement, then the .6450 February low.