JPY flows: BoJ intervention triggers sharp reversal

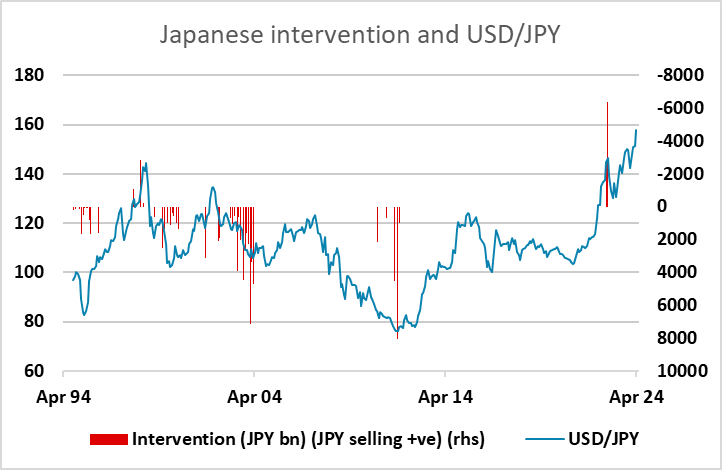

Reported BoJ intervention has triggered a 5 figure drop in USD/JPY in late Asia trade. The upside now looks capped near term, and there is scope for a huge decline, but lower US yields look necessary to trigger it.

The long awaited BoJ intervention finally arrived this morning as JPY weakness has spiralled out of control since the Friday BoJ meeting indicated no near term change in policy. There are four points to make clear here.

1) It is generally unwise to oppose BoJ intervention in the short run. They have very deep pockets and history is on their side.

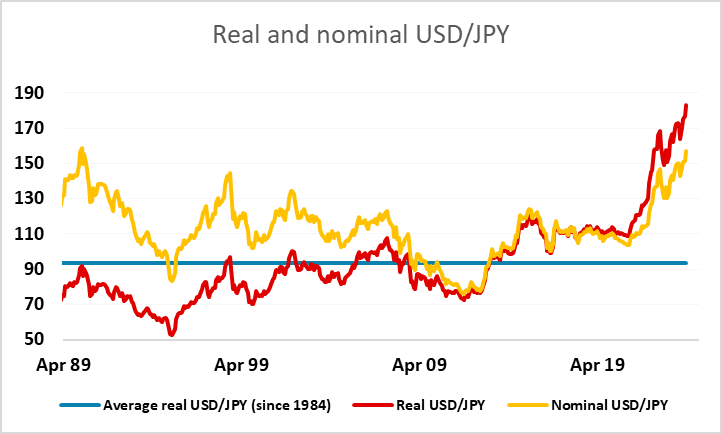

2) The intervention reflects extreme short term JPY weakness in the last few days, but also extreme long term weakness. The JPY is not only the weakest it has ever been in the floating era, it is the weakest any major currency has been in the floating era. Value is a weak factor in determining FX in the short run, but in the long run developed market FX tends to be mean reverting, suggesting this is a good level for long term JPY buyers.

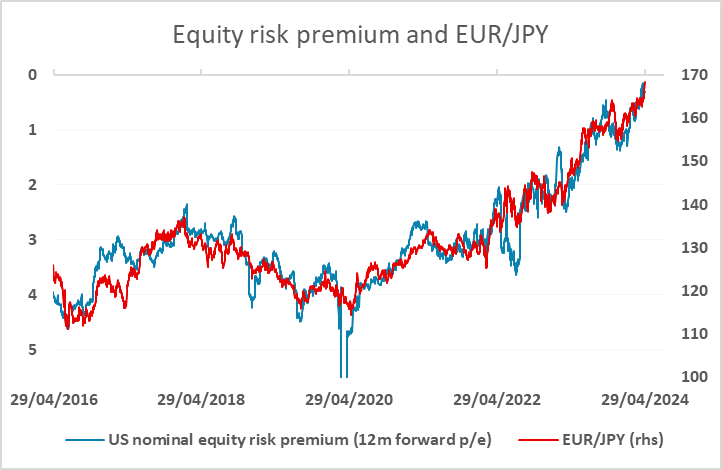

3) The main driver of JPY weakness has been rising US yields, not inaction from the BoJ. And while yield spreads have been supportive for USD/JPY, the current level of the JPY is too low based on a simple yield spread correlation. However, rising US yields have also been a major factor in driving equity risk premia to new lows, and JPY crosses have been highly correlated with this decline. As long as risk premia remain low, the JPY recovery is unlikely to gain much momentum.

4) While the correlation with equity risk premia is hard to ignore, it is not solidly based fundamentally. In particular, it doesn’t take account of real (as opposed to nominal) exchange rates. The real JPY has declined much more than the nominal JPY in recent years due to relatively low Japanese inflation, and this suggests that the correlation with risk premia will eventually break.