FX Weekly Strategy: APAC, January 8th-12th

USD to correct lower into US CPI, particularly against the JPY

EUR likely to struggle to regain 1.10

CHF strength likely to wane

GBP can correct lower on UK GDP

Strategy for the week ahead

USD to correct lower into US CPI, particularly against the JPY

EUR likely to struggle to regain 1.10

CHF strength likely to wane

GBP can correct lower on UK GDP

While US yields and the USD dropped after the weaker than expected ISM services data on Friday, the underlying story of last week was rising yields and a rising USD. The weaker ISM services data in itself, while weaker than expected, was not sufficient to justify the sharp reversal it triggered. The USD decline at the end of the week was therefore likely due more to positioning than the data itself. But the rise in the USD and yields through the week didn’t have a huge amount of support from the previous data either. The employment report itself was mixed, once revisions were taken into account, and Fed commentary was in our view consistent with the more dovish tilt seen after the December FOMC, even though the market took it to be on the hawkish side. So the corrective move at the end of the week looks justified, and a period of stability in yields may now be seen ahead of the CPI data on Thursday, which is the main data of the week.

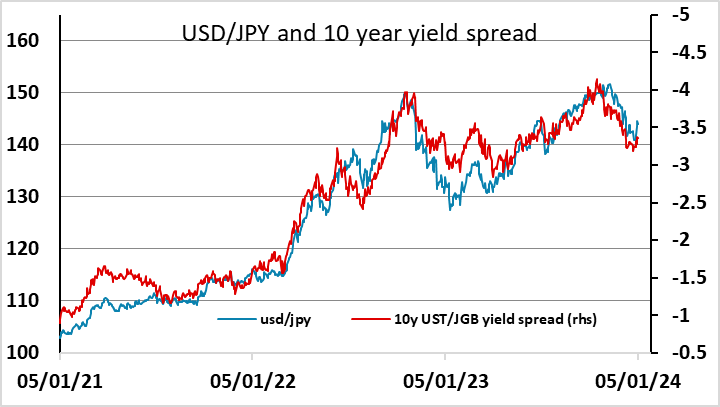

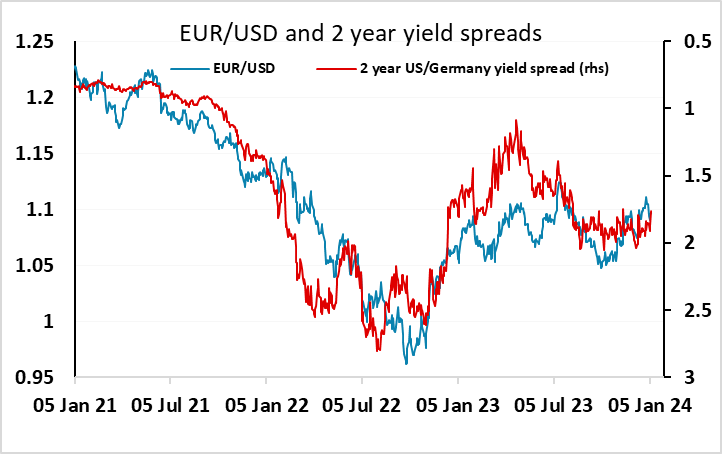

Our forecasts suggest mild downside risks for the USD and yields on CPI, but even ahead of the data there is scope for further corrective downside pressure on USD/JPY, which was the stand-out gainer on the week. Yield spreads suggests we can see a move back sub-142 before the data, with USD/JPY having somewhat overshot the move up in yields. There should also be scope for JPY gains on the crosses, as the rise in EUR yields in particular last week looks even less well justified than the rise in US yields, as the core Eurozone CPI data makes it clear that inflation is continuing to decline despite the bounce in the y/y headline Eurozone CPI in December. EUR/USD seem likely to struggle to resurface above 1.10.

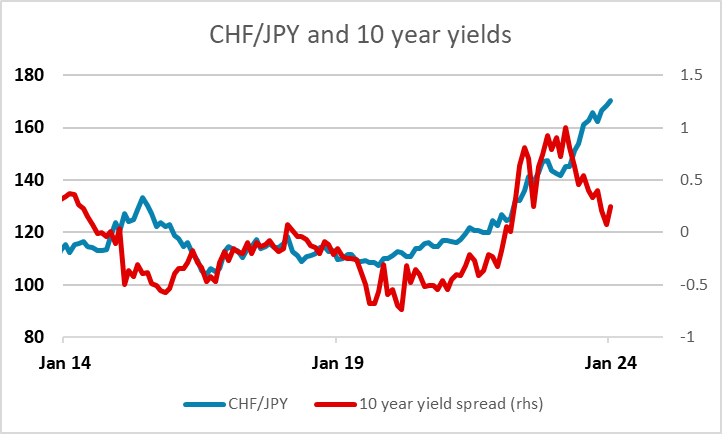

However, the EUR and the other riskier currencies continue to get support from solid equity market performance. Even though equities fell back last week, equity risk premia are still very low and supportive of strength in EUR/JPY and other JPY crosses. We don’t expect this to last, but because of the potential for JPY weakness on the crosses if risk sentiment is strong, we see CHF/JPY as representing the best value for JPY bulls. The CHF is likely to soften a little if equities are strong, and hit a new all time high against the JPY at 170.70 on Friday, some 35% up in just two years. Unlike other pairs, there is no yield spread justification for the CHF move.

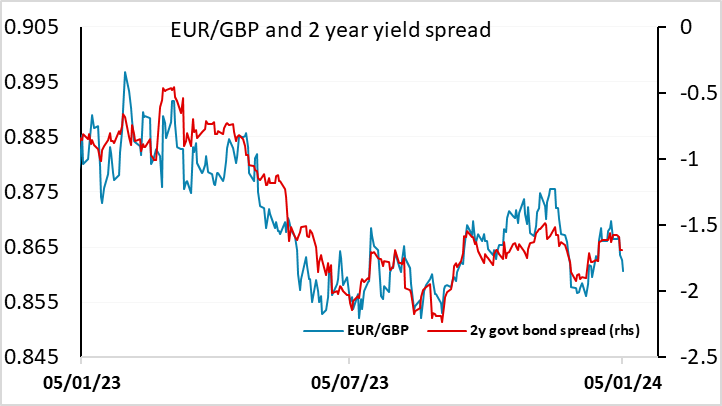

Otherwise, there are monthly UK GDP numbers on Friday that could impact GBP, which has had a strong start to the year helped by the recovery seen in the UK PMI services data. The GDP data might undermine some of this optimism. Even though we are likely to see a bounce in November after the weather related drop in October, Q4 is still likely to look weak. The market still prices a less aggressive easing from the BoE than from the ECB or the Fed, in spite of the high starting point for UK rates, so there is some risks of yield convergence which could push EUR/GBP back up towards 0.8650.

Data and events for the week ahead

USA

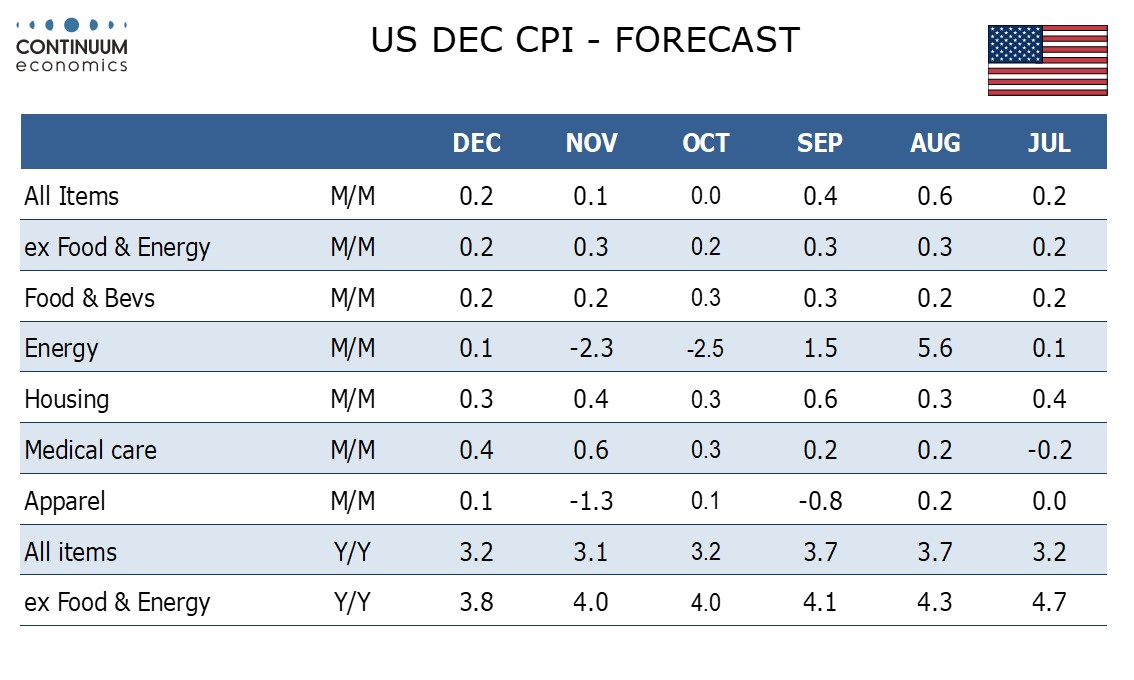

The key U.S. release of the week will be Thursday’s CPI for December. We expect gains of 0.2% both overall and ex food and energy, though gains are likely to be on the high side of 0.2% before rounding. On Friday we expect subdued December PPI data, with gains of 0.1% both overall and ex food and energy.

Monday sees November consumer credit, and Tuesday December’s NFIB survey on small business optimism. Also on Tuesday we expect November’s trade deficit to increase to $64.8bn from $64.3bn. November wholesale trade is due on Wednesday and Thursday sees weekly jobless claims as well as the CPI. Fed speakers due in the week include Bostic on Monday, Williams on Wednesday and Kashkari on Friday.

Canada

Canada releases November’s trade balance and November building permits on Tuesday.

UK

Datawise, the week is dominated by monthly GDP figures on Friday, these arriving alongside fresh trade figures. Coming in lower than expected, and probably hindered by poor weather and a recovery in imports, GDP fell by 0.3% m/m in the October data, a result that meant that the surprise rise of the previous month was more than reversed. Regardless, there may be some recovery in these looming November numbers, (a rise of no more that 0.1% m/m), this flagged by an already published rise in retail sales, albeit where the data should show the impact of the recent downward revision to national account numbers.

Eurozone

Survey data start the week with the EU Commission figures due on Monday. The same day sees EZ retail sales numbers with another flat(ish) number envisaged. Unemployment data (Thu) may show a further rise while ECB insight arrives via comments from ECB Chief Economist Lane on Friday. There is also the ECB Bulletin on Thursday

In Germany, manufacturing orders (Mon) data should show a bounce after the marked drop seen in October, while industrial production figures (Tue) may edge down further.

Rest of Western Europe

There are key events in Sweden, with the focus on the monthly GDP indicator where a clear correction back is seen after the surprise October bounce. In Norway, CPI data should see the CPI-ATE measure don a further 0.2 ppt after the surprise drop to 5.8% seen in November. There si also the Norges Bank BLS on Thursday. Switzerland also sees CPI data and where base effects may pull up the headline rate marginally from the 1.4% November outcome.

Japan

Tokyo CPI on Monday, Jan 8 and Labor Cash Earning, Tuesday, Jan 9 head the calendar for Japan next week. Labor cash earning would be slightly more important, given the current BoJ direction seems to be focusing more on “sustainable” wage growth which in plain terms is 2%. If we see wage growth to further pick up, a Mar/Apr hike to 0% interest rate is cemented. Else, if CPI shows a sharp drop, though unlikely, will dampens the speculation of BoJ entering the tightening cycle (as they will still exit ultra-loose monetary policy). Tokyo CPI is expected to further moderate in all 3 categories reported with headline and ex fresh food outpacing ex fresh food and energy.

Australia

Monthly CPI will be released on Tuesday Jan 9 and should continue the trend of moderation with little expectation of another spike like Q3’s high energy price. We also have the retail sales on Monday. Jan 8 and Trade Balance on Wednesday, Jan 10. Both will provide us information on the unexpectedly solid domestic demand and whether it would continue to support Australian growth.

NZ

Almost empty calendar for NZ except building permit.

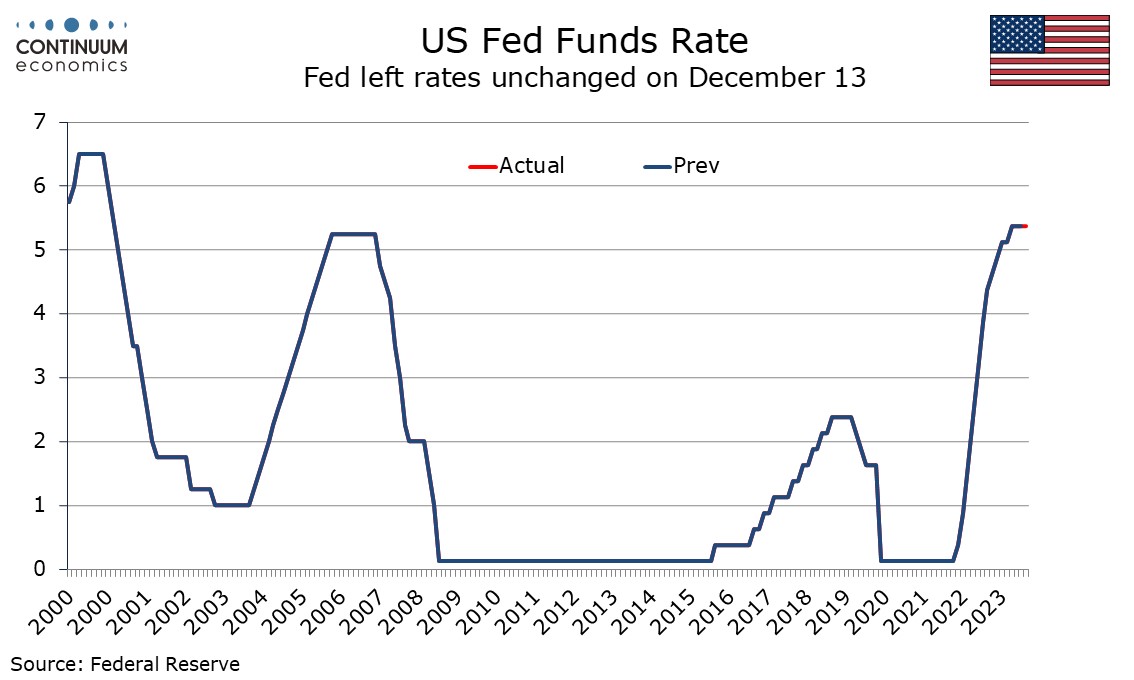

Highlights from the last week

FOMC minutes from December 13 show that while almost all participants expect lower rates to be seen by the end of 2024, they want forecasts to be treated cautiously at this point. Caution over easing and increased confidence that progress is being made on inflation are however both clear in the minutes. If progress on inflation continues, the Fed will start to consider easing, with timing data-dependent. Participants noted unusually elevated uncertainty and that the economy could evolve in a way that made further tightening appropriate, even though participants agreed rates were likely near or at their peak. Several observed that circumstances might warrant keeping rates at the current level for longer than expected. They reaffirmed the need to keep policy restrictive for some time until inflation was clearly moving down sustainably towards target.

Given that upside risks to inflation were seen as having diminished this gives scope for the FOMC to start contemplating easing should progress on inflation continue, though for now concern that progress on inflation could stall persists. Some did point to downside economic risks associated with potentially overly restrictive policy, though downside economic surprises would not automatically bring easing, with a few concerned with a potential tradeoff between the Fed’s dual mandate goals. All agreed clear progress had been made on inflation but more evidence was needed before they could feel confident of a return to the 2% target. Uneven progress across components was a concern with core services still elevated, though there was some confidence that a more balanced labor market was easing wage pressures. The minutes reiterate the view seen in the post-meeting statement that Q4 GDP was seen slowing from a strong Q3, but also note uncertainty on the outlook, noting upside risks as well as potential downside ones. Notable were the possibility that momentum may be stronger than assessed and the possibility of easing financial conditions making the inflation goal harder to achieve. Reducing the balance sheet was seen as an important part of the Fed’s overall approach though several remarked that plans indicated easing and stopping the decline in the balance sheet when reserve balances are somewhat above the level consistent with ample reserves. It was suggested that the FOMC would discuss the technical factors that would guide such a decision well before such a decision is reached.

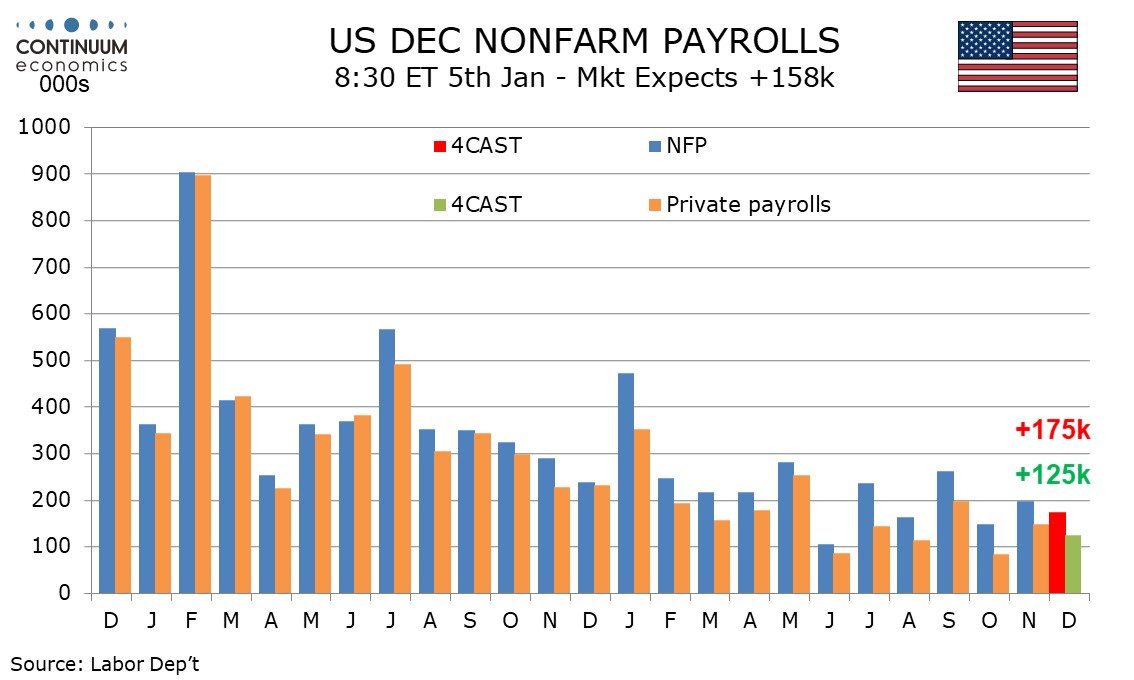

The data highlight of the first week of 2024 will be December non-farm payrolls on Friday. We expect no change in trend, with a 175k increase in non-farm payrolls, 125k in the private sector, a 0.3% increase in average hourly earnings and an unchanged unemployment rate of 3.7%. ADP’s estimate of private sector employment growth is due on Thursday. We expect a rise of 110k, marginally underperforming private sector payrolls. Other labor market indicators due are November’s JOLTS report on job openings on Wednesday and weekly jobless claims on Thursday. Also important will be FOMC minutes from December 13 on Wednesday. We expect increased confidence that inflation is falling but still enough caution to mean easing is not on the near term agenda. We expect slightly firmer ISM indices for December, with manufacturing on Wednesday rising to 47.5 from 46.7 and services on Friday rising to 53.0 from 52.7. Other releases scheduled are November construction spending on Tuesday, and on Friday November’s trade balance and factory orders.

A 175k payroll increase would be slower than November’s 199k though November was lifted by the return of strikers, 25k in autos and 16k in motion pictures. October’s 150k increase was restrained by the start of the auto strike. Government looks set to maintain a firm picture. A 125k increase in private sector payrolls would compare to 150k in November and 85k and October but would be slightly stronger than both excluding the impact of strikes. Hinting at upside risk are a stalling of an upmove in initial claims, and more supportive seasonal adjustments.

Average hourly earnings trend has been gradually losing momentum with trend now on the low side of 0.3%, and we expect a rise of 0.26% in December before rounding. This would follow an above trend 0.35% in November which was resumed up to 0.4%, which corrected a below trend 0.21% increase in October. Yr/yr growth would then slip to 3.9% from 4.0%. There is extra uncertainty on unemployment in December with historical revisions due, though we expect any changes to be marginal. Historical revisions for non-farm payrolls data come with January’s report. We expect an unchanged rate of 3.7% assuming November is unrevised, with employment and the workforce seen delivering similar moderate gains, contrasting sharp bounced in both in November which corrected declines in October.

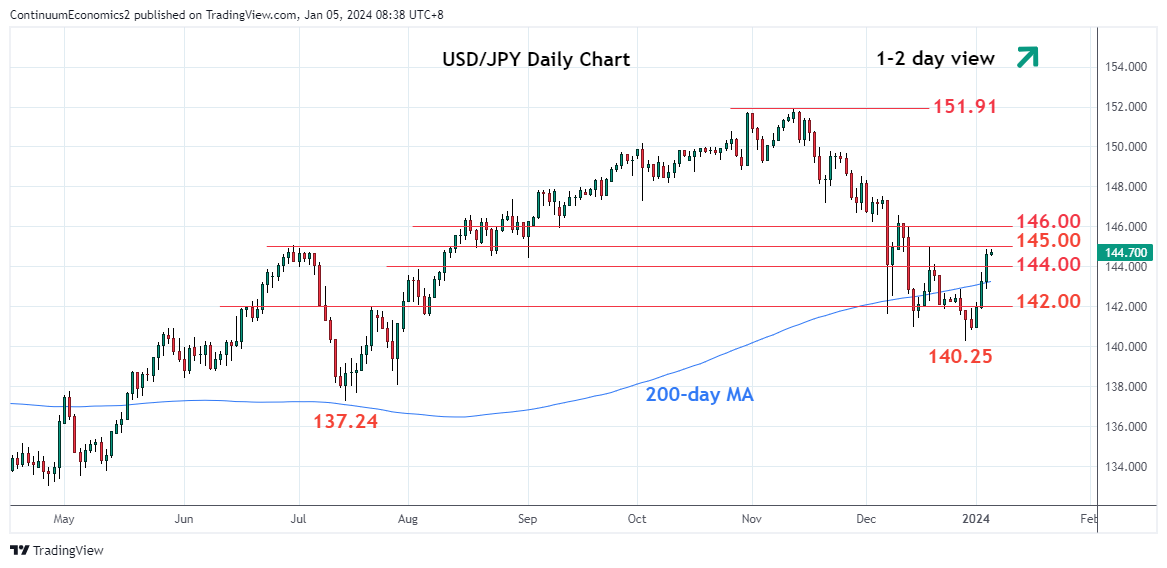

USD/JPY has rebounded strongly since the beginning of new year as USD rose on higher Treasury yields for the FOMC minutes seems to suggest the magnitude and pace of easing is slower. Haven bids for the greenback also arise with geopolitical tension flares up. Geopolitical uncertainty of potential U.S. military action further pumps up the demand for USD and outbid JPY for JGB yields are downbeat to start the year.

On the chart, the pair is extending bullish run-up from the 140.25 low with break above the 144.00 level shift focus to the strong resistance at the 145.00 level. Stretched intraday studies suggest reaction here likely though the positive daily chart suggest scope for further gains ahead. Clearing the 145.00 level will see room to the 146.00/10 congestion and 50% Fibonacci level. Meanwhile, support is raised to the 144.00/143.73 area then the 142.85 higher low which should now underpin and sustain gains from the 140.25 low.

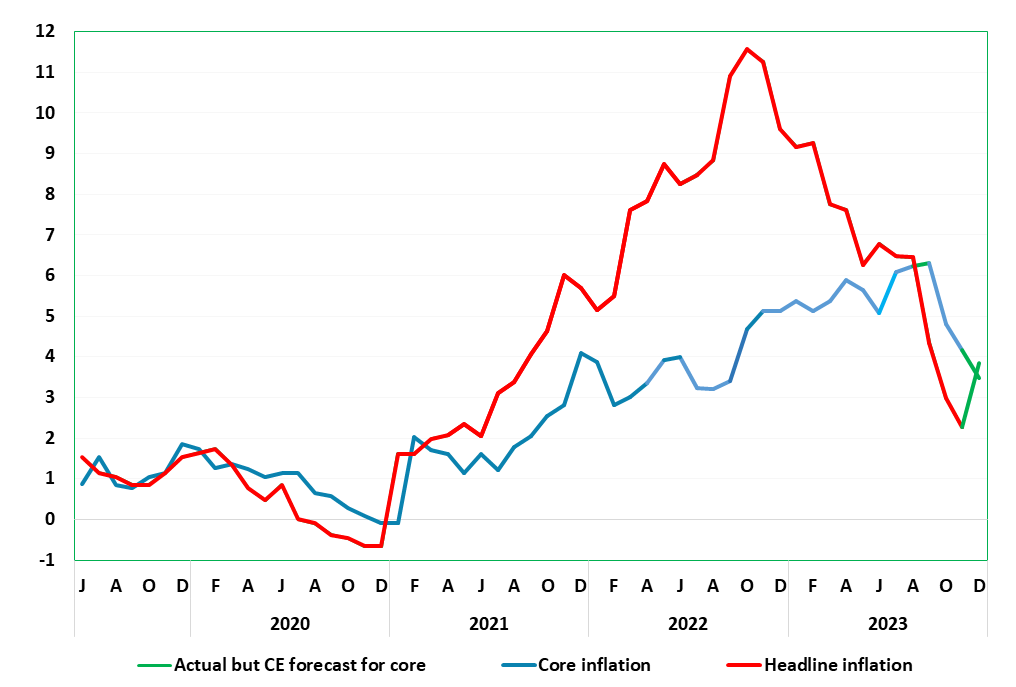

Figure: HICP Inflation Jumps, But Core More Contained

A clear and continued fall in overall German and EZ inflation pressures, initially evident in survey data but spreading to official numbers has been the case for some months. This downtrend was much more evident in the softer-than-expected October and also the November HICP numbers. Indeed, the headline HICP in November eased 0.7 ppt to 2.3%, a 29-month low, with the core dropping by 0.7 ppt to 3.5%. However, last month, and despite a further fall in fuel prices, recreation-sourced and particularly energy-related base effects, pushed up the headline rate back to 3.8%, a little lower than consensus and with the core down further at least for the CPI measure (Figure 1) where the headline for the latter rose by far less. Regardless, the disinflation backdrop is underlined by what may be a softer core seasonally adjusted trend (Figure 2) which may be running close to zero. Regardless, the headline y/y rate may resume a downtrend in the New Year even with some tax rises now due.

Adverse energy related base effects may have affected other EZ countries such as Italy, as well as in France. But progress on core inflation should continue, this very much the case in recently related Spanish numbers. As for the actual EZ HICP due tomorrow (Jan 5), the headline tick higher from November’s 2.4% by 0.4-0.5 ppt, but only on a short-lived basis as the fall will resume into and through 2024. We see the December core steady at 3.5% but with downside risks. As for the ECB, its forecast outlined last month implies a rise of around 0.25 ppt and a slightly higher headline outcome than our expectation.

Regardless, a further insight into the disinflation backdrop is provided by the seasonally adjusted data which we compute – the Bundesbank does its own measurement on this basis. As Figure 2 shows there has also been a clear slowing in the trend m/m changes on an adjusted basis, most notably for the core. This seemingly continued in December albeit with the smoothed (3-mth avg) adjusted rate edging up to just 0.1% m/m

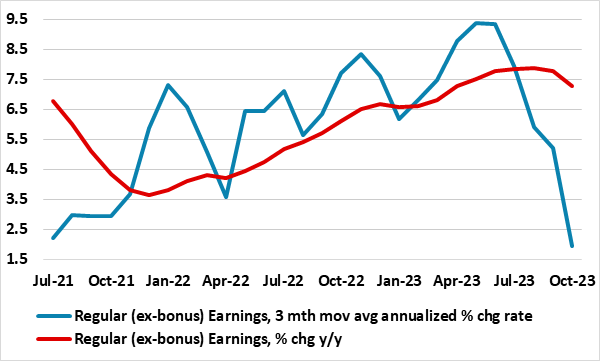

Figure: Adjusted m/m Earnings vs y/y Data

While quite content to assess real economy matters via data presented on a q/q or even m/m basis, DM central bankers seem unwilling to evaluate inflation signals on just about anything but y/y numbers. This is particularly the case in the UK where the BoE’s focus on y/y rates means they are both slaves to what may be aberrant base effects and less able to pinpoint short-term turning points. We have frequently highlighted that seasonally adjusted m/m CPI data are offering a much more benign inflation backdrop. But, as we highlight below, officially computed seasonally adjusted - but m/m presented - earnings data also offer a very much more benign cost picture than y/y numbers (Figure 1) with every likelihood that this may trigger a fresh dose of downward pressure on CPI inflation. Surely, this is likely to temper what is clearly at the core of the BoE’s worries about inflation persistence.

There have been inflation signs of late to reassure the BoE. The Bank may be calmed as various alternative y/y measures of core and underlying inflation have started to fall and where seasonally adjusted core prices eased further in October. However, recent months suggest that this slowing in core m/m adjusted inflation has not intensified, instead with recent underlying inflation remaining close to target on a smoothed m/m adjusted basis. Regardless, it may be that downside economy risks are now taking precedence for the MPC majority but where some on the MPC want to see more convincing evidence that wage inflation is abating, possibly anticipating that the weaker economic outlook will reinforce disinflationary signals, particularly on wages.