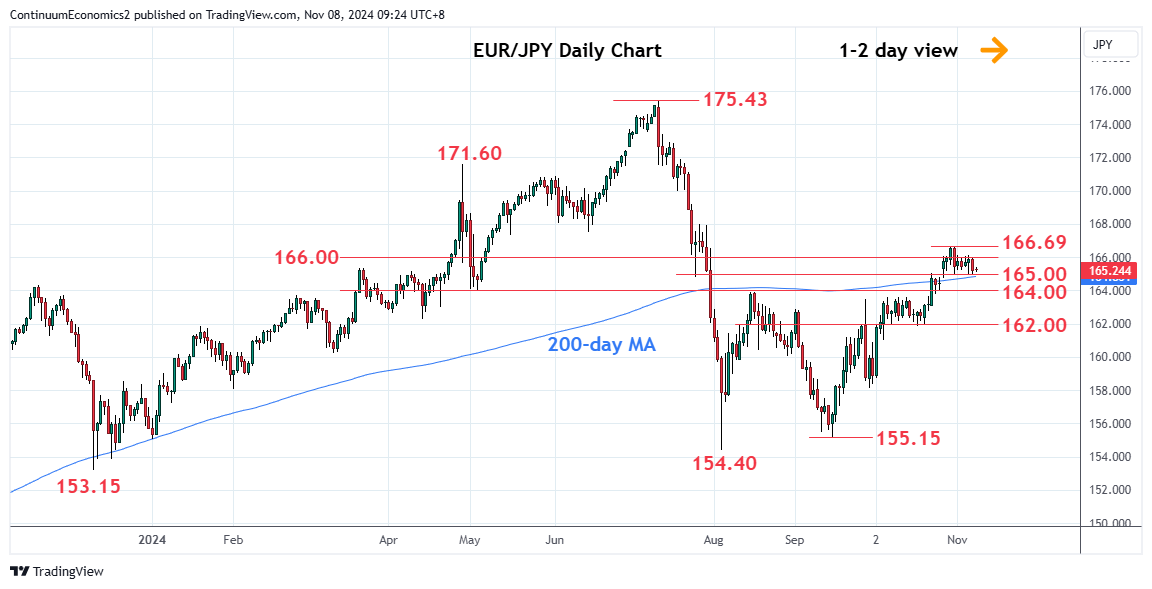

Remains in consolidation above the 165.00 level but finally showing signs of turning lower to extend pullback from the 166.69 high

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 168.00 | ** | congestion | S1 | 165.00 | * | congestion | |

| R3 | 167.40 | * | 61.8% Jul/Aug fall | S2 | 164.00 | ** | congestion | |

| R2 | 166.69 | * | 31 Oct high | S3 | 163.60 | * | 10 Oct high | |

| R1 | 166.00 | * | congestion | S4 | 162.00 | ** | congestion |

Asterisk denotes strength of level

01:25 GMT - Remains in consolidation above the 165.00 level but finally showing signs of turning lower to extend pullback from the 166.69 high. Break will open up deeper losses to retrace gains from the 155.15, September low. Lower will turn focus to the strong support at the 164.00/163.60 area. Below this, if seen, will see scope to the 162.00 support. Meanwhile, resistance is lowered to the 166.00 level which is expected to cap and sustain losses from the 166.69 high. Above the latter, but not expected, will open up extension to the 167.40, 61.8% Fibonacci retracement, then the 168.00 level.